Question: Alison just started learning about options for saving for her retirement. Her friend is a big fan of tax-sheltered accounts. pre-tax dollars? non-tax- sheltered accounts?

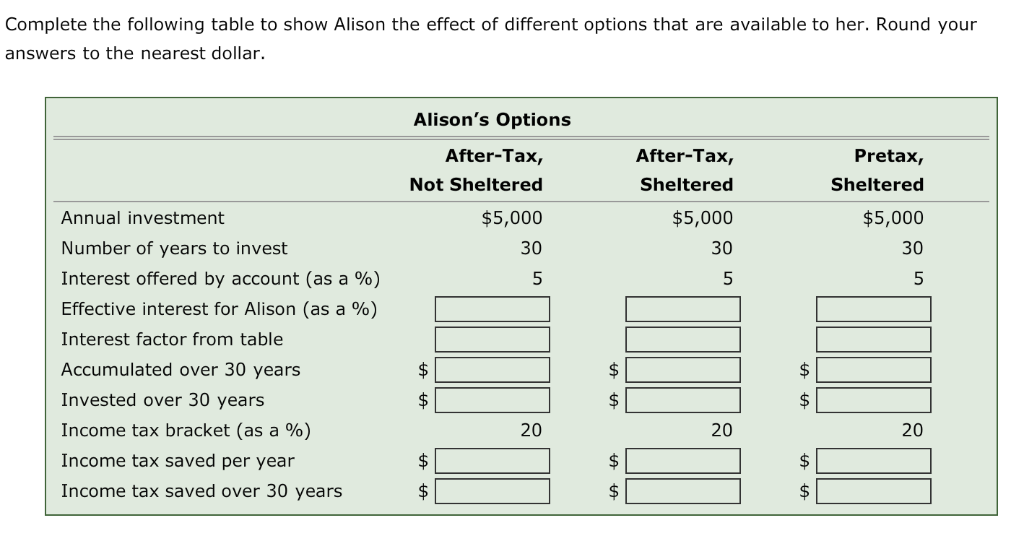

Alison just started learning about options for saving for her retirement. Her friend is a big fan of tax-sheltered accounts. pre-tax dollars? non-tax- sheltered accounts? after-tax dollars? Why do you suppose that is? Check all that apply. tax-sheltered accounts? under the mattress? Funds can be withdrawn at any time for any reason without penalty or tax payments. Investments are always safer in a tax-sheltered account. Contributions may be tax deductible in the year the contributions are made. Earnings are tax-deferred as long as they are reinvested within the account. Before she commits any money to an account, Alison wants to see how much her savings would earn using different investment tactics. She asked you to help and provided the following information: She plans to invest $5,000 every year for 30 years. She has found an investment account that earns 5% per year. She is in a 20% income tax bracket. Complete the following table to show Alison the effect of different options that are available to her. Round your answers to the nearest dollar. Alison's Options After-Tax, Not Sheltered $5,000 After-Tax, Sheltered $5,000 Pretax, Sheltered $5,000 30 30 30 | Annual investment Number of years to invest Interest offered by account (as a %) Effective interest for Alison (as a %) Interest factor from table Accumulated over 30 years Invested over 30 years Income tax bracket (as a %) Income tax saved per year Income tax saved over 30 years # h # h # h | # Alison just started learning about options for saving for her retirement. Her friend is a big fan of tax-sheltered accounts. pre-tax dollars? non-tax- sheltered accounts? after-tax dollars? Why do you suppose that is? Check all that apply. tax-sheltered accounts? under the mattress? Funds can be withdrawn at any time for any reason without penalty or tax payments. Investments are always safer in a tax-sheltered account. Contributions may be tax deductible in the year the contributions are made. Earnings are tax-deferred as long as they are reinvested within the account. Before she commits any money to an account, Alison wants to see how much her savings would earn using different investment tactics. She asked you to help and provided the following information: She plans to invest $5,000 every year for 30 years. She has found an investment account that earns 5% per year. She is in a 20% income tax bracket. Complete the following table to show Alison the effect of different options that are available to her. Round your answers to the nearest dollar. Alison's Options After-Tax, Not Sheltered $5,000 After-Tax, Sheltered $5,000 Pretax, Sheltered $5,000 30 30 30 | Annual investment Number of years to invest Interest offered by account (as a %) Effective interest for Alison (as a %) Interest factor from table Accumulated over 30 years Invested over 30 years Income tax bracket (as a %) Income tax saved per year Income tax saved over 30 years # h # h # h | #

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts