Question: After you have calculated a C L V for each type o f customer that NCA serves, Kari would like you consider the following questions

After you have calculated a for each type customer that NCA serves, Kari would like you consider the following questions and summarize your findings and recommendations the memo that you prepare:

What the value average and customer? Which kind customer your analyses suggest the most valuable? Also, are the breakeven points for these customers the same they vary?

Kari and her team are considering dropping the price its coaching program. The proposal the table reduce the price this offering $ a new price $ The related costs for this offering would remain the same but NCA predicts that the new lower price would boost the response rate and the retention rate Assuming that these forecasts are correct, should NCA implement this strategy?

Kari has also come with some fresh new ideas for how boost the profitability their coaching product. a nutshell, they have come with two different options. Kari describes both these options you little out there and says that they only want mention these the NCA management team one them really has the potential boost the company profitability. For now, Kari says coyly, the specific these options will have stay wraps Assume that the associated costs for these options are identical and that the timing these costs also identical. Based solely your analyses, which option looks like the preferred choice? Under what assumptions would you recommend actually implementing this option? Here are the options consider:

Option : Kari believes that this option would boost the response rate from

Option : Kari believes that this option would boost the retention rate from

Finally, based all the analyses you have conducted and the insights into customer profitability that you have obtained, what actions should NCA take improve its overall financial performance? Specifically, they need make any modifications their product lineup? they make these changes, what kind shortterm and longterm effects will this have NCA business?General Context and Information About the Firm

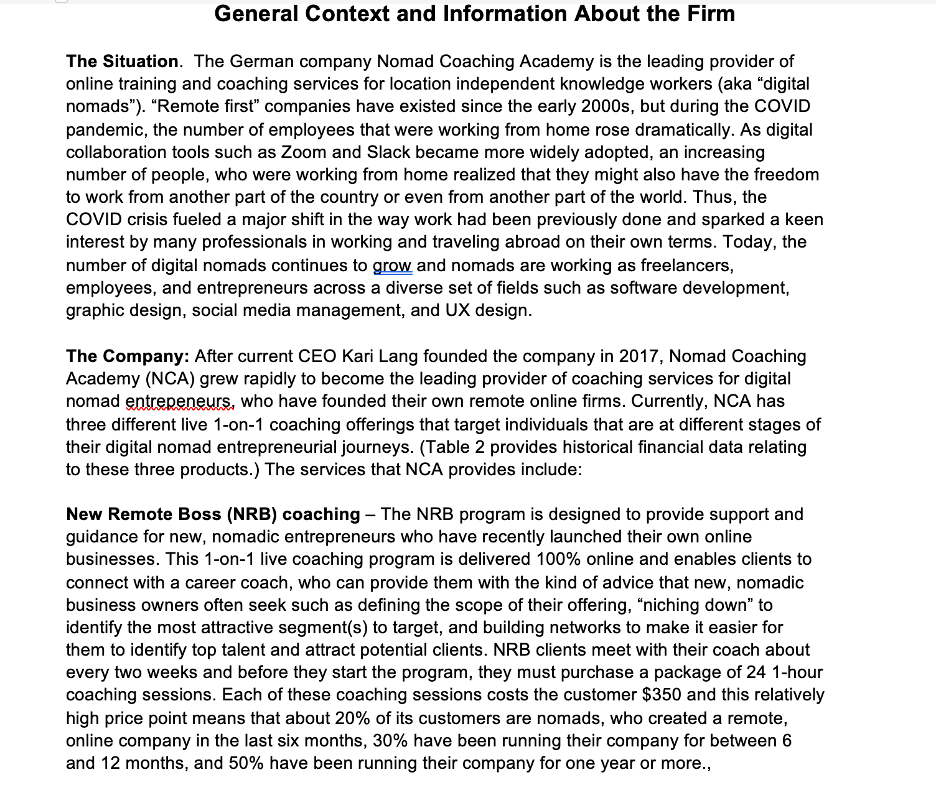

The Situation. The German company Nomad Coaching Academy the leading provider

online training and coaching services for location independent knowledge workers "digital

nomads" "Remote first" companies have existed since the early but during the COVID

pandemic, the number employees that were working from home rose dramatically. digital

collaboration tools such Zoom and Slack became more widely adopted, increasing

number people, who were working from home realized that they might also have the freedom

work from another part the country even from another part the world. Thus, the

COVID crisis fueled a major shift the way work had been previously done and sparked a keen

interest many professionals working and traveling abroad their own terms. Today, the

number digital nomads continues grow and nomads are working freelancers,

employees, and entrepreneurs across a diverse set fields such software development,

graphic design, social media management, and design.

The Company: After current CEO Kari Lang founded the company Nomad Coaching

Academy grew rapidly become the leading provider coaching services for digital

nomad entrepeneurs, who have founded their own remote online firms. Currently, NCA has

three different live coaching offerings that target individuals that are different stages

their digital nomad entrepreneurial journeys. provides historical financial data relating

these three products. The services that NCA provides include:

New Remote Boss coaching The program designed provide support and

guidance for new, nomadic entrepreneurs who have recently launched their own online

businesses. This live coaching program delivered online and enables clients

connect with a career coach, who can provide them with the kind advice that new, nomadic

business owners often seek such defining the scope their offering, "niching down"

identify the most attractive segment target, and building networks make easier for

them identify top talent and attract potential clients. clients meet with their coach about

every two weeks and before they start the program, they must purchase a package hour

coaching sessions. Each these coaching sessions costs the customer $ and this relatively

high price point means that about its customers are nomads, who created a remote,

online company the last six months, have been running their company for between

and months, and

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock