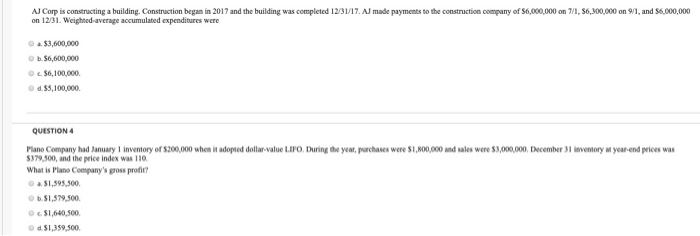

Question: AJ Corp is constructing a building. Construction began in 2017 and the building was completed 12/31/17. A made payments to the construction company of $6,000,000

AJ Corp is constructing a building. Construction began in 2017 and the building was completed 12/31/17. A made payments to the construction company of $6,000,000 on 7/1, 56,300,000 on 9/1, and 56,000,000 on 12/31. Weighted average accumulated expenditures were a $3,600,000 b. $6,600,000 56,100.000 od 55,100.000 QUESTION 4 Plane Company had January 1 inventory of $200,000 when it adopted dollar-value LIFO. During the year, purchases were $1,800,000 and sales were 53,000,000, December 31 inventory Myear-end prices was $379.500, and the ice index was 110 What is Plano Company's gross profit 2. 51,595,500 b.$1,579,500 OCSI 640.500 Od $1,359.500

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts