Question: Ali received an invoice dated 21 March 2021 worth RM 450,000 for 100 units of laptops. The invoice was offered trade discounts of 8 %

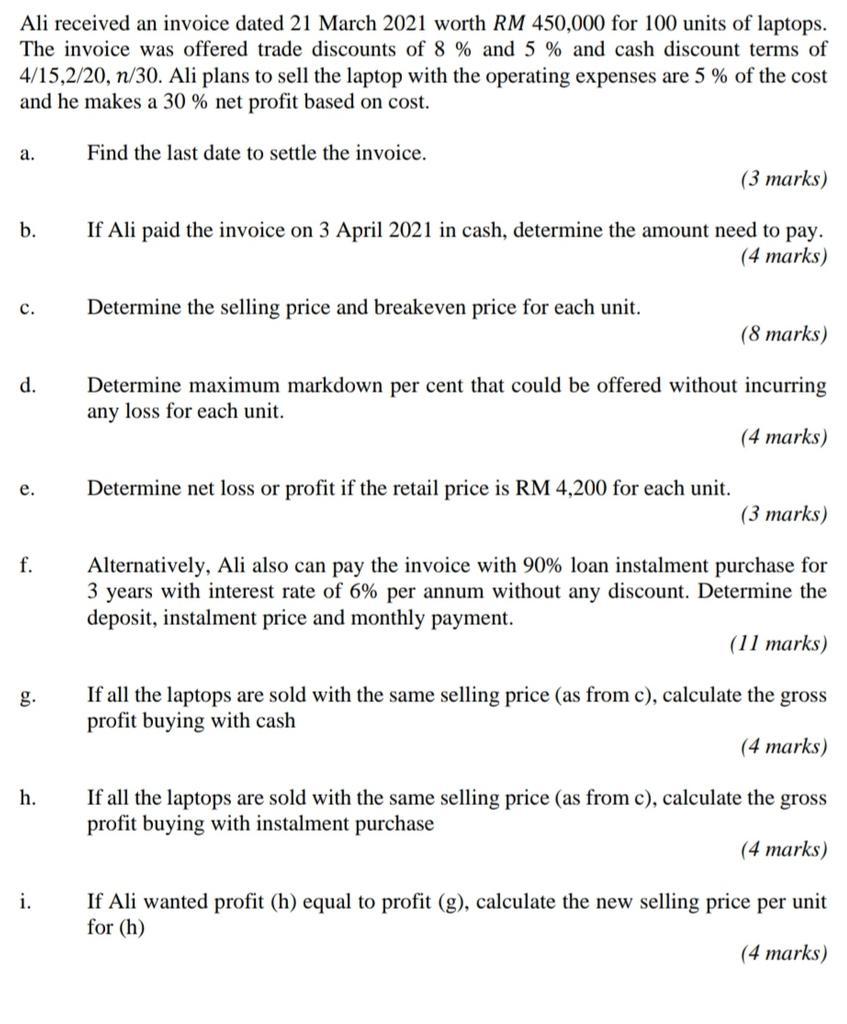

Ali received an invoice dated 21 March 2021 worth RM 450,000 for 100 units of laptops. The invoice was offered trade discounts of 8 % and 5 % and cash discount terms of 4/15,2/20, n/30. Ali plans to sell the laptop with the operating expenses are 5 % of the cost and he makes a 30 % net profit based on cost. a. Find the last date to settle the invoice. (3 marks) b. If Ali paid the invoice on 3 April 2021 in cash, determine the amount need to pay. (4 marks) c. Determine the selling price and breakeven price for each unit. (8 marks) d. Determine maximum markdown per cent that could be offered without incurring any loss for each unit. (4 marks) e. Determine net loss or profit if the retail price is RM 4,200 for each unit. (3 marks) f. Alternatively, Ali also can pay the invoice with 90% loan instalment purchase for 3 years with interest rate of 6% per annum without any discount. Determine the deposit, instalment price and monthly payment. (11 marks) If all the laptops are sold with the same selling price (as from c), calculate the gross profit buying with cash (4 marks) h. If all the laptops are sold with the same selling price (as from c), calculate the gross profit buying with instalment purchase (4 marks) i. If Ali wanted profit (h) equal to profit (g), calculate the new selling price per unit for (h) (4 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts