After failed merger discussions with a reluctant management, Gordon Co. plans to make a hostile bid for

Question:

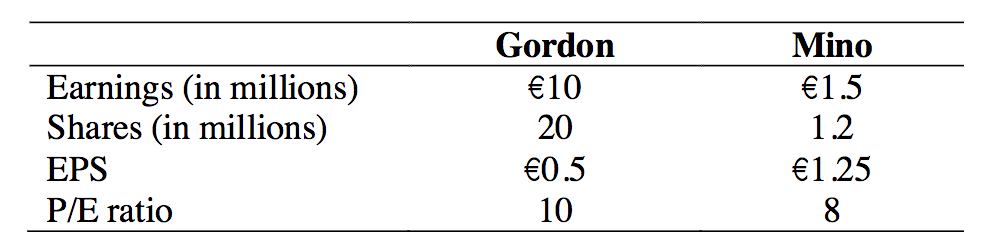

After failed merger discussions with a reluctant management, Gordon Co. plans to make a hostile bid for Mino Inc. The managements for both companies? know that a potential acquisition would generate ?1 million in synergies and cost savings annually. They also expect the appropriate cost of capital for these incremental cash flows to be 10%. For simplicity, assume that neither firm?s share price currently contains acquisition expectations. Further assume that if and when a bid for Mino?s shares is made, all private information described above becomes public. Current public data about the two companies as stand-alone entities are presented below.

Suppose Gordon announces its takeover intentions and offers four new Gordon shares for each Mino share. Assume that even though Mino?s management is strongly opposed, the offer and takeover are generally believed to succeed without difficulty.

a)

What is the present value of the expected gain (to Gordon and Mino combined) from the acquisition?

b)

What is the announcement return (in percentage) on Gordon?s share price?

c)

What is the announcement return (in percentage) on Mino?s share price?

Intermediate Accounting

ISBN: 978-0324592375

17th Edition

Authors: James D. Stice, Earl K. Stice, Fred Skousen