Question: al 92% 12:40 PM A + B D E F G H 1 J 4 5 In-Class Problem 6 7 8 9 HCA Mission Healthcare

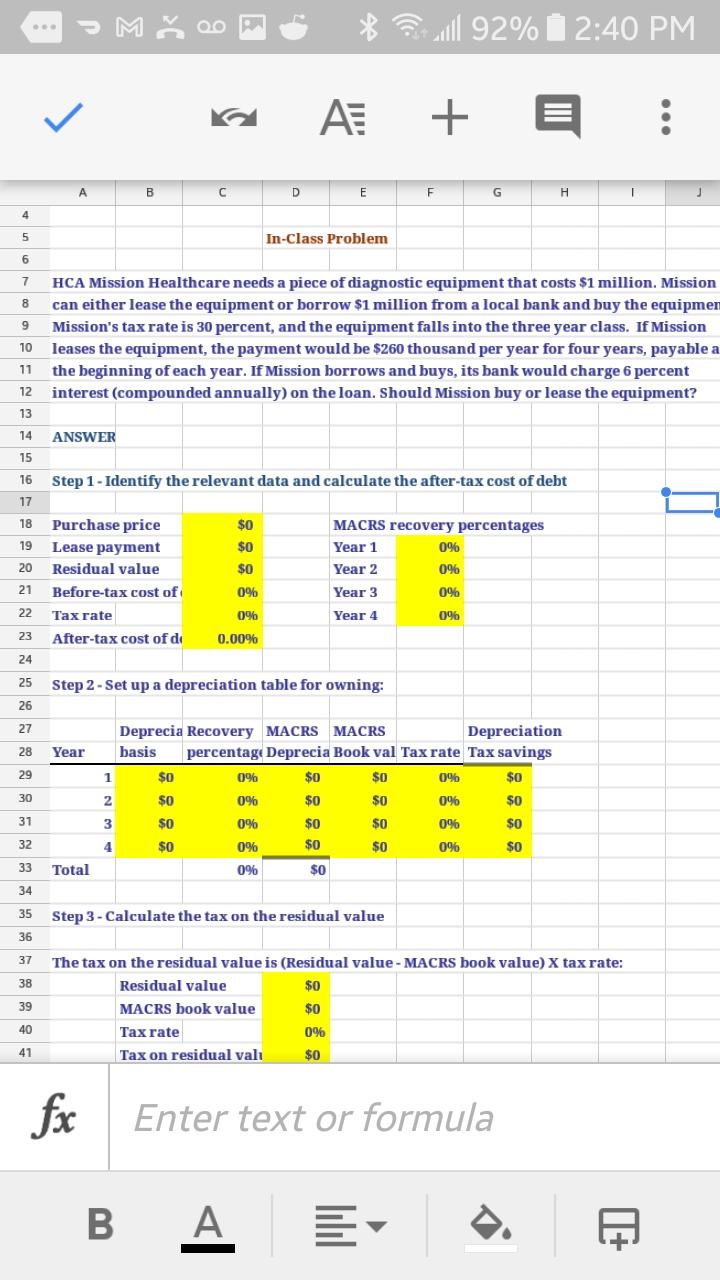

al 92% 12:40 PM A + B D E F G H 1 J 4 5 In-Class Problem 6 7 8 9 HCA Mission Healthcare needs a piece of diagnostic equipment that costs $1 million. Mission can either lease the equipment or borrow $1 million from a local bank and buy the equipmen Mission's tax rate is 30 percent, and the equipment falls into the three year class. If Mission leases the equipment, the payment would be $260 thousand per year for four years, payable a the beginning of each year. If Mission borrows and buys, its bank would charge 6 percent interest (compounded annually) on the loan. Should Mission buy or lease the equipment? 10 11 12 13 14 ANSWER 15 16 Step 1 - Identify the relevant data and calculate the after-tax cost of debt 17 $0 $0 18 19 20 21 22 Purchase price Lease payment Residual value Before-tax cost of Tax rate After-tax cost of de $0 0% MACRS recovery percentages Year 1 09 Year 2 0% Year 3 0% Year 4 0% 0% 0.00% 23 24 25 Step 2 - Set up a depreciation table for owning: 26 27 28 Year 29 1 Deprecia Recovery MACRS MACRS Depreciation basis percentage Deprecia Book val Tax rate Tax savings $0 0% $0 $0 0% $0 2 $0 0% $0 $0 0% $0 3 $0 0% $0 $0 0% $0 4 $0 0% $0 $0 096 $0 30 31 32 33 34 Total 0% $0 35 Step 3 - Calculate the tax on the residual value 36 37 38 39 The tax on the residual value is (Residual value - MACRS book value) X tax rate: Residual value $0 MACRS book value $0 Tax rate 096 Tax on residual vali $0 40 41 fx Enter text or formula B. A. TE al 92% 12:40 PM A + B D E F G H 1 J 4 5 In-Class Problem 6 7 8 9 HCA Mission Healthcare needs a piece of diagnostic equipment that costs $1 million. Mission can either lease the equipment or borrow $1 million from a local bank and buy the equipmen Mission's tax rate is 30 percent, and the equipment falls into the three year class. If Mission leases the equipment, the payment would be $260 thousand per year for four years, payable a the beginning of each year. If Mission borrows and buys, its bank would charge 6 percent interest (compounded annually) on the loan. Should Mission buy or lease the equipment? 10 11 12 13 14 ANSWER 15 16 Step 1 - Identify the relevant data and calculate the after-tax cost of debt 17 $0 $0 18 19 20 21 22 Purchase price Lease payment Residual value Before-tax cost of Tax rate After-tax cost of de $0 0% MACRS recovery percentages Year 1 09 Year 2 0% Year 3 0% Year 4 0% 0% 0.00% 23 24 25 Step 2 - Set up a depreciation table for owning: 26 27 28 Year 29 1 Deprecia Recovery MACRS MACRS Depreciation basis percentage Deprecia Book val Tax rate Tax savings $0 0% $0 $0 0% $0 2 $0 0% $0 $0 0% $0 3 $0 0% $0 $0 0% $0 4 $0 0% $0 $0 096 $0 30 31 32 33 34 Total 0% $0 35 Step 3 - Calculate the tax on the residual value 36 37 38 39 The tax on the residual value is (Residual value - MACRS book value) X tax rate: Residual value $0 MACRS book value $0 Tax rate 096 Tax on residual vali $0 40 41 fx Enter text or formula B. A. TE

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts