Question: Again, for this question, assume that: (a) a large Delaware corporation, Big Public Co., is going to buy all of DIY Chef's assets for $28,000,000;

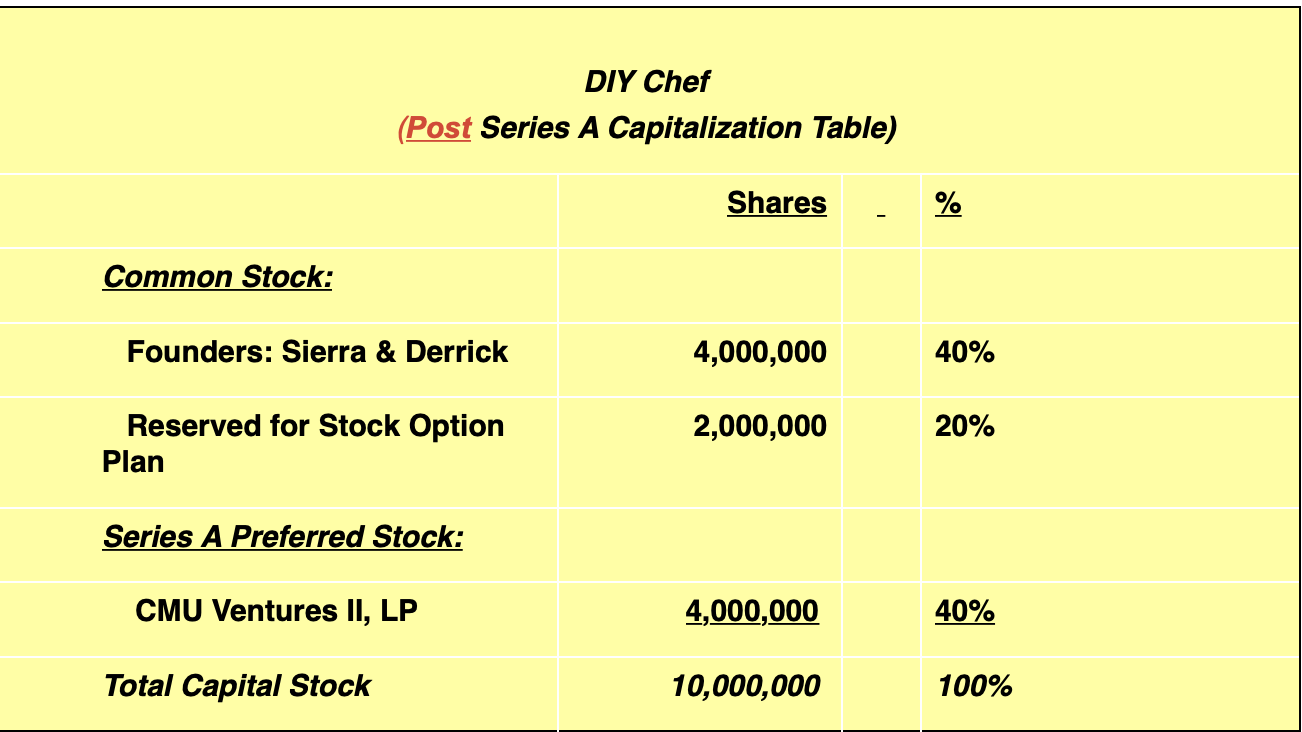

Again, for this question, assume that: (a) a large Delaware corporation, Big Public Co., is going to buy all of DIY Chef's assets for $28,000,000; (b) immediately after the sale, no shares of DIY Chef's common stock will be subject to any vesting; (c) immediately after the sale, DIY Chef has no debts or other liabilities; and, (d) DIY Chef is going to distribute all of the sale proceeds to its stockholders. Also, for purposes of this question only, assume that CMUV had acquired NON-participating preferred stock (i.e., instead of the full participating preferred stock). Assume further that the NON-participating preferred stock has a ONE times liquidation preference right (i.e., LP = 1X). Should CMUV convert its preferred stock to common stock after learning about the terms of the sale (HINT: 50% of $28,000,000 is $14,000,000)? No - because converting to common stock would cause CMUV to lose its special rights No - because converting to common stock would cause CMUV to receive LESS cash (than it would receive if it does NOT convert) Yes - because converting to common stock would cause CMUV to receive MORE cash (than it would receive if it does NOT convert) It does not matter. CMUV will receive exactly the same amount of cash regardless of whether it converts the preferred stock to common stock

Again, for this question, assume that: (a) a large Delaware corporation, Big Public Co., is going to buy all of DIY Chef's assets for $28,000,000; (b) immediately after the sale, no shares of DIY Chef's common stock will be subject to any vesting; (c) immediately after the sale, DIY Chef has no debts or other liabilities; and, (d) DIY Chef is going to distribute all of the sale proceeds to its stockholders. Also, for purposes of this question only, assume that CMUV had acquired NON-participating preferred stock (i.e., instead of the full participating preferred stock). Assume further that the NON-participating preferred stock has a ONE times liquidation preference right (i.e., LP = 1X). Should CMUV convert its preferred stock to common stock after learning about the terms of the sale (HINT: 50% of $28,000,000 is $14,000,000)? No - because converting to common stock would cause CMUV to lose its special rights No - because converting to common stock would cause CMUV to receive LESS cash (than it would receive if it does NOT convert) Yes - because converting to common stock would cause CMUV to receive MORE cash (than it would receive if it does NOT convert) It does not matter. CMUV will receive exactly the same amount of cash regardless of whether it converts the preferred stock to common stock

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts