Question: Agee Technology, Inc., issued 9% bonds, dated January 1, with a face amount of $1,000 million on July 1, 2021, at a price of $990

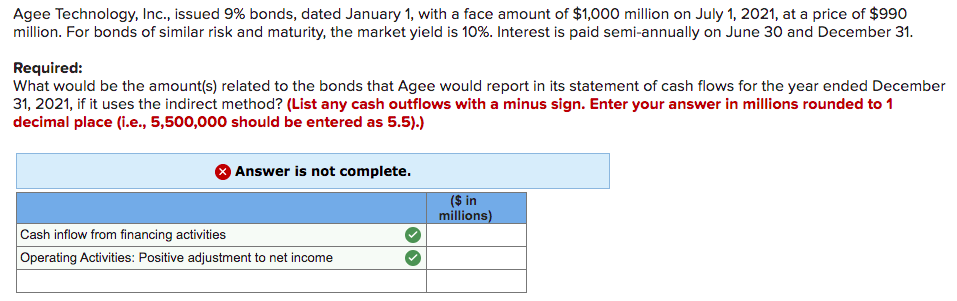

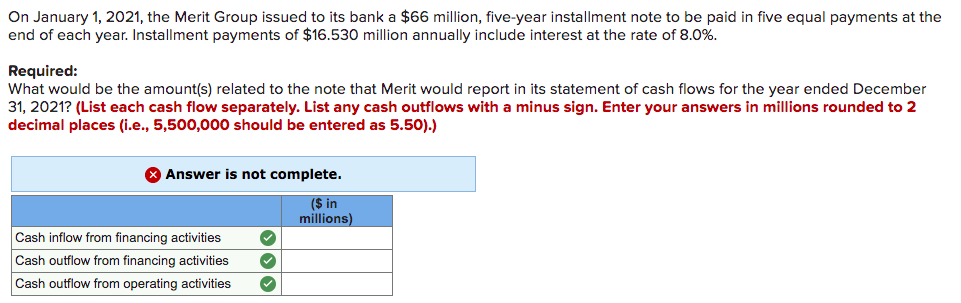

Agee Technology, Inc., issued 9% bonds, dated January 1, with a face amount of $1,000 million on July 1, 2021, at a price of $990 million. For bonds of similar risk and maturity, the market yield is 10%. Interest is paid semi-annually on June 30 and December 31. Required: What would be the amount(s) related to the bonds that Agee would report in its statement of cash flows for the year ended December 31, 2021, if it uses the indirect method? (List any cash outflows with a minus sign. Enter your answer in millions rounded to 1 decimal place (i.e., 5,500,000 should be entered as 5.5).) Answer is not complete. ($ in millions) Cash inflow from financing activities Operating Activities: Positive adjustment to net income On January 1, 2021, the Merit Group issued to its bank a $66 million, five-year installment note to be paid in five equal payments at the end of each year. Installment payments of $16.530 million annually include interest at the rate of 8.0%. Required: What would be the amount(s) related to the note that Merit would report in its statement of cash flows for the year ended December 31, 2021? (List each cash flow separately. List any cash outflows with a minus sign. Enter your answers in millions rounded to 2 decimal places (i.e., 5,500,000 should be entered as 5.50).) Answer is not complete. ($ in millions) Cash inflow from financing activities Cash outflow from financing activities Cash outflow from operating activities OOO

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts