Question: - AL 1 | . 1 Normal 1 No Spac... Heading 1 Heading 2 Title Subtitle Subtle Paragraph 21 1 Practice Exercises Chapters 6 and

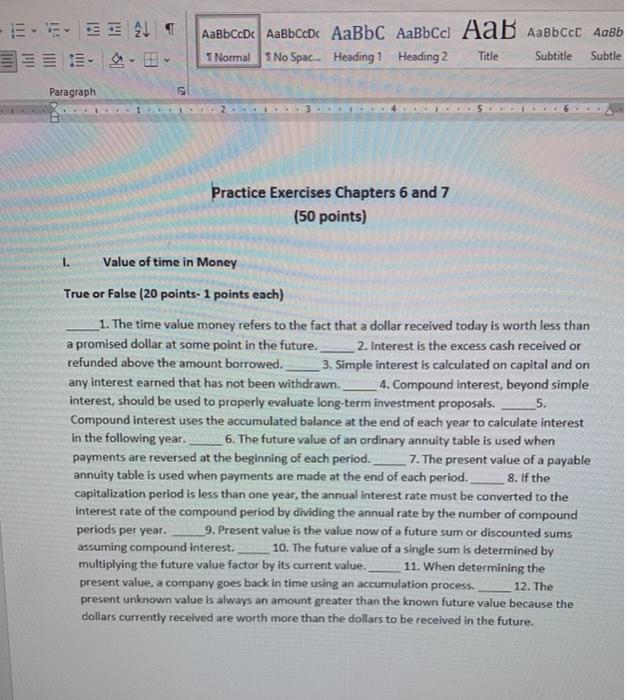

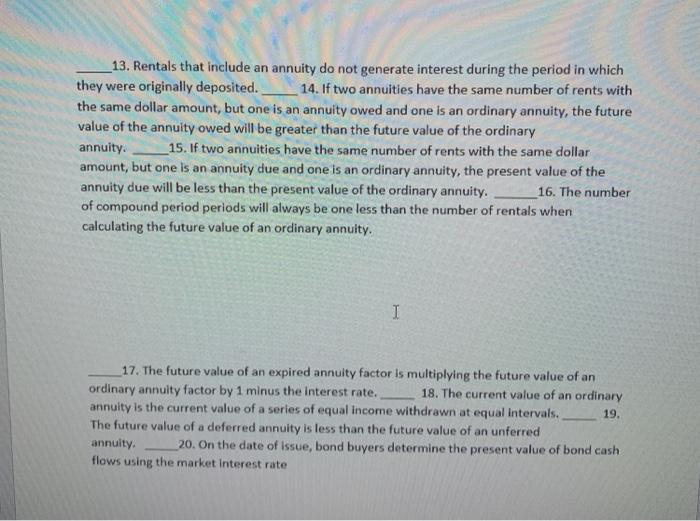

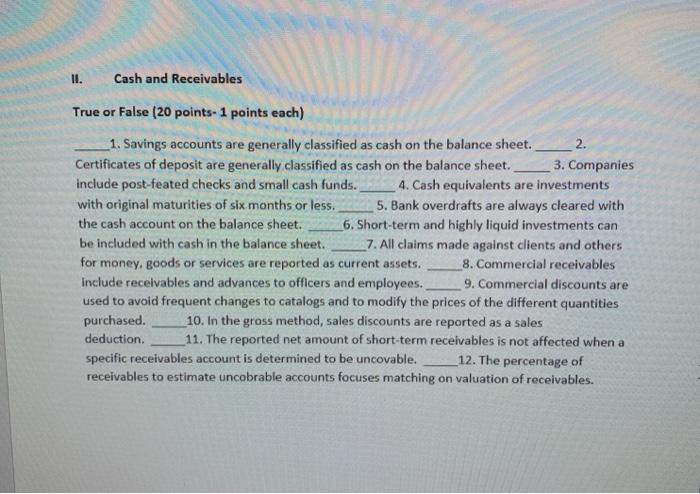

- AL 1 | . 1 Normal 1 No Spac... Heading 1 Heading 2 Title Subtitle Subtle Paragraph 21 1 Practice Exercises Chapters 6 and 7 (50 points) 1. Value of time in Money True or False (20 points. 1 points each) 1. The time value money refers to the fact that a dollar received today is worth less than a promised dollar at some point in the future. 2. Interest is the excess cash received on refunded above the amount borrowed. 3. Simple interest is calculated on capital and on any interest earned that has not been withdrawn. 4. Compound interest, beyond simple interest, should be used to properly evaluate long-term investment proposals. 5. Compound interest uses the accumulated balance at the end of each year to calculate interest in the following year. 6. The future value of an ordinary annuity table is used when payments are reversed at the beginning of each period. _7. The present value of a payable annuity table is used when payments are made at the end of each period. 8. If the capitalization period is less than one year, the annual interest rate must be converted to the interest rate of the compound period by dividing the annual rate by the number of compound periods per year. 9. Present value is the value now of a future sum or discounted sums assuming compound interest. 10. The future value of a single sum is determined by multiplying the future value factor by its current value. 11. When determining the present value, a company goes back in time using an accumulation process. 12. The present unknown value is always an amount greater than the known future value because the dollars currently received are worth more than the dollars to be received in the future. 13. Rentals that include an annuity do not generate interest during the period in which they were originally deposited. 14. If two annuities have the same number of rents with the same dollar amount, but one is an annuity owed and one is an ordinary annuity, the future value of the annuity owed will be greater than the future value of the ordinary annuity. 15. If two annuities have the same number of rents with the same dollar amount, but one is an annuity due and one is an ordinary annuity, the present value of the annuity due will be less than the present value of the ordinary annuity. 16. The number of compound period periods will always be one less than the number of rentals when calculating the future value of an ordinary annuity. I 17. The future value of an expired annuity factor is multiplying the future value of an ordinary annuity factor by 1 minus the interest rate. 18. The current value of an ordinary annuity is the current value of a series of equal income withdrawn at equal intervals. The future value of a deferred annuity is less than the future value of an unferred annuity. 20. On the date of issue, bond buyers determine the present value of bond cash flows using the market interest rate 19. II. Cash and Receivables True or False (20 points. 1 points each) 1. Savings accounts are generally classified as cash on the balance sheet. 2. Certificates of deposit are generally classified as cash on the balance sheet. 3. Companies include post-feated checks and small cash funds. 4. Cash equivalents are investments with original maturities of six months or less. 5. Bank overdrafts are always cleared with the cash account on the balance sheet. 6. Short-term and highly liquid investments can be included with cash in the balance sheet. 7. All claims made against clients and others for money, goods or services are reported as current assets. 8. Commercial receivables include receivables and advances to officers and employees. 9. Commercial discounts are used to avoid frequent changes to catalogs and to modify the prices of the different quantities purchased. 10. In the gross method, sales discounts are reported as a sales deduction 11. The reported net amount of short-term receivables is not affected when a specific receivables account is determined to be uncovable, 12. The percentage of receivables to estimate uncobrable accounts focuses matching on valuation of receivables. value. 16. Accounts receivable are generally reported as non-current assets. 17. Recognition of an appeal obligation will make a loss in the sale of receivables larger than would otherwise have been. 18. When purchasing accounts receivable with recourse, the buyer assumes the risk of collecting and absorbs any loss of credit. 19. For accounts receivable sold on appeal, the seller guarantees payment to the buyer if the debtor does not paga. 20. The reason for the rotation of the receivables is calculated by dividing net sales between the final net accounts

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts