Question: Alfarsi Industries uses the net present value method to make investment decivions and recuires a 15% annual return on all investments. The company is considering

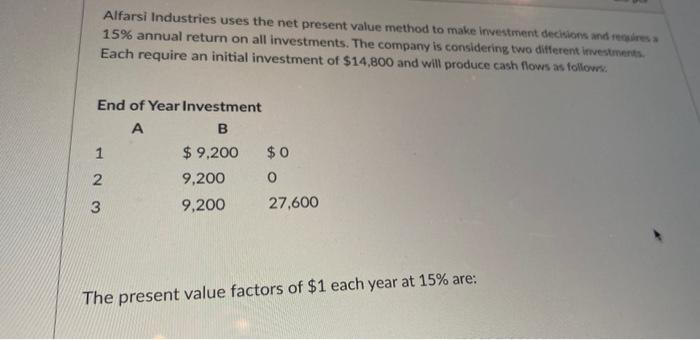

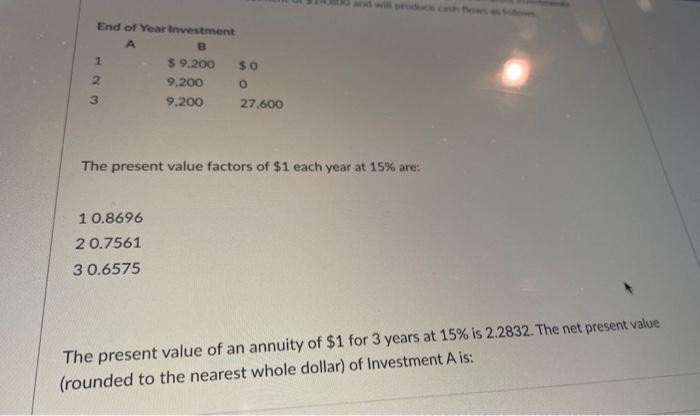

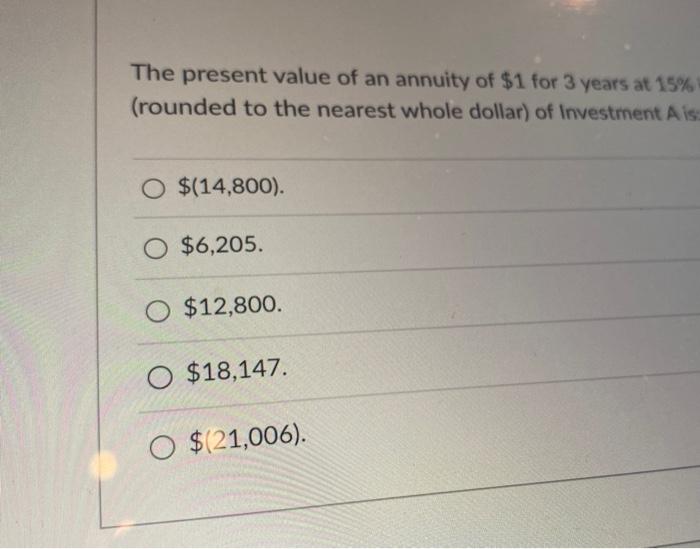

Alfarsi Industries uses the net present value method to make investment decivions and recuires a 15% annual return on all investments. The company is considering two different investments. Each require an initial investment of $14,800 and will produce cash flows as follows. The present value factors of $1 each year at 15% are: The present value factors of $1 each year at 15% are: 10.869620.756130.6575 The present value of an annuity of $1 for 3 years at 15% is 2.2832. The net present value (rounded to the nearest whole dollar) of Investment A is: The present value of an annuity of $1 for 3 years at 15\% (rounded to the nearest whole dollar) of Investment A is $(14,800). $6,205. $12,800. $18,147. $(21,006)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts