Question: Alan and Sara Winthrop are a married couple who file a joint income tax return. They have two children, so they claim a total of

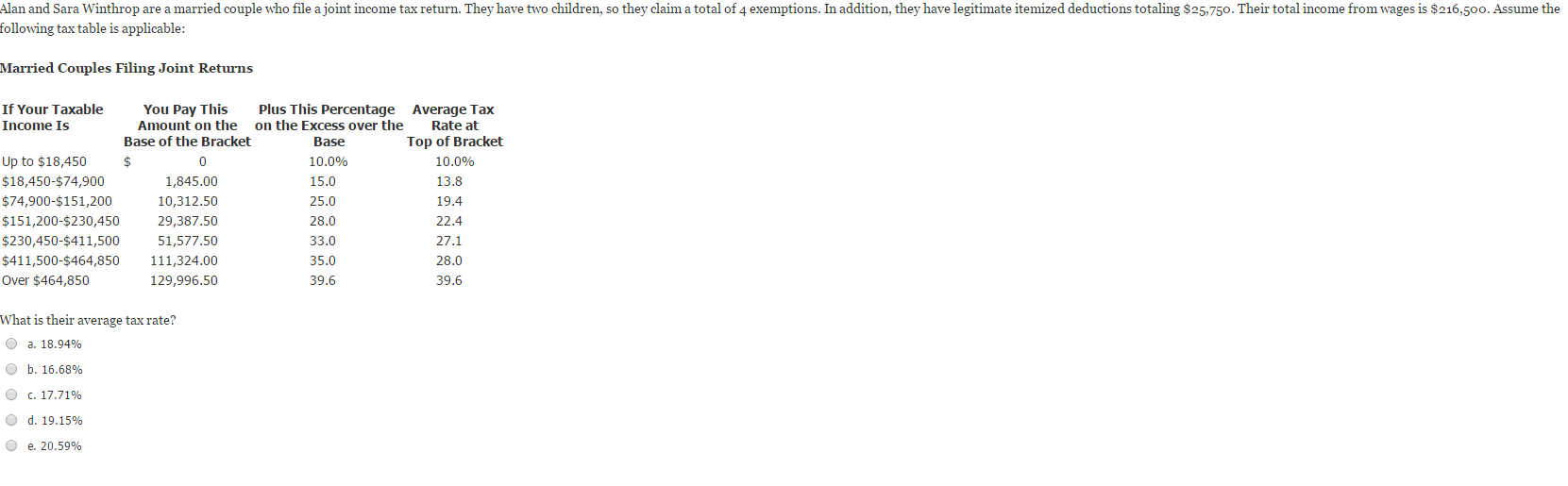

Alan and Sara Winthrop are a married couple who file a joint income tax return. They have two children, so they claim a total of 4 exemptions. In addition, they have legitimate itemized deductions totaling $25,750. Their total income from wages is $216,500. Assume the following tax table is applicable: Married Couples Filing Joint Returns If Your Taxable You Pay This Amount on the Base of the Bracket Plus This Percentage on the Excess over the Base Average Tax Rate at Top of Bracket Up to $18,450 $ 0 10.0% 10.0% $18,450-$74,900 1,845.00 15.0 13.8 $74,900-$151, 200 10,312.50 25.0 19.4 $151, 200-$230,450 29,387.50 28.0 22.4 $230,450-$411,500 51,577.50 33.0 27.1 $411,500-$464,850 111,324.00 35.0 28.0 Over $464,850 129,996.50 39.6 39.6 What is their average tax rate? 18.94% 16.68% 17.71% 19.15% 20.59%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts