Question: ALE HOME INSERT PAGE LAYOUT FORMULAS DATA REVIEW VIEW Sign In Calibri 11 Paste BIU- A A - Alignment Number Conditional Format as Cell Formatting

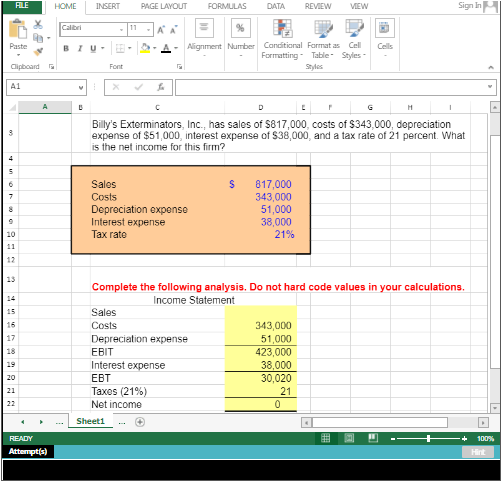

ALE HOME INSERT PAGE LAYOUT FORMULAS DATA REVIEW VIEW Sign In Calibri 11 Paste BIU- A A - Alignment Number Conditional Format as Cell Formatting Table Styles Styles Cells Clipboard Font A1 C D G 1 3 Billy's Exterminators, Inc., has sales of $817,000, costs of $343,000, depreciation expense of $51,000 interest expense of $38,000, and a tax rate of 21 percent. What is the net income for this firm? 4 5 S 7 Sales Costs Depreciation expense Interest expense Tax rate 817,000 343,000 51,000 38,000 21% 9 10 11 12 13 15 16 17 18 Complete the following analysis. Do not hard code values in your calculations. Income Statement Sales Costs 343,000 Depreciation expense 51,000 EBIT 423,000 Interest expense 38,000 EBT 30,020 Taxos (21%) 21 Net income 0 19 20 21 22 Sheet1 100% READY Attempt(s) Hint X x All answers must be entered as a formula. Click OK to begin. OK

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts