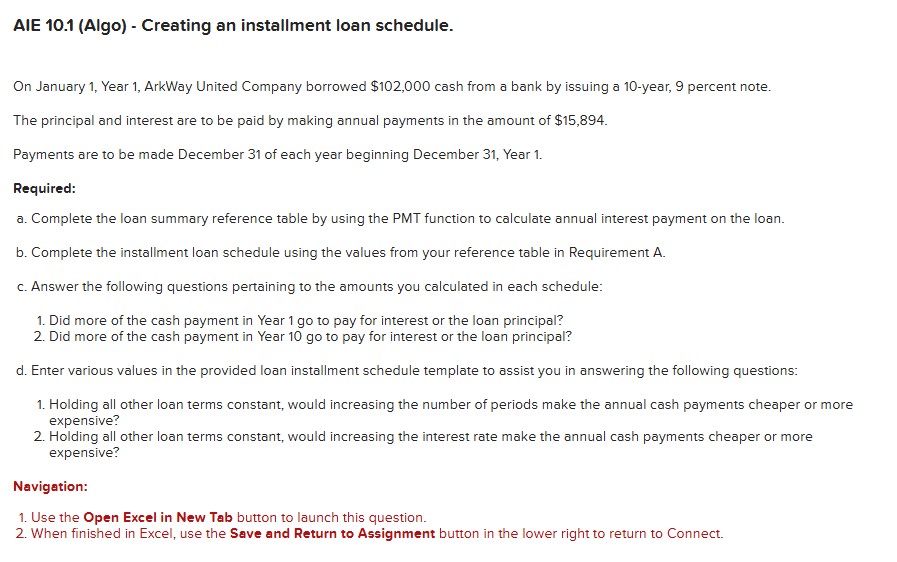

Question: AIE 1 0 . 1 ( Algo ) - Creating an installment loan schedule. On January 1 , Year 1 , ArkWay United Company borrowed

AIE Algo Creating an installment loan schedule.

On January Year ArkWay United Company borrowed $ cash from a bank by issuing a year, percent note.

The principal and interest are to be paid by making annual payments in the amount of $

Payments are to be made December of each year beginning December Year

Required:

a Complete the loan summary reference table by using the PMT function to calculate annual interest payment on the loan.

b Complete the installment loan schedule using the values from your reference table in Requirement A

c Answer the following questions pertaining to the amounts you calculated in each schedule:

Did more of the cash payment in Year go to pay for interest or the loan principal?

Did more of the cash payment in Year go to pay for interest or the loan principal?

d Enter various values in the provided loan installment schedule template to assist you in answering the following questions:

Holding all other loan terms constant, would increasing the number of periods make the annual cash payments cheaper or more expensive?

Holding all other loan terms constant, would increasing the interest rate make the annual cash payments cheaper or more expensive?

Navigation:

Use the Open Excel in New Tab button to launch this question.

When finished in Excel, use the Save and Return to Assignment button in the lower right to return to Connect. begintabularccccccc

hline multicolumnlmultirowt & & multicolumnc

hline & & & multicolumncAmount & multicolumnc Change

hline multirowtAssets & multirowtCurrent Assets & Cash and cash equivalents & $ & & &

hline & & Marketable securities & $ & & &

hline & & Restricted cash & $ & & &

hline & & Accounts receivables & $ & & &

hline & & Funds receivable and amounts held on behalf of & $ & & A &

hline & & Prepaids and other current assets & $ & & &

hline & multirowtLongterm Assets & Property and equipment, net & $ & & &

hline & & Intangible assets, net & $ & & A &

hline & & Goodwill & $ & & A &

hline & multicolumnlmultirowtTotal Other assets, noncurrent & $ & & multirowt

mathbfDelta

& multirowb

hline & & & & $ & &

hline multirowtLiabilities & multirowtCurrent Liabilities & multirowtbegintabularl

Accounts payable

Accrued expenses and other current liabilities Funds payable and amounts payable to custom.. Unearned fees Other liabilities, current

endtabular & $ & & A &

hline & & & $ & & &

hline & & & $ & & &

hline & & & $ & & &

hline & & & $ & & &

hline & Longterm Liabilities & Longterm debt, net of current portion & $ & & &

hline & Longterm liabilities & Other liabilities, noncurrent & $ & multirowb$ & multirowtA &

hline & Total & multirowtCommon stock Retained earnings Other equity & & & &

hline multirowtEquity & multirowtStockholders Equity & & & & A &

hline & & &

$

& & &

hline & Total & & & $ & &

hline

endtabular

Shown in thousands. Data Source: Kreport filings.

Required:

As of December what percent of assets will be used or converted into cash within the next year?

As of December what how many liabilities are due to be paid within the next year?

As of December what is Airbnb's current ratio?

Is Airbnb a profitable company?

Based on the current ratio, do you expect Airbnb will have a liquidity problem within the next year?

As of December what was Airbnb"s debttoassets ratio?

Based on debttoassets ratio, is Airbnb insolvent?

Based on data, would you say that Airbnb has a healthy balance sheet?

Given Airbnb's lack of ability to generate income, how are they able to stay in business?

Airbnb's current asset Funds recelvable and amounts held on behalf of customers has the same balance as the current liability Funds payable and amounts payable to customers. Is this an error or is there a good explanation? Income Statement for Airbnb

Legend: Revenue Net Income Loss Statement of Cash Flow for Airbnb

Select a Financial Statemen

Statement of Cash Flow

Legend: Cash from Operations Cash from Investing Cash from Financing

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock