Question: Aggie enters into a contract offering variable consideration. The contract pays him $4,400 /month for six months of continuous consulting services. In addition, there is

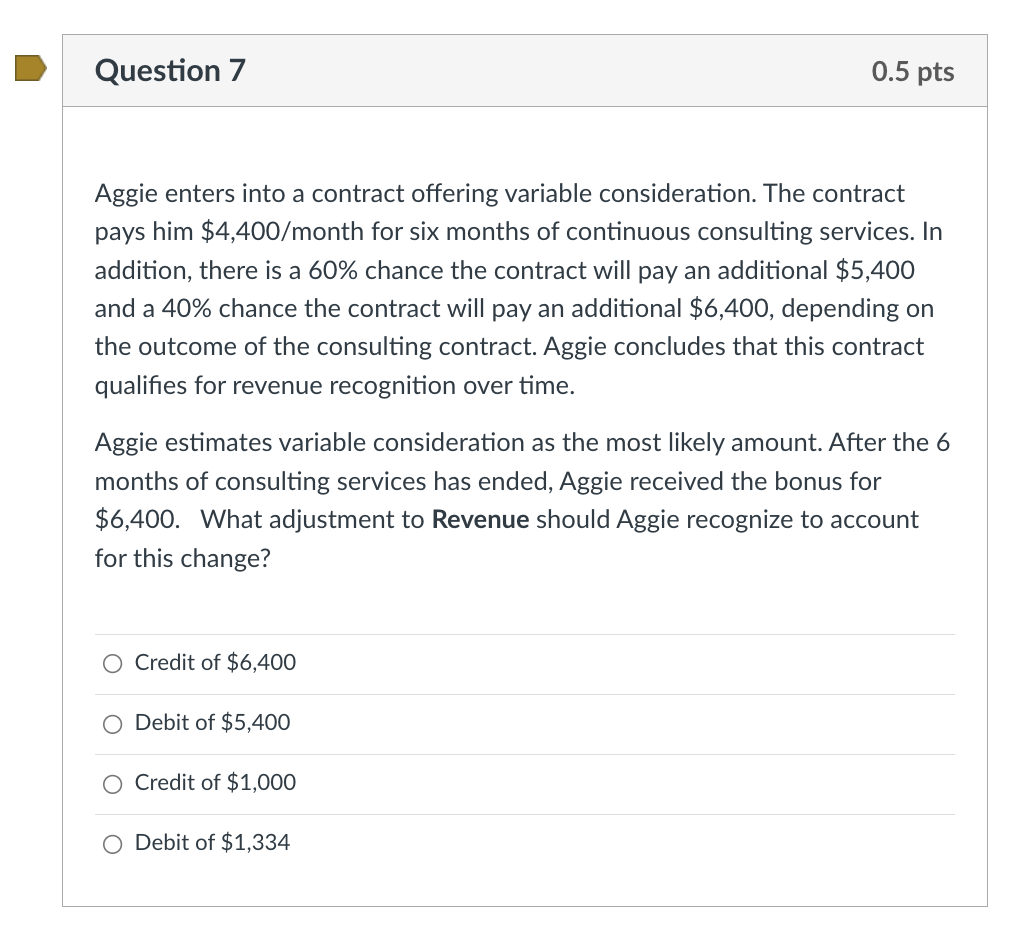

Aggie enters into a contract offering variable consideration. The contract pays him $4,400 /month for six months of continuous consulting services. In addition, there is a 60% chance the contract will pay an additional $5,400 and a 40% chance the contract will pay an additional $6,400, depending on the outcome of the consulting contract. Aggie concludes that this contract qualifies for revenue recognition over time. Aggie estimates variable consideration as the most likely amount. After the 6 months of consulting services has ended, Aggie received the bonus for $6,400. What adjustment to Revenue should Aggie recognize to account for this change? Credit of $6,400 Debit of $5,400 Credit of $1,000 Debit of $1,334

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts