Question: After reading chapter 2 of the textbook: answer with: 1) increase, 2) decrease, 3) does not affect 1. Earnings are not distributed as dividends (i.e.,

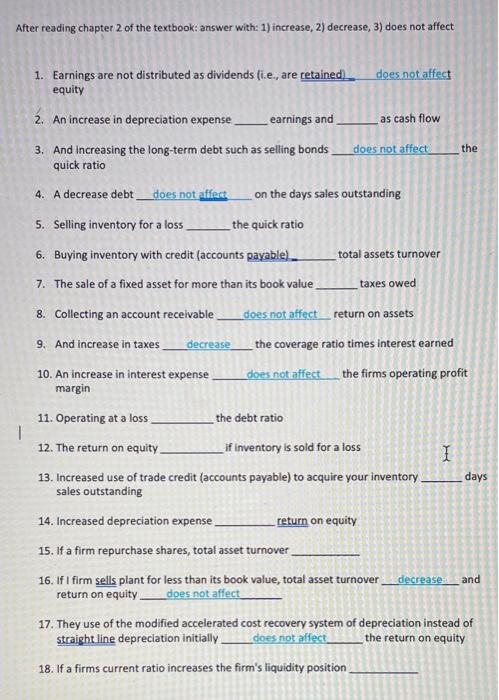

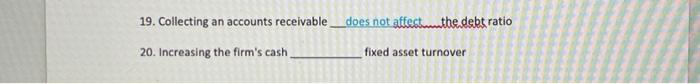

After reading chapter 2 of the textbook: answer with: 1) increase, 2) decrease, 3) does not affect 1. Earnings are not distributed as dividends (i.e., are retained) equity does not affect as cash flow 2. An increase in depreciation expense earnings and 3. And increasing the long-term debt such as selling bonds quick ratio does not affect the 1 4. A decrease debt does not affect on the days sales outstanding 5. Selling inventory for a loss the quick ratio 6. Buying inventory with credit (accounts payable total assets turnover 7. The sale of a fixed asset for more than its book value taxes owed 8. Collecting an account receivable does not affect_return on assets 9. And increase in taxes decrease the coverage ratio times interest earned 10. An increase in interest expense does not affect the firms operating profit margin 11. Operating at a loss the debt ratio 12. The return on equity if inventory is sold for a loss I 13. Increased use of trade credit (accounts payable) to acquire your inventory days sales outstanding 14. Increased depreciation expense return on equity 15. If a firm repurchase shares, total asset turnover 16. If I firm sells plant for less than its book value, total asset turnover decrease and return on equity___does not affect 17. They use of the modified accelerated cost recovery system of depreciation instead of straight line depreciation initially does not affect _the return on equity 18. If a firms current ratio increases the firm's liquidity position 19. Collecting an accounts receivable__does not affect the debt ratio 20. Increasing the firm's cash fixed asset turnover

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts