Question: . Herb and Alice are married and file a joint return. Herb is 74 years old and Alice turns 72 in February 2023. Neither

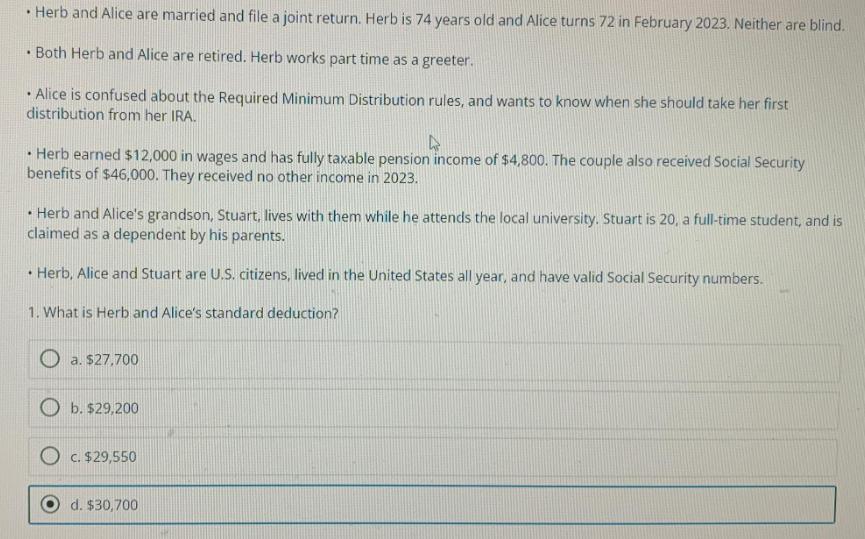

. Herb and Alice are married and file a joint return. Herb is 74 years old and Alice turns 72 in February 2023. Neither are blind. Both Herb and Alice are retired. Herb works part time as a greeter. Alice is confused about the Required Minimum Distribution rules, and wants to know when she should take her first distribution from her IRA. 4 Herb earned $12,000 in wages and has fully taxable pension income of $4,800. The couple also received Social Security benefits of $46,000. They received no other income in 2023. . . Herb and Alice's grandson, Stuart, lives with them while he attends the local university. Stuart is 20, a full-time student, and is claimed as a dependent by his parents. Herb, Alice and Stuart are U.S. citizens, lived in the United States all year, and have valid Social Security numbers. . 1. What is Herb and Alice's standard deduction? a. $27,700 Ob. $29,200 O c. $29,550 d. $30,700

Step by Step Solution

3.40 Rating (159 Votes )

There are 3 Steps involved in it

The detailed answer for the above question is provided below To determine Her... View full answer

Get step-by-step solutions from verified subject matter experts