Question: Ahmad Inc. is evaluating a project that requires an initial investment in equipment of 90,000 KD and then requires an investment in working capital of

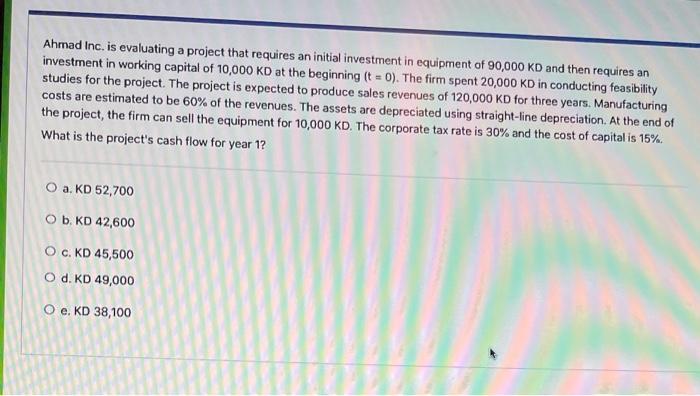

Ahmad Inc. is evaluating a project that requires an initial investment in equipment of 90,000 KD and then requires an investment in working capital of 10,000 KD at the beginning (t = 0). The firm spent 20,000 KD in conducting feasibility studies for the project. The project is expected to produce sales revenues of 120,000 KD for three years. Manufacturing costs are estimated to be 60% of the revenues. The assets are depreciated using straight-line depreciation. At the end of the project, the firm can sell the equipment for 10,000 KD. The corporate tax rate is 30% and the cost of capitalis 15% What is the project's cash flow for year 1? O a KD 52,700 O b.KD 42,600 Oc. KD 45,500 O d. KD 49,000 O e.KD 38,100

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts