Question: After the financial analysis based on 2016 preliminary estimates was completed, a number of changes were adopted to improve financial and business results for S&S

After the financial analysis based on 2016 preliminary estimates was completed, a number of changes were adopted to improve financial and business results for S&S Air during 2016. The customer that awarded the large 40 aircraft order agreed to make interim payments as finished aircraft were delivered (for a price concession). Revenue was revised up slightly due to updated marketing plans. Expenses were trimmed and controls were established that greatly reduced on hand inventory needs. A portion of the line of credit was converted to a 5 year, fixed rate loan. Cash on hand and general liquidity was forecasted to improve to acceptable levels by the end of the year.

Mark and Marie approached Chris about creating a forecast for 2017. They had learned the value of the financial analysis done for 2016 and wanted to get a look at any issues or problems that might be looming in the future. Of particular concern was the continuing need for external funds as the firm continued to grow.

The general consensus of Mark and Marie was that S&S Air should realize an increase in revenue of 17% in 2017 from the 2016 results, based on anticipated demand of aircraft. It was felt expenses would change by the same percent of sales as incurred in 2016. However, it was estimated that annual depreciation in 2017 would increase 70% (to a total of $1,075,000), due to the substantial increase in assets that were going to be needed. Finally, Chris said that her banking contract indicted that interest expense should be about 8% of both notes payable and long term debt in 2017.

By the end of 2016, the firm would be operating at capacity; it was estimated that further growth in 2017 would require $6,500,000 (including all depreciation - that is, adding $6.5 million to the 2016 Net PP&E to derive PP&E for 2017) in plant upgrades and additions to meet anticipated production volume. Everyone felt that all other asset categories (including cash) and current liabilities (including the line of credit) would change by percent of revenue.

Both owners were concerned about where any needed external financing would come from. Neither was interested in raising any further equity, and agreed that they would likely secure long term financing for any external funds needed. The plan was to pay dividends totaling $400,000 in 2017. Chris knew that a key exhibit would be the forecast mode. She planned to set up the model so that a key input would be the sales growth forecast. The "plug" to reconcile the balance sheet would be long term debt.

1) Complete forecast model, then answer questions below.

Income statement 2013 % rev 2016 % rev 2017 % rev

Sales $15,444,000 100.0% $21,566,000 100.0% 17%%

COGS 10,884,000 70.5% 14,786,000 68.6% % of rev 68.6%

Other expenses 1,845,600 12.0% 2,375,000 11.0% % of rev 11.0%

Depreciation 504,000 3.3% 625,000 2.9% given 1,075,000

EBIT 2,210,400 14.3% 3,780,000 17.5% calc

Interest 277,800 1.8% 437,000 2.0% given 8.0%

Taxable income 1,932,600 12.5% 3,343,000 15.5% calc

Taxes (40%) 773,040 5.0% 1,337,200 6.2% calc TI * tax rate 40.0%

Net income 1,159,560 7.5% 2,005,800 9.3% calc

Dividends 347,868 2.3% 375,000 1.7% given 400,000

Add to RE 811,692 5.3% 1,630,800 7.6% calc

Balance Sheet 2016 % rev 2017 %

Current Assets

Cash 280,800 1.8% 425,000 2.0% % of rev 2.0%

Accounts rec. 505,200 3.3% 855,000 4.0% % of rev 4.0%

Inventory 566,400 3.7% 689,000 3.2% % of rev 3.2%

Total CA 1,352,400 8.8% 1,969,000 9.1% calc

Fixed assets

Net PP&E 8,673,600 56.2% 9,873,000 45.8% given 6,500,000

Total Assets 10,026,000 64.9% 11,842,000 54.9% calc

Current Liabilities

Accounts Payable 596,400 3.9% 727,000 3.4% % of rev 3.4%

Notes Payable 1,207,200 7.8% 1,467,000 6.8% % of rev 6.8%

Total CL 1,803,600 11.7% 2,194,000 10.2% calc

Long-term debt 3,114,000 20.2% 2,908,800 13.5% PLUG

TOTAL CL + LTL 5,102,800

Shareholder Equity

Common stock 120,000 0.8% 120,000 0.6% no change

Retained earnings 4,988,400 32.3% 6,619,200 30.7% +2017 RE

Total Equity 5,108,400 33.1% 6,739,200 31.2% calc

Total L&E 10,026,000 64.9% 11,842,000 54.9% calc

Ratio Analysis

2016 2017 Industry

PM

7.2%

ROA 6.8%

ROE 13.8%

Debt / Equity 1.01

Debt / Total Assets 0.50

Equity Multiplier 2.01

Total Asset TO 0.95

DuPont ROE PM TATO EM

2016

2017

Industry 13.8% 7.2% 0.95 2.01

Q U E S T I O N S

2) Compare PM, ROA, and ROE from 2016 to 2017. Why the differences?

3) Compare debt ratios from 2016 to 2017. Why the differences?

4) Compare total asset turnover from 2016 to 2017. Why the difference? What observations can you make regarding capacity utilitzation from 2016 to 2017?

5) Estimate the maximum revenue possible given the new level of assets in 2017, based on TATO in 2016 (at full capacity).

6) If COGS could be decreased by 1% of revenue, how much increase in EBIT would result? Express the change in EBIT in both dollar terms and % change.

7) DuPont analysis on S&S Air for both 2016 and 2017. If the owners asked you for any issues or concerns about the basic results forecasted for 2017, what would you tell them? Consider operating, investing, and financing issues.

7a. Operating Comments

7b. Investing Comments

7c. Financing Comments

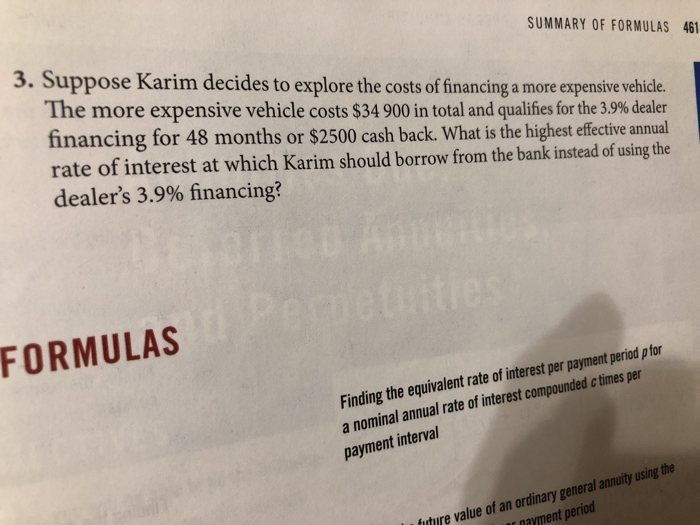

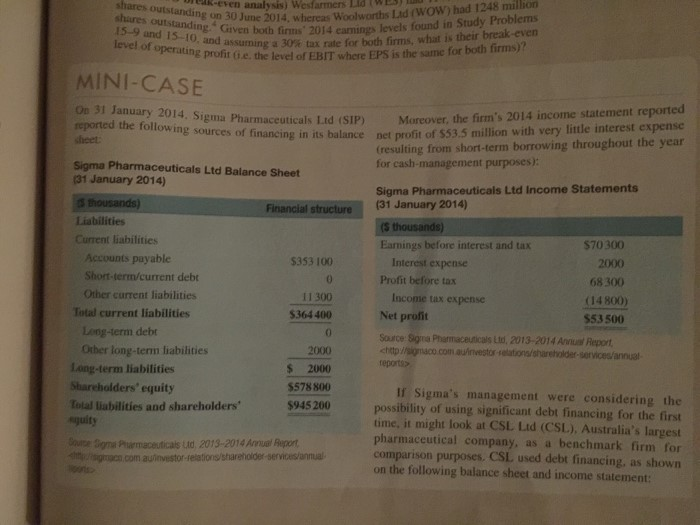

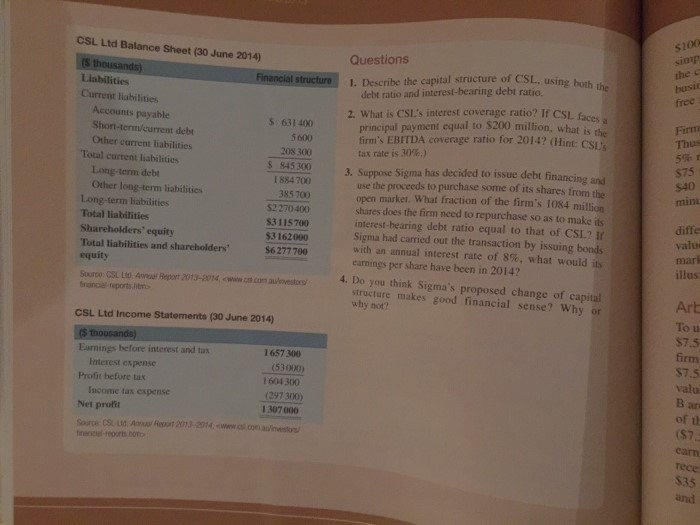

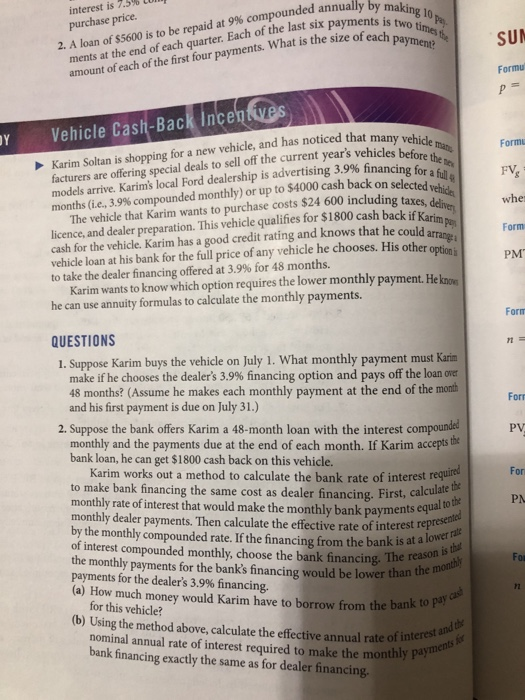

SUMMARY OF FORMULAS 461 3. Suppose Karim decides to explore the costs of financing a more expensive vehicle. The more expensive vehicle costs $34 900 in total and qualifies for the 3.9% dealer financing for 48 months or $2500 cash back. What is the highest effective annual rate of interest at which Karim should borrow from the bank instead of using the dealer's 3.9% financing? FORMULAS Finding the equivalent rate of interest per payment period p for a nominal annual rate of interest compounded c times per payment interval uture value of an ordinary general annuity using the payment periodshares outstanding analyst westander Crown had 1248 million shares outstanding.* Given both firms' 2014 earnings levels found in Study Problems 15-9 and 15-10. 0, and assuring a 30% tax rate for both firms, what is their break-even level of operating profit (ie. the level of EBIT where EPS is the same for both firms)? MINI-CASE On 31 January 2014. Sigma Pharmaceuticals Led (SIP) Moreover, the firm's 2014 income statement reported reported the following sources of financing in its balance net profit of $53.5 million with very little interest expense theet: (resulting from short-term borrowing throughout the year for cash-management purposes): Sigma Pharmaceuticals Ltd Balance Sheet (31 January 2014) Sigma Pharmaceuticals Ltd Income Statements [ thousands) Financial structure (31 January 2014) Liabilities ($ thousands) Current liabilities Earnings before interest and tax $70300 Accounts payable $353 100 Interest expense 2000 Short-term/current debt Profit before tax 68 300 Other current liabilities 11 300 Income tax expense (14 800) Total current liabilities $364 400 Net profit $53500 Long-term debt Source: Signs Pharmaceuticals Lid, 2013-2014 Annual Report, Other long-term liabilities 2000 chipw/sigmaco.com.auinvestor-relations/shareholder-services/annual Long-term liabilities 2000 Shareholders' equity $578 800 If Sigma's management were considering the Total liabilities and shareholders' $945 200 possibility of using significant debt financing for the first Equity time, it might look at CSL Lid (CSL), Australia's largest Source Siya Phurmeceuticals Lid, 2013-2014 Annual Report, pharmaceutical company, as a benchmark firm for shippingrogen,com auninvestor-relations/shareholder-services/annual comparison purposes. CSL used debt financing, as shown on the following balance sheet and income statement:sinn CSL Lid Balance Sheet (30 June 2014) Questions the ($ thousands) Financial structure I. Describe the capital structure of CSL. using both the busi Liabilities debt ratio and interest-bearing debt ratio. fred Current liabilities 2. What is CSL's interest coverage ratio? If CSL faces a Accounts payable 5:631400 Principal payment equal to $200 million, what is the Firm Short-term/current debt 5600 firm's EBITDA coverage ratio for 2014? (Hint: CSU's Thus Other current liabilities 208 300 tax rate is 30136.) Total current liabilities $75 5 845 300 Long-term debt J. Suppose Sigma has decided to issue debt financing and 1 884 700 use the proceeds to purchase some of its shares from the Other long-term liabilities 385 700 min open market. What fraction of the firm's 1084 million Long-term Habilities 52 270 400 shares does the firm need to repurchase so as to make its Total liabilities $3115700 interest-bearing debt ratio equal to that of CSL? Ir diffe Shareholders' equity $3162000 Sigma had carried out the transaction by issuing bonds valu Total liabilities and shareholders" $6277 700 with an annual interest rate of 8%, what would its mar equity earnings per share have been in 2014? illus Source: CSL Lid. Amout Report 2013-2014, www and con awbovestory 4. Do you think Sigma's proposed change of capital financial reports, hints why not? structure makes good financial sense? Why or Art To u CSL Lid Income Statements (30 June 2014) $7.5 ($ thousands) firm Earnings before interest and tax 1 657 300 $7.5 Interest expense (53000) valu Profit before tak 1601 300 Bar Income tax expense (297 300) Net profit 1:307 000 of t ($7 carn rece $35 andinterest is 7.570 purchase price. " A loan of $5600 is to be repaid at 9% compounded annually by making 10 thents at the end of each quarter. Each of the last six payments is two times amount of each of the first four payments. What is the size of each payment SUN Formu P = Vehicle Cash-Back Incentives Y Karim Soltan is shopping for a new vehicle, and has noticed that many vehicle mary Form facturers are offering special deals to sell off the current year's vehicles before the per models arrive. Karim's local Ford dealership is advertising 3.9% financing for a full FVg months (ie., 3.9% compounded monthly) or up to $4000 cash back on selected vehide The vehicle that Karim wants to purchase costs $24 600 including taxes, deliver whe licence, and dealer preparation. This vehicle qualifies for $1800 cash back if Karim pan cash for the vehicle. Karim has a good credit rating and knows that he could arrange : Form vehicle loan at his bank for the full price of any vehicle he chooses. His other option is to take the dealer financing offered at 3.9% for 48 months. PM Karim wants to know which option requires the lower monthly payment. He knows he can use annuity formulas to calculate the monthly payments. Form QUESTIONS 1. Suppose Karim buys the vehicle on July 1. What monthly payment must Karim make if he chooses the dealer's 3.9% financing option and pays off the loan over 48 months? (Assume he makes each monthly payment at the end of the month and his first payment is due on July 31.) For 2. Suppose the bank offers Karim a 48-month loan with the interest compounded PV monthly and the payments due at the end of each month. If Karim accepts the bank loan, he can get $1800 cash back on this vehicle. Karim works out a method to calculate the bank rate of interest required For to make bank financing the same cost as dealer financing. First, calculate the monthly rate of interest that would make the monthly bank payments equal to the monthly dealer payments. Then calculate the effective rate of interest represented by the monthly compounded rate. If the financing from the bank is at a lower rate of interest compounded monthly, choose the bank financing. The reason is that the monthly payments for the bank's financing would be lower than the monthly Fo payments for the dealer's 3.9% financing. for this vehicle? (a) How much money would Karim have to borrow from the bank to pay as (b) Using the method above, calculate the effective annual rate of interest and the nominal annual rate of interest required to make the monthly payments bank financing exactly the same as for dealer financing