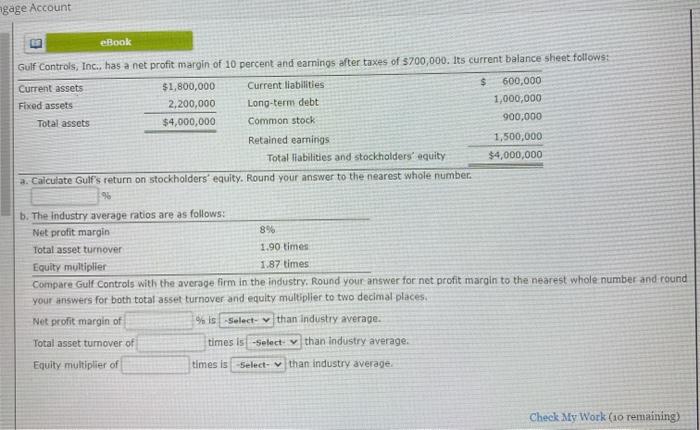

Question: agage Account E eBook Gulf Controls, Inc., has a net profit margin of 10 percent and earnings after taxes of $700,000. Its current balance sheet

agage Account E eBook Gulf Controls, Inc., has a net profit margin of 10 percent and earnings after taxes of $700,000. Its current balance sheet follows: Current assets $1,800,000 Current liabilities $ 600,000 Fixed assets 2,200,000 Long-term debt 1,000,000 Total assets $4,000,000 Common stock 900,000 Retained earings 1,500,000 Total liabilities and stockholders' equity $4,000,000 a. Calculate Gulf's return on stockholders' equity. Round your answer to the nearest whole number 96 b. The Industry average ratios are as follows: Net profit margin 8% Total asset turnover 1.90 times Equity multiplier 1.87 times Compare Gulf Controls with the average firm in the industry. Round your answer for net profit margin to the nearest whole number and round your answers for both total asset turnover and equity multiplier to two decimal places Net profit margin of % is select than industry average. Total asset turnover of times is-Select than Industry average Equity multiplier of times is select-than industry average Check My Work (10 remaining)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts