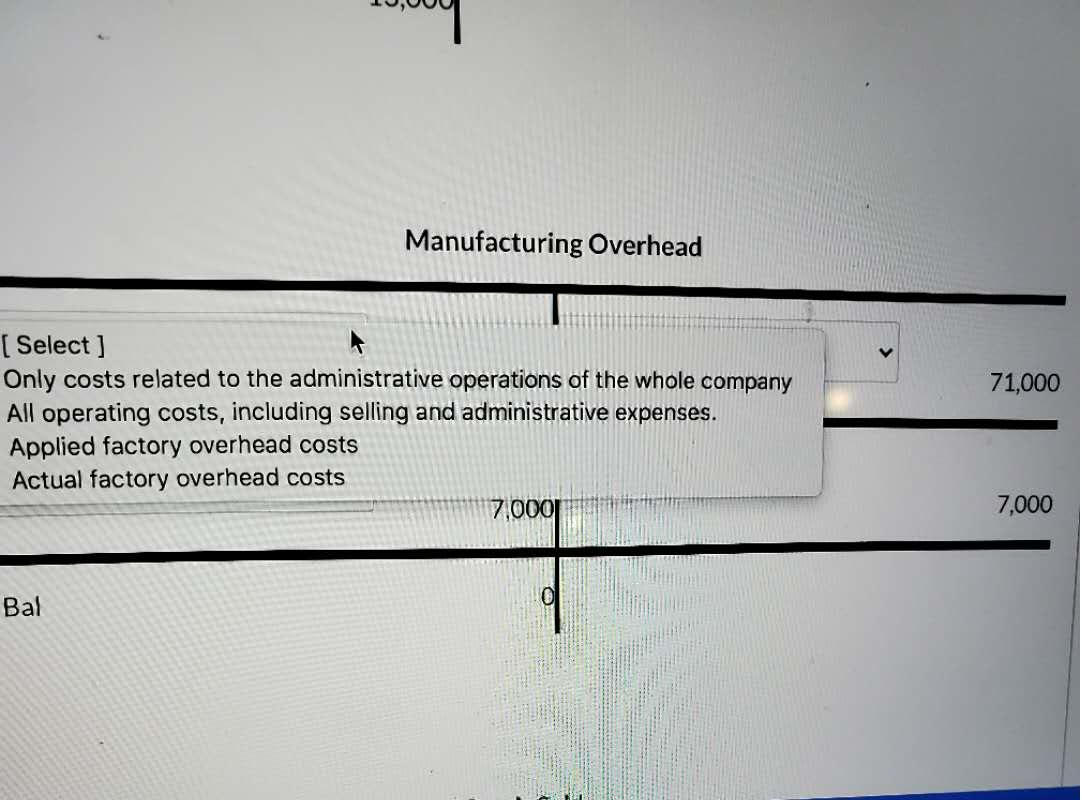

Question: -al. (Select ] 4,000 Finished Goods Bal. [ Select 52,00 Ending balance of inventory on hand that is available for Cost of units completed and

![-al. (Select ] 4,000 Finished Goods Bal. [ Select 52,00 Ending](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/09/66ebbf224d6fd_92166ebbf21915a8.jpg)

![of goods sold. Bal. 13,000 Manufacturing Overhead 71,000 (Select ] Only costs](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/09/66ebbf251e8e3_92466ebbf245f1de.jpg)

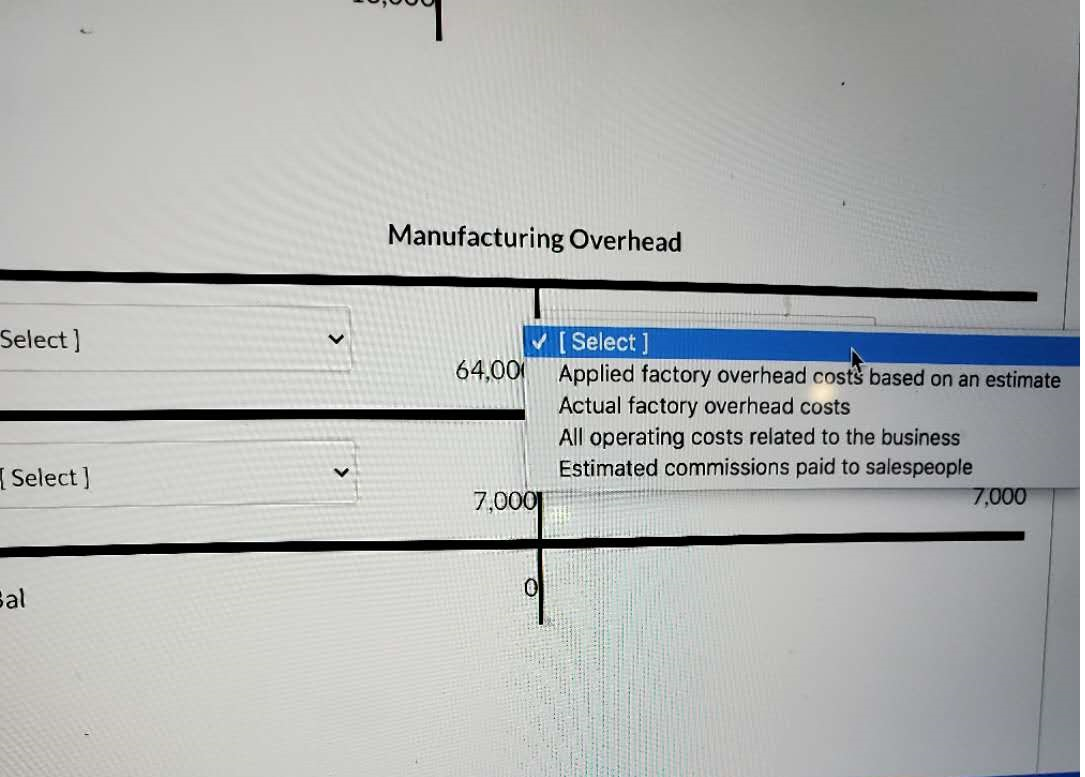

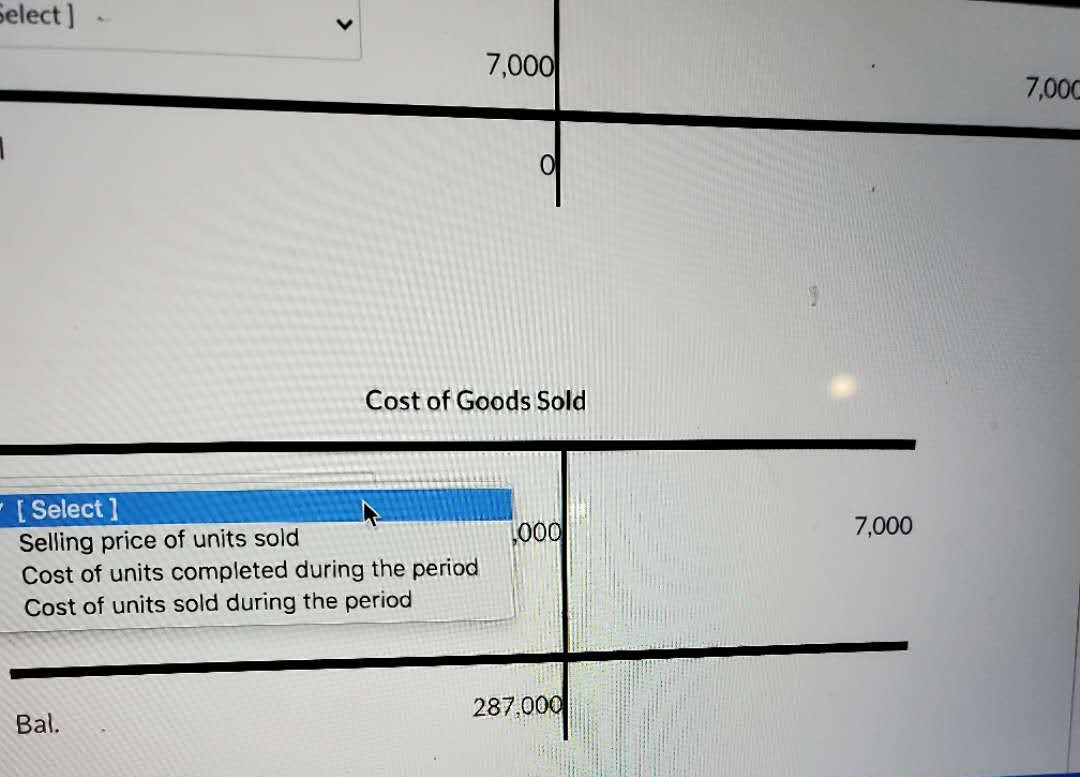

-al. (Select ] 4,000 Finished Goods Bal. [ Select 52,00 Ending balance of inventory on hand that is available for Cost of units completed and transferred to finished good Cost of inventory purchased 255,001 Cost of goods sold. Bal. 13,000 Manufacturing Overhead 71,000 (Select ] Only costs related to the administrative operations of the whole company All operating costs, including selling and administrative expenses. Applied factory overhead costs Actual factory overhead costs 7,000 7,000 Bal Manufacturing Overhead Select) Select] 64,001 Applied factory overhead costs based on an estimate Actual factory overhead costs All operating costs related to the business Estimated commissions paid to salespeople 7,000 7,000 Select) Sal Manufacturing Overhead [Select] [ Select] 64,000 71,000 7,000 [Select ] Amount of under-applied factory overhead costs Amount of over-applied factory overhead costs Ending balance in the manufacturing overhead account odi 1 cont of Goods sold Select] 7,000 7,000 0 Cost of Goods Sold 1000 7,000 [ Select) Selling price of units sold Cost of units completed during the period Cost of units sold during the period 287,000 Bal

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts