Question: . alfa 1:51 PM @ 100% docs.google.com Assume that you bought an October 2018 expiration call option on stock X at a strike price of

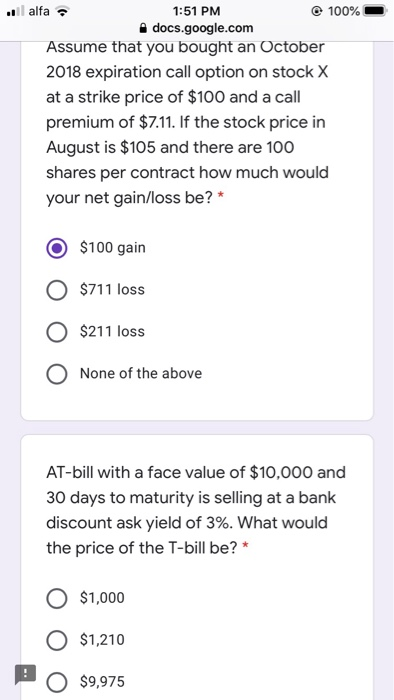

. alfa 1:51 PM @ 100% docs.google.com Assume that you bought an October 2018 expiration call option on stock X at a strike price of $100 and a call premium of $7.11. If the stock price in August is $105 and there are 100 shares per contract how much would your net gain/loss be? * O $100 gain O $711 loss O $211 loss O None of the above AT-bill with a face value of $10,000 and 30 days to maturity is selling at a bank discount ask yield of 3%. What would the price of the T-bill be?* O $1,000 O $1,210 P O $9,975

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts