Question: AGEC 340 Class Assignment Date: Name: 2. What is the IRR for an investment that requires a $5,000 initial investment and yields $5,800 cash payment

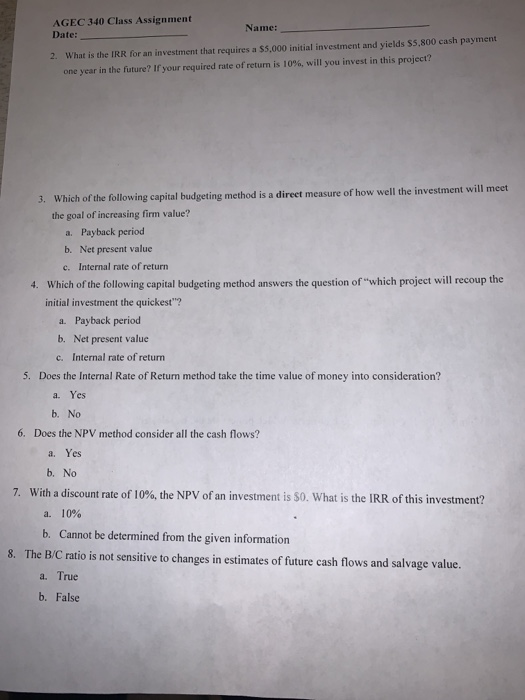

AGEC 340 Class Assignment Date: Name: 2. What is the IRR for an investment that requires a $5,000 initial investment and yields $5,800 cash payment one year in the future? If your required rate of return is 10%, will you invest in this project? 3. Which of the following capital budgeting method is a direct measure of how well the investment will meet the goal of increasing firm value? a. Payback period b. Net present value c. Internal rate of return 4. Which of the following capital budgeting method answers the question of "which project will recoup the initial investment the quickest"? a. Payback period b. Net present value c. Internal rate of return 5. Does the Internal Rate of Retum method take the time value of money into consideration? a. Yes b. No 6. Does the NPV method consider all the cash flows? a. Yes b. No 7. With a discount rate of 10%, the NPV of an investment is $0. What is the IRR of this investment? a. 10% b. Cannot be determined from the given information 8. The B/C ratio is not sensitive to changes in estimates of future cash flows and salvage value. a. True b. False

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts