Question: Airbnb ( ticker: ABNB ) was a high - profile initial public offering ( IPO ) in January 2 0 2 1 , and it

Airbnb ticker: ABNB was a highprofile initial public offering IPO in January and it has been in the news ever since. There is a considerable amount of uncertainty surrounding Airbnbs longterm viabilityas local governments attempt to limit its operation. The purpose of this case is to apply your capital budgeting skills in a valuation of Airbnb.Think of valuing a company like a big capital budgeting exercise. However, instead of forecasting cash flows for a single project, you will be forecasting cash flows for an entire company. Likewise, instead of computing the NPV of an individual project, you will compute the NPV of the cash flows of the entire company. There will be one key difference: with projects we typically assume they come to an end, but with companies we dont at least we hope not! Thus, we need to make an assumption about how cash flows in the company grow in the long run. Typically we forecast individual cash flows for years and then make an assumption about how cash flows grow after that more details on this below Here are the steps for the Airbnb case:

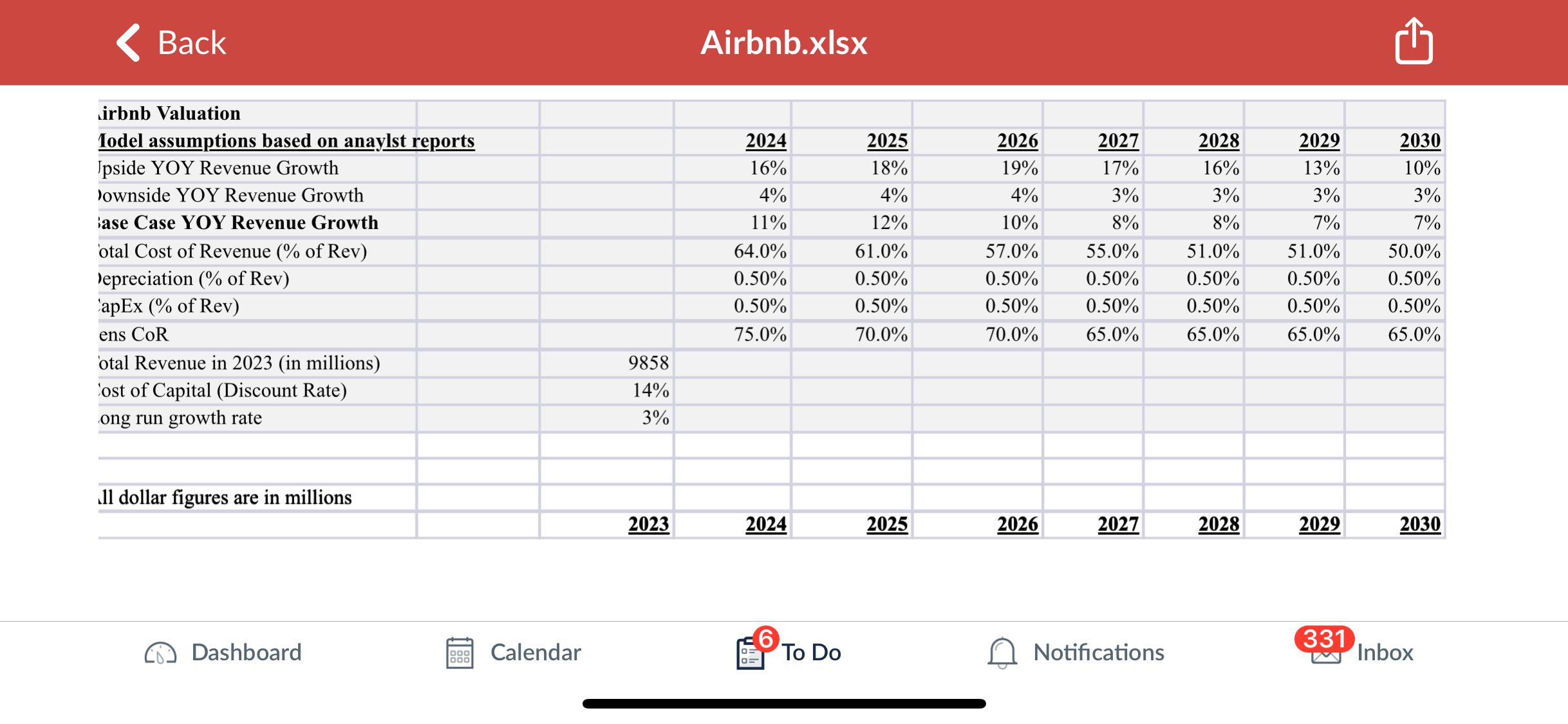

Start with the Airbnb excel worksheet Screenshot Back

Airbnb.xlsx

tabletableirbnb ValuationIodel assumptions based on anaylst reports The spreadsheet gives assumptions about the yearoveryear YOY growth of revenues and related expenses for These assumptions come from analyst reports and Airbnb management forecasts. Combining these sources gives a bumpy growth forecast for the next few years which is why the YOY growth estimates do not follow a smooth pattern at first. Use the base case assumptions in the excel sheet to build a forecast of earnings and free cash flows for the years to Specifically, start by forecasting revenues each year. Then, using these forecasts, compute the associated cost of revenue, depreciation and capital expenditures. Cost of revenue are all costs of revenue not including depreciation, so that Revenue Cost of Revenue Earnings Before Interest Taxes Depreciation and Amortization EBITDA Subtract off depreciation to get EBIT. Continue as we did in our capital budgeting exercises until you eventually get to Free Cash Flow. You can assume a tax rate of and negligible changes in net working capital. You can also assume an opportunity cost of capital of for all the FCFs

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock