Question: After doing a sensitivity analysis for a project finance case study, I got the following results (see attached picture). The Required Rate Of Return (RRR)

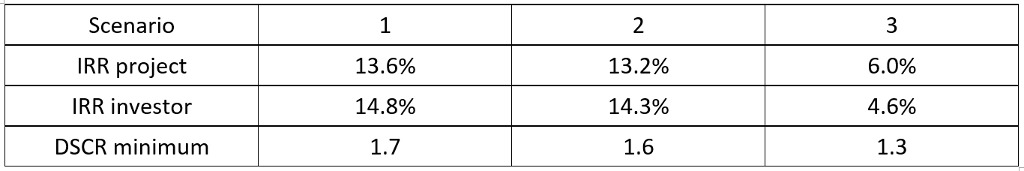

After doing a sensitivity analysis for a project finance case study, I got the following results (see attached picture).

The Required Rate Of Return (RRR) by the investor is 15%. The minimum DSCR required by lenders is 1.3.

Is the project attractive for both investors and lenders? If it isn't, what propositions can be made by lenders (banks) to investors or investors to the government?

Thanks in advance for your valuable help!

Scenario IRR project IRR investor DSCR minimum 1 13.6% 14.8% 1.7 13.2% 14.3% 1.6 6.0% 4.6% 1.3

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts