Question: Aitkens Technologies Ltd (ATL), based in St. Catherine, has just patented a new technology which will give them a competitive advantage over their competitors.

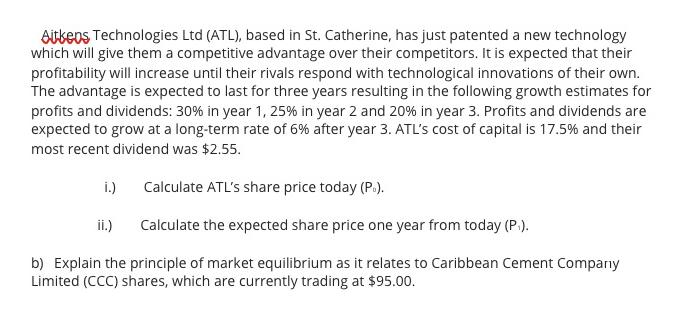

Aitkens Technologies Ltd (ATL), based in St. Catherine, has just patented a new technology which will give them a competitive advantage over their competitors. It is expected that their profitability will increase until their rivals respond with technological innovations of their own. The advantage is expected to last for three years resulting in the following growth estimates for profits and dividends: 30% in year 1, 25% in year 2 and 20% in year 3. Profits and dividends are expected to grow at a long-term rate of 6% after year 3. ATL's cost of capital is 17.5% and their most recent dividend was $2.55. Calculate ATL's share price today (P.). Calculate the expected share price one year from today (P.). b) Explain the principle of market equilibrium as it relates to Caribbean Cement Company Limited (CCC) shares, which are currently trading at $95.00. i.) ii.)

Step by Step Solution

There are 3 Steps involved in it

i To calculate ATLs share price today we need to use the dividend discount model DDM P D r g where P is the share price D is the most recent dividend ... View full answer

Get step-by-step solutions from verified subject matter experts