Question: After-Class 10 1 3.12 points Grey Wolf, Inc., has current assets of $2,210, net fixed assets of $9,700, current liabilities of $1,370, and long-term debt

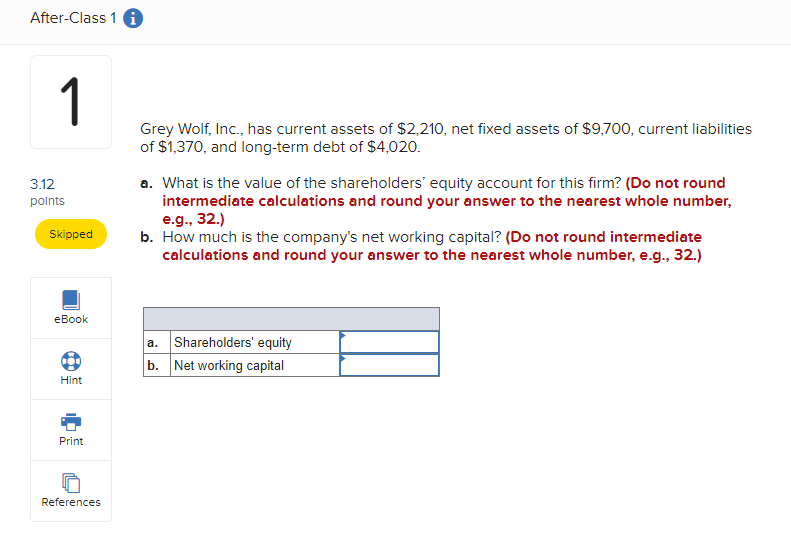

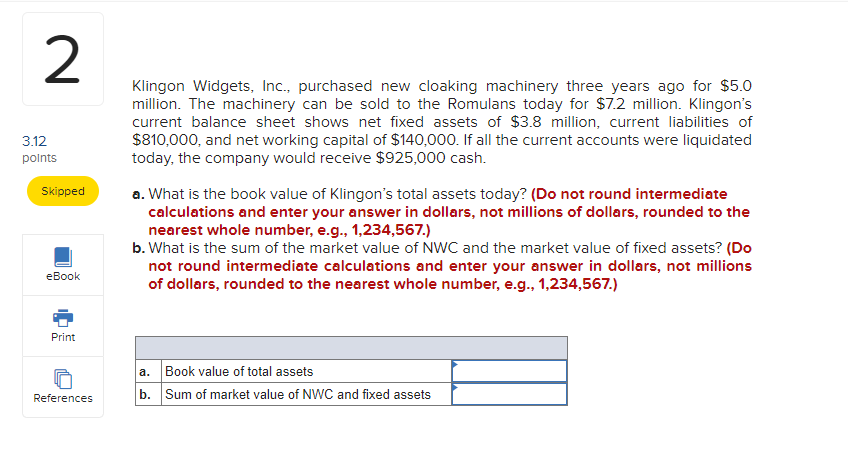

After-Class 10 1 3.12 points Grey Wolf, Inc., has current assets of $2,210, net fixed assets of $9,700, current liabilities of $1,370, and long-term debt of $4,020. a. What is the value of the shareholders' equity account for this firm? (Do not round intermediate calculations and round your answer to the nearest whole number, e.g., 32.) b. How much is the company's net working capital? (Do not round intermediate calculations and round your answer to the nearest whole number, e.g., 32.) Skipped eBook a. Shareholders' equity b. Net working capital Hint Print References 2 3.12 points Skipped Klingon Widgets, Inc., purchased new cloaking machinery three years ago for $5.0 million. The machinery can be sold to the Romulans today for $7.2 million. Klingon's current balance sheet shows net fixed assets of $3.8 million, current liabilities of $810,000, and networking capital of $140,000. If all the current accounts were liquidated today, the company would receive $925,000 cash. a. What is the book value of Klingon's total assets today? (Do not round intermediate calculations and enter your answer in dollars, not millions of dollars, rounded to the nearest whole number, e.g., 1,234,567.) b. What is the sum of the market value of NWC and the market value of fixed assets? (Do not round intermediate calculations and enter your answer in dollars, not millions of dollars, rounded to the nearest whole number, e.g., 1,234,567.) eBook Print a. Book value of total assets b. Sum of market value of NWC and fixed assets References

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts