Question: After performing the ratio analysis, developing common-size financial statements, and examining return on equity by the DuPont method, Warren Lynch presented his findings and recommendations

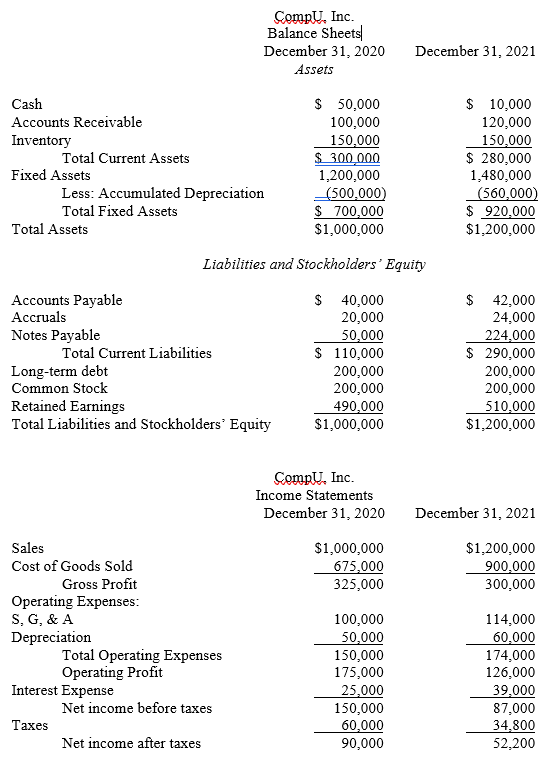

After performing the ratio analysis, developing common-size financial statements, and examining return on equity by the DuPont method, Warren Lynch presented his findings and recommendations for CompU to Bill Jobs. Warren stated that the large decrease in cash and the use of short-term debt concerned him and recommended doing cash and profit planning to make sound financing and expansion decisions. He also pointed out that the cost of goods sold was increasing and needed further analysis. Bill agreed, and thanked Warren for his hard work. Bill said he would talk to their suppliers and determine what was driving the increased costs while Warren started the cash and profit planning process. Warren said he would develop pro forma financial statements to forecast future profits and financing required.

- Using the financial statements for 2020 and 2021, information given, prepare the pro forma income statement and balance sheet for 2022. How much additional financing will CompU need?

- Based on the amount of additional financing requirements, what recommendations would you make to Warren in regards to the type of financing to pursue? What types of adjustments could CompU make in the operational forecast to reduce the amount of financing needed while still growing the business?

Information for pro forma financial statements:

- Sales are forecast to increase by 41.667% in 2022.

- Cash on the balance sheet will equal the $25,000 minimum cash balance Warren wants maintained.

- Additional fixed assets of $320,000 will be purchased in 2022.

- Warren wants to issue long-term debt of $175,000 and use the proceeds to pay down notes payable.

- Costs of Goods Sold, SG&A Expense, Accounts Receivable, Inventory, Accounts Payable, and Accruals will change in direct response to the change in sales.

- Common stock will remain unchanged.

- Depreciation expense will equal $75,000 for 2022.

- Interest expense will equal $40,000 for 2022.

- CompUs tax rate is 40%.

- Dividends of $2,500 will be paid in March, June, September, and December.

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts