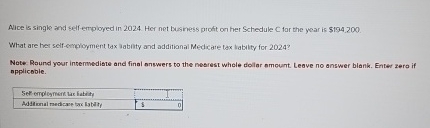

Question: Alice is single and self - employed in 2 0 2 4 . Her net busiresss proft on her Schedule for the yoar is $

Alice is single and selfemployed in Her net busiresss proft on her Schedule for the yoar is $

What are her selfcmployment ldx sabily and additianal Medicate tax liabilty for

Note Round your invermediste and final snswers to the nosrest whole dolar mmount Leave no answer blank. Enter zera if npplicoble.

tableSet emplegment wax fatioty,Adifunal medicar tax latity,

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock