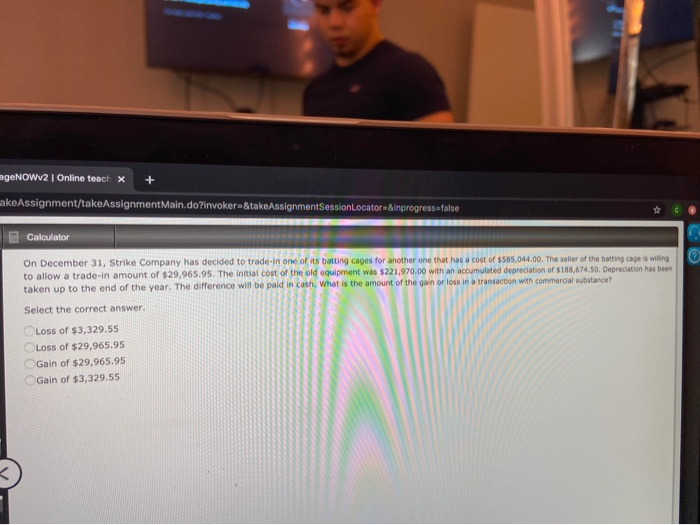

Question: ageNOWV2 Online teach x + akeAssignment/takeAssignment Main.do?invokere&takeAssignmentSessionLocator &inprogress false Calculator On December 31, Strike Company has decided to trade in one of its batting cages

ageNOWV2 Online teach x + akeAssignment/takeAssignment Main.do?invokere&takeAssignmentSessionLocator &inprogress false Calculator On December 31, Strike Company has decided to trade in one of its batting cages for another one that has a cost of $585,014.00. The seller of the batting cage is willing to allow a trade-in amount of $29,965.95. The initial cost of the old equipment was $221,970.00 with an accumulated depreciation of $188,674.50. Depreciation has been taken up to the end of the year. The difference will be paid in cash. What is the amount of the gain or loss in a transaction with commercial substance? Select the correct answer. Loss of $3,329.55 Loss of $29,965.95 Gain of $29,965.95 Gain of $3,329.55

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts