Question: After preparing a bank reconciliation, a journal entry would be required for which of the following. A. A deposit in transit. B. A check for

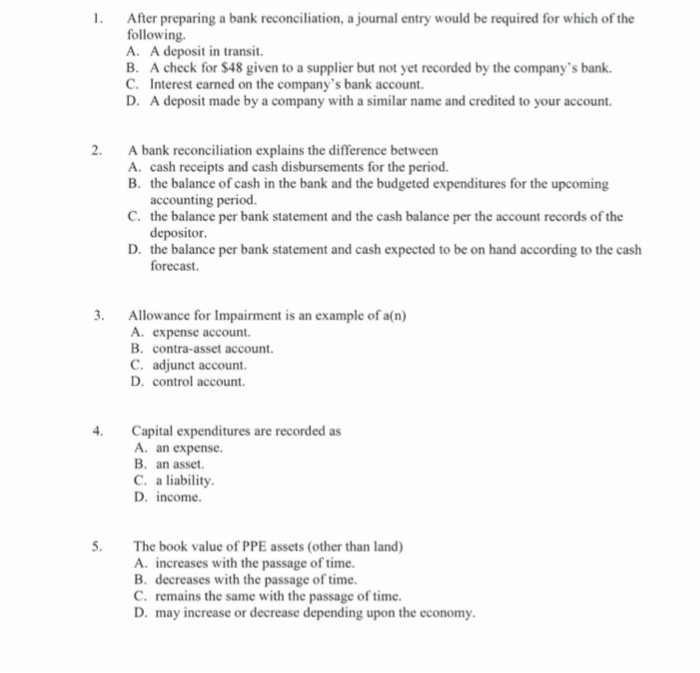

After preparing a bank reconciliation, a journal entry would be required for which of the following. A. A deposit in transit. B. A check for $48 given to a supplier but not yet recorded by the company's bank. C. Interest earned on the company's bank account. D. A deposit made by a company with a similar name and credited to your account 2. A bank reconciliation explains the difference between A. cash receipts and cash disbursements for the period. B. the balance of cash in the bank and the budgeted expenditures for the upcoming accounting period. c. the balance per bank statement and the cash balance per the account records of the depositor. D. the balance per bank statement and cash expected to be on hand according to the cash forecast 3. Allowance for Impairment is an example of a(n) A. expense account. B. contra-asset account. C. adjunct account. D. control account. Capital expenditures are recorded as A. an expense. B. an asset. C. a liability, D. income. The book value of PPE assets (other than land) A increases with the passage of time. B. decreases with the passage of time. C. remains the same with the passage of time. D. may increase or decrease depending upon the economy

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts