Question: After successfully completing FI 3300. David is considering buying some bonds to add to his recently started retirement account. He is looking at a bond

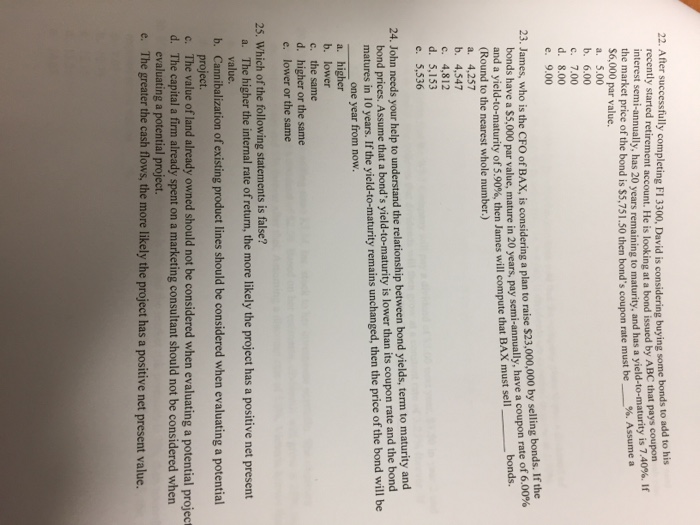

After successfully completing FI 3300. David is considering buying some bonds to add to his recently started retirement account. He is looking at a bond issued by ABC that pays coupon interest semi-annually, has 20 years remaining to maturity, and has a yield-to-maturity is 7.40 %. If the market price of the bond is $5.751.50 then bond's coupon rate must be %. Assume a $6.000 par value. 5.00 6.00 7.00 8.00 9.00 James, who is the CFO of BAX. is considering a plan to raise $23,000.000 by selling bonds. If the bonds have a $5.000 par value, mature in 20 years, pay semi-annually, have a coupon rate of 6.00% and a yield-to-maturity of 5.90%. then James will compute that BAX must sell bonds (Round to the nearest whole number.) 4.257 4, 547 4.812 5.153 5.536 John needs your help to understand the relationship between bond yields, term to maturity and bond prices. Assume that a bond's yield-to-maturity is lower than its coupon rate and the bond matures in 10 years. If the yield-to-maturity remains unchanged, then the price of the bond will be one year from now. higher lower the same higher or the same lower or the same Which of the following statements is false? The higher the internal rate of return, the more likely the project has a positive net present value. Cannibalization of existing product lines should be considered when evaluating a potential project. The value of land already owned should not be considered w hen evaluating a potential project The capital a firm already spent on a marketing consultant should not be considered when evaluating a potential project. The greater the cash flows, the more likely the project has a positive net present value

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts