Question: After you have provided their input on the effect the acquisition will have on their department, perform an overall analysis to explain your recommendation to

After you have provided their input on the effect the acquisition will have on their department, perform an overall analysis to explain your recommendation to the CEO. Your analysis should include the following:Appendix A

Technology Year Average for Industry Averages

Management Effectiveness

Efficiency

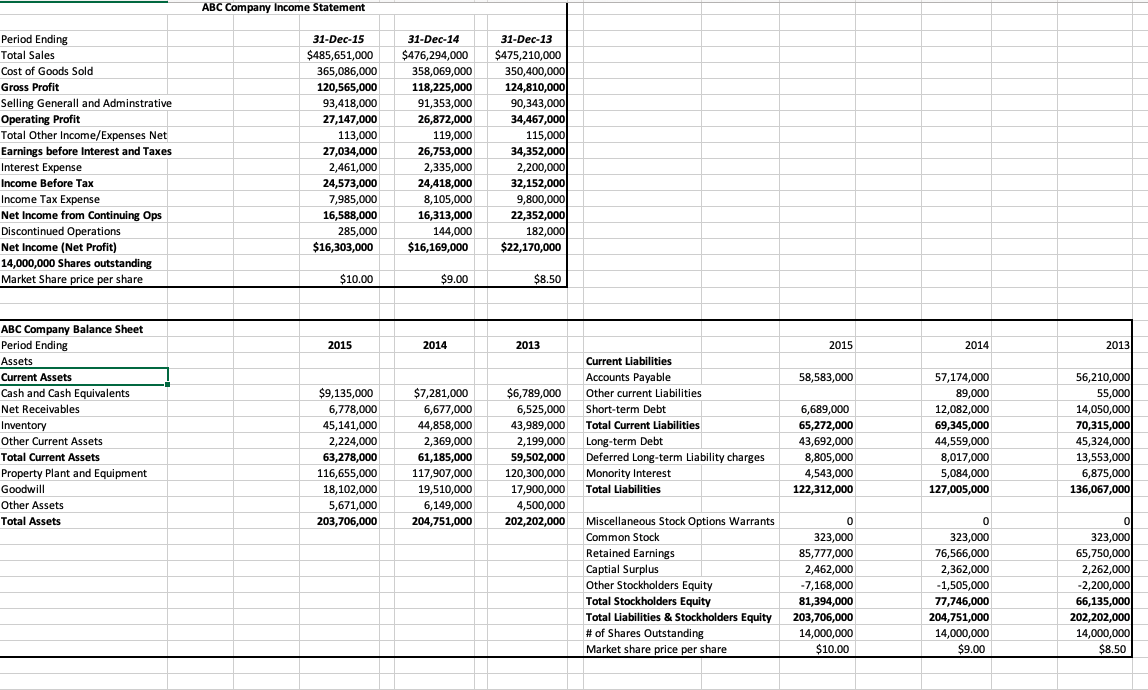

tableAcD EG IRatio CalculationsFormula Used Write out formulasLiquidity RatiosCurrent Ratio,,Current AssetsCurrent LiabilitiesQuick Ratio,,Current AssetsInventoryCurrent LiabilitiesActivity RatiosInventory Turnover,,COGSAverage InventoryAccounts Recievables Turnover,,Net SalesAverage Account ReceivableTotal Asset Turnover,,Net SalesAverage Total AssetsAverage Collection Period,,Average Accounts ReceivableNet SalesFinancing RatiosDebt Ratio,,Total DebtTotal AssetsDebttoEquity Ratio,,Total LiabilitesTotal Shareholder's EquityTimes Interest Earned Ratio,,EBITTotal Interest ExpenseMarket RatiosEarnings per Share EPSNet IncomeNumber of SharePrice Earnings PEShare PriceEarning per ShareProfitability RatiosReturn on Equity ROENet IncomeShareholders EquityReturn on Assets ROANet IncomeAverage AssetsNet Profit Margin,,Net IncomeSalesOperating Profit Margin,,Operating ProfitSales

Explain how the company is trending based on the yearoveryear ratios.

Compare the company to the industry average in Appendix A in the Excel workbook in areas of profitability, management effectiveness, and efficiency.

Based on the above, summarize the pros and cons of ABC Company using both the yearoveryear ratio analysis from Part and the industry average comparisons from Part

Provide your final recommendation as to whether or not the CEO should invest in ABC Company.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock