Question: aiz navigation 2 3 4 5 6 Question 19 Not yet answered Marked out of 15.00 Time 15123 8 9 10 11 12 p Flag

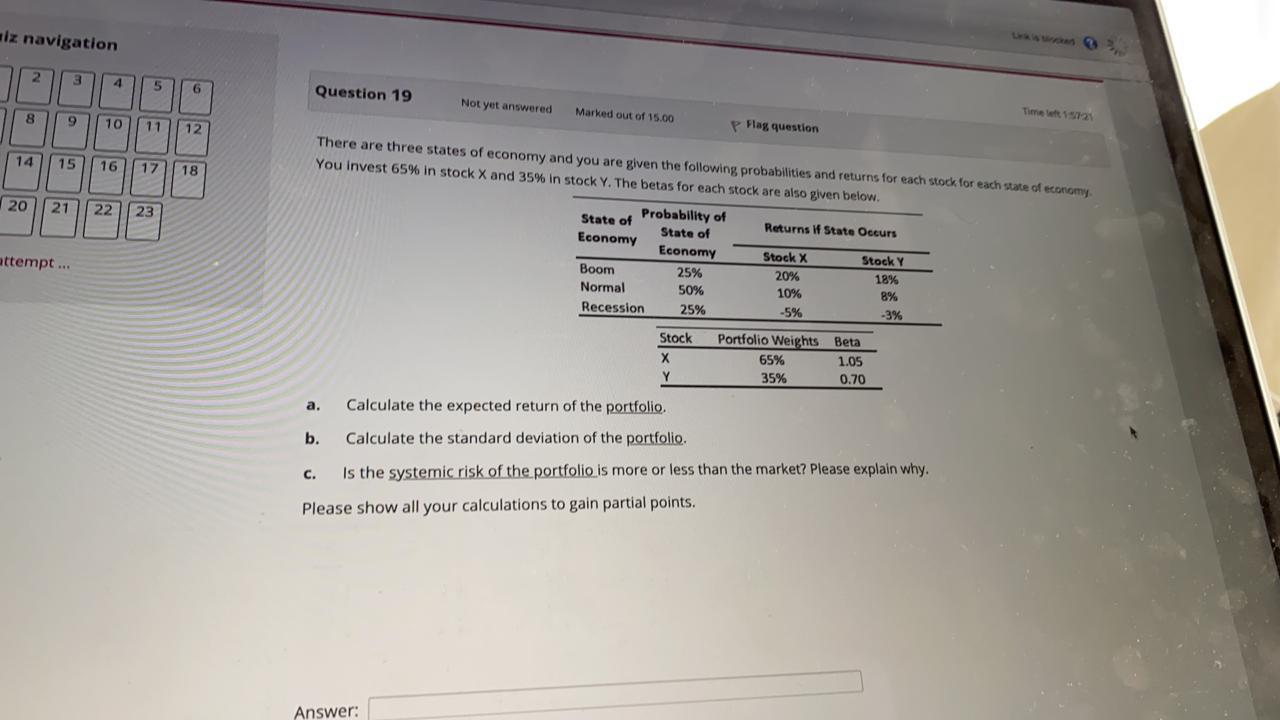

aiz navigation 2 3 4 5 6 Question 19 Not yet answered Marked out of 15.00 Time 15123 8 9 10 11 12 p Flag question There are three states of economy and you are given the following probabilities and returns for each stock for each state of economy You invest 65% in stock X and 35% in stock Y. The betas for each stock are also given below. 14 15 16 17 18 20 21 22 23 State of Probability of Returns if State Occurs Economy State of Economy attempt... Stock X 25% Boom Normal Recession 50% 25% 20% 10% -5% Stock Y 18% 8% -3% Stock X Y Portfolio Weights Beta 65% 1.05 35% 0.70 a. Calculate the expected return of the portfolio b. Calculate the standard deviation of the portfolio. c. Is the systemic risk of the portfolio is more or less than the market? Please explain why. Please show all your calculations to gain partial points

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts