Question: all 3 parts please! Mt. Monk is a self-employed computer consultant who earns more than $100,000 each year. He also is an enthusiostic ortist. This

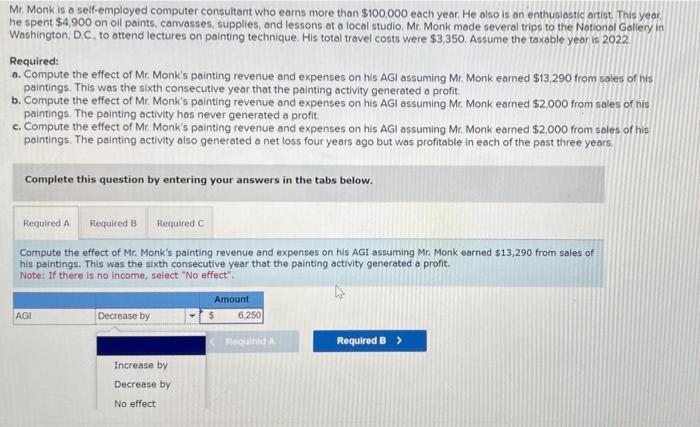

Mt. Monk is a self-employed computer consultant who earns more than $100,000 each year. He also is an enthusiostic ortist. This year he spent $4,900 on oll paints, canvasses, supplies, and lessons ot a local studio. Mr. Monk made several trips to the National Gollery in Washington, D.C. to ottend lectures on painting technique. His total travel costs were $3,350. Assume the taxable year is 2022 Required: a. Compute the effect of Mr. Monk's painting revenue and expenses on his AGl assuming Mr. Monk earned $13.290 from sales of his paintings. This was the sixth consecutive year that the painting activity generated a profit. b. Compute the effect of Mr. Monk's painting revenue and expenses on his AGI assuming Mr. Monk earned $2.000 from sales of his paintings. The painting activity has never generated a profit c. Compute the effect of Mr. Monk's painting revenue and expenses on his AGl assuming Mr. Monk earned $2,000 from sales of his paintings. The painting activity also generated a net loss four years ago but was profitable in each of the past three years. Complete this question by entering your answers in the tabs below. Compute the effect of Mr. Monk's painting revenue and expenses on his AGI assuming Mr. Monk earned $13,290 from sales of his paintings. This was the sixth consecutive year that the painting activity generated a profit. Note: If there is no income, select "No effect

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts