Question: After having studied the educational resources presented in this module and having read the textbook Intermediate Accounting: Reporting and Analysis, proceed to perform the following

After having studied the educational resources presented in this module and having read the textbook Intermediate Accounting: Reporting and Analysis, proceed to perform the following exercises:

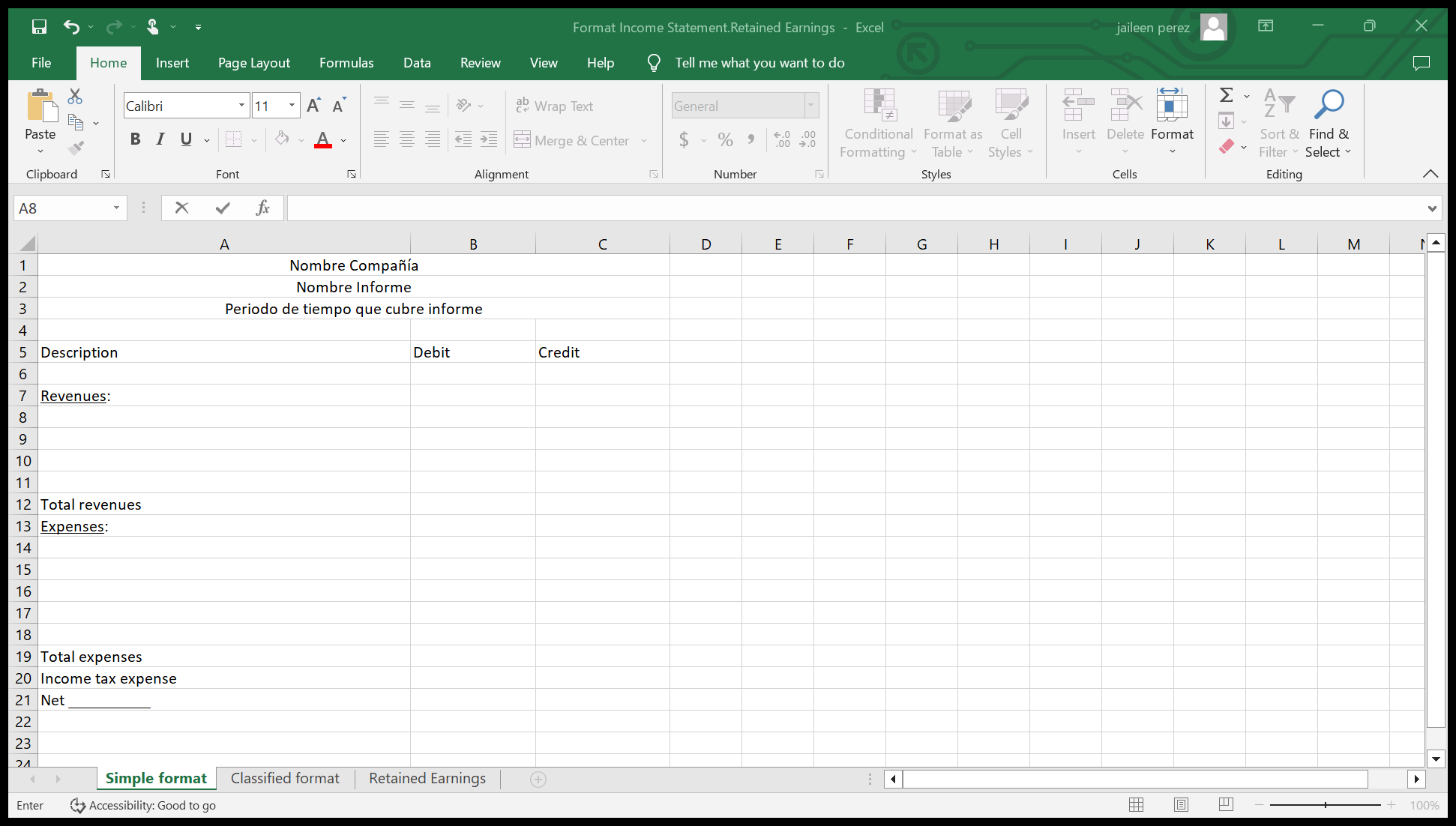

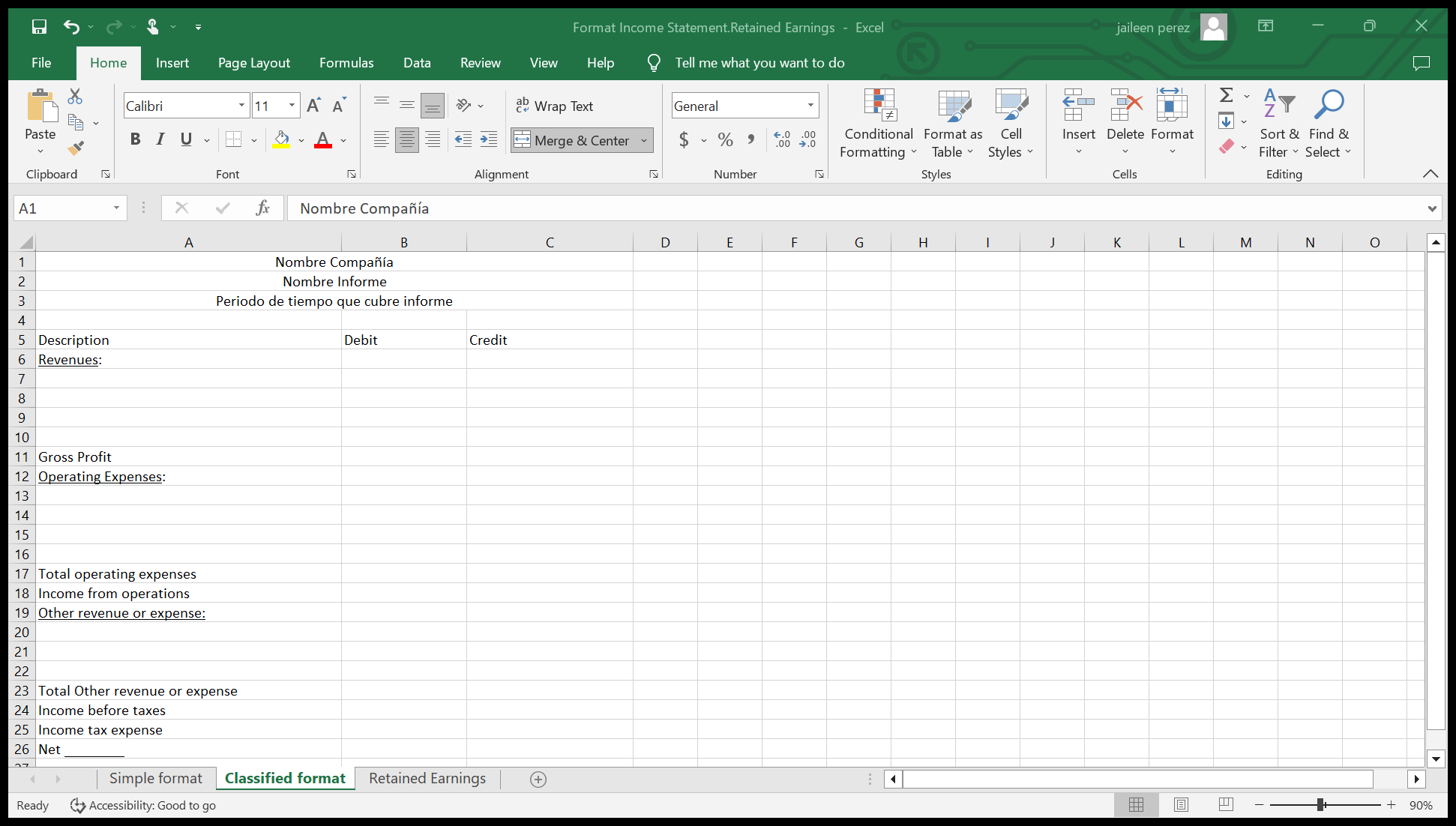

E-5-5 page 5-59: Single and Multiple and Income Statement instructions #2, Tax rate 35% E5-8, pages 5-61: Cost of Goods Sold, Income Statements, and Statement of Comprehensive Income Instructions #3, Tax rate 25%.

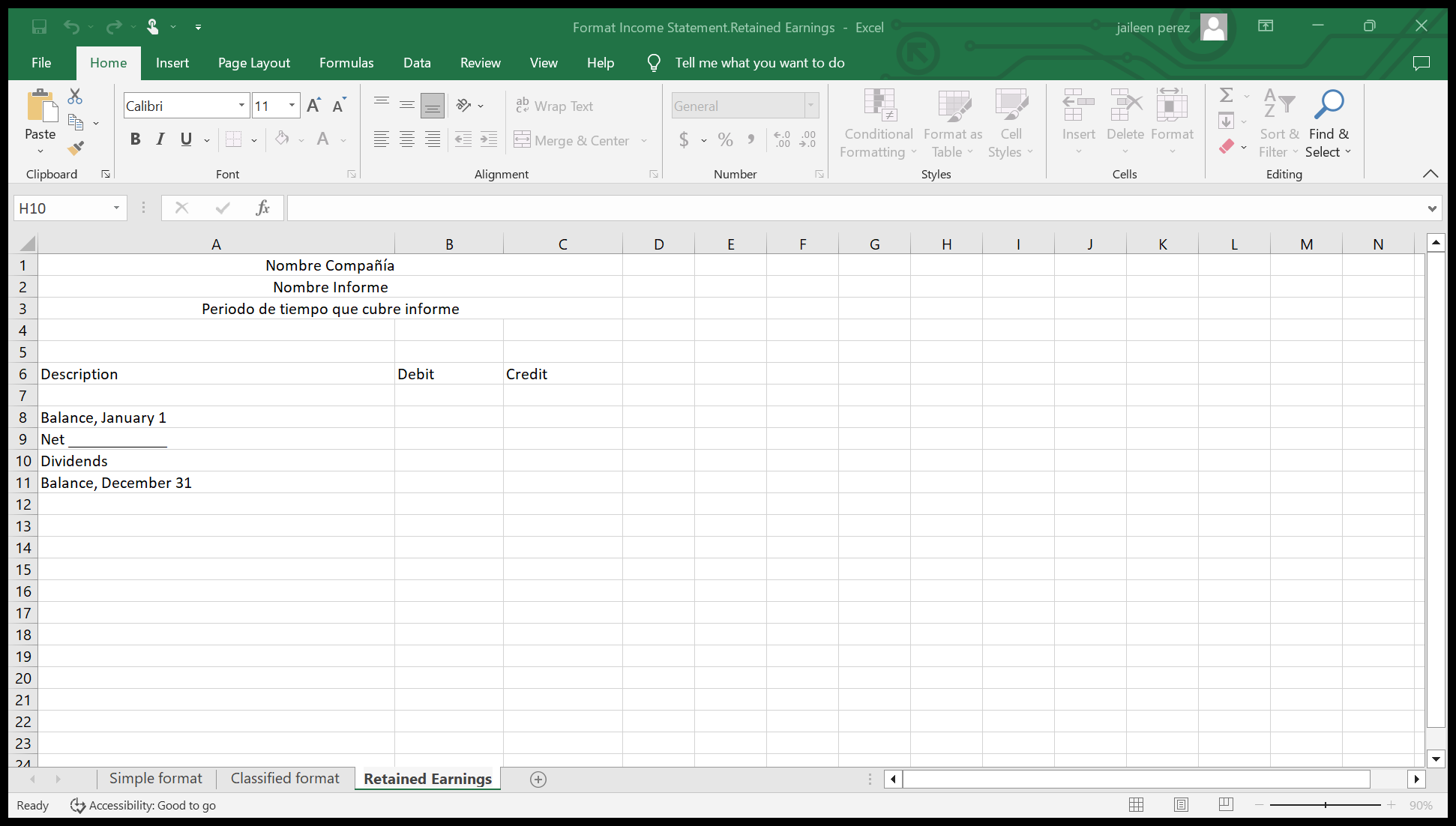

E5-17, p. 5-64: Multiple Income Statement and Retained Earnings Statement Instructions: Simple Income Statement and Retained earnings Statement.Income tax is 35%, Cash dividend $2.75

E5-5

Sales $225,725

Cost of Goods Sold $152,225

Add Gain from Stock $ 50,275

E5-8

Sales $140,000

Purchases 80,000

Freight In exchange for Interest Expense account

E5-17

Sales $150,275

Cost of Goods Sold 85,000

Operating Expenses 32,225

Retained Earnings 46,750

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts