Question: Ali Ltd is considering a project, which will involve the following cash inflows and (out) flows: Initial Outlay 5979 After 1 Year 769.5 After 2

Ali Ltd is considering a project, which will involve the following cash inflows and (out) flows:

Initial Outlay 5979

After 1 Year 769.5

After 2 Years 838

After 3 Years 1135.6

What will be the NPV (net present value) of this project if a discount rate of 0.1 is used

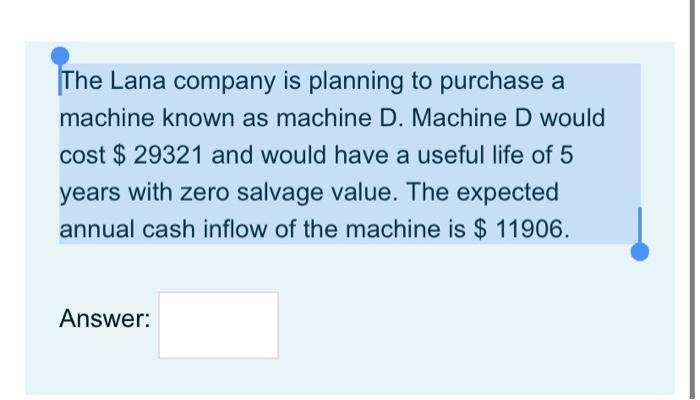

The Lana company is planning to purchase a machine known as machine D. Machine D would cost $ 29321 and would have a useful life of 5 years with zero salvage value. The expected annual cash inflow of the machine is $ 11906

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts