Question: Algoma Incorporated has a capital structure which is based on 35% debt, 15% preferred stock, and 50% common stock. The after-tax cost of debt is

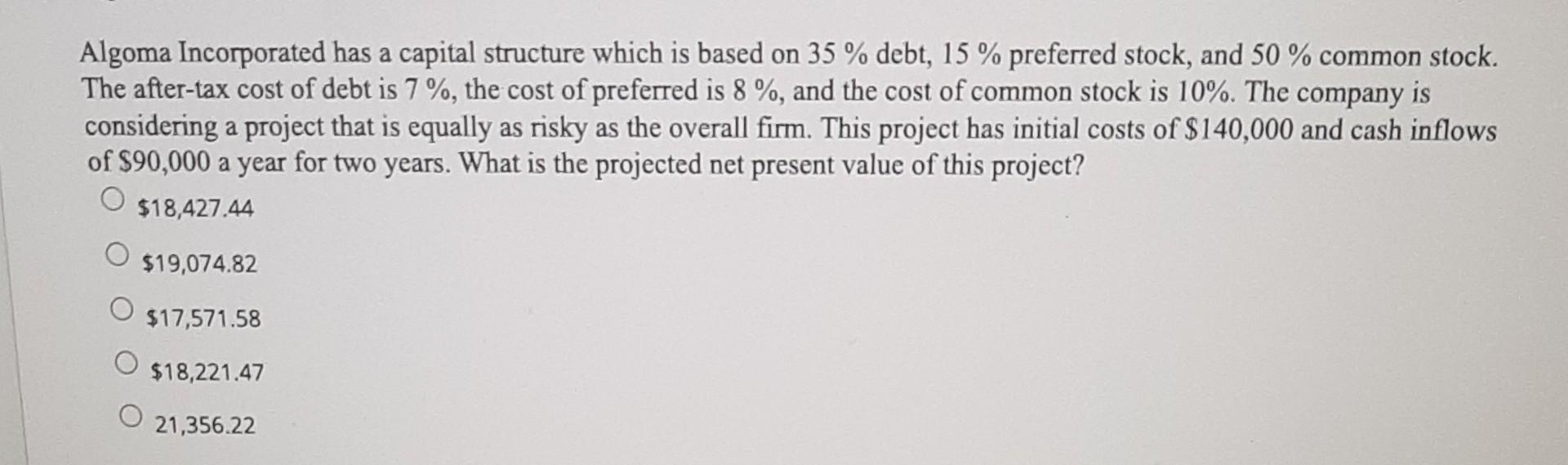

Algoma Incorporated has a capital structure which is based on 35% debt, 15% preferred stock, and 50% common stock. The after-tax cost of debt is 7%, the cost of preferred is 8%, and the cost of common stock is 10%. The company is considering a project that is equally as risky as the overall firm. This project has initial costs of $140,000 and cash inflows of $90,000 a year for two years. What is the projected net present value of this project? $18,427.44 $19,074.82 $17,571.58 $18,221.47 21,356.22

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts