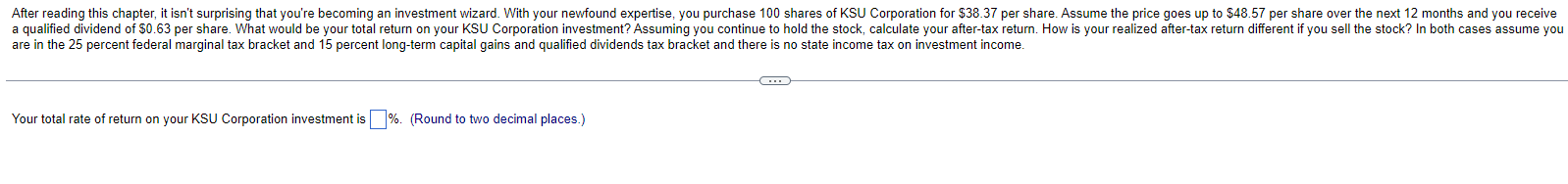

Question: After reading this chapter, it isn't surprising that you're becoming an investment wizard. With your newfound expertise, you purchase 100 shares of KSU Corporation for

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock