Question: All 5 sections please thank you so much! Required: 1. Compute the erect moterials varlance, including its price and quantity variances 2. Compute the cirect

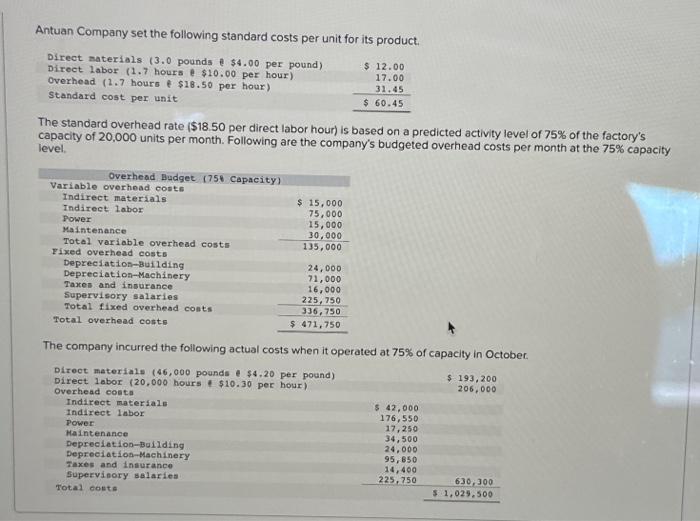

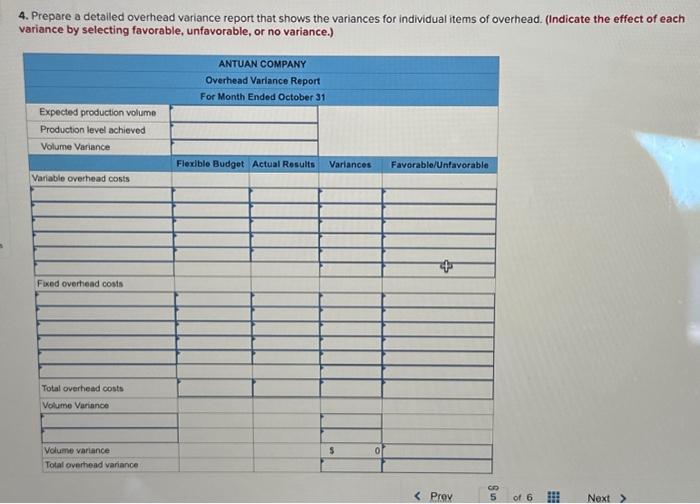

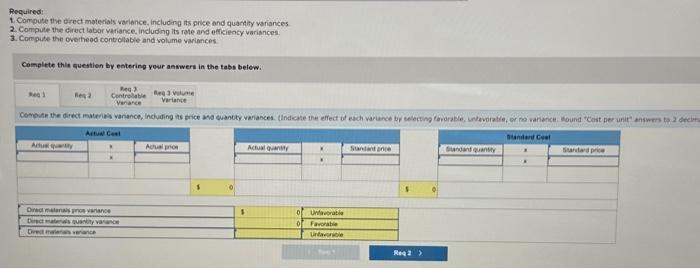

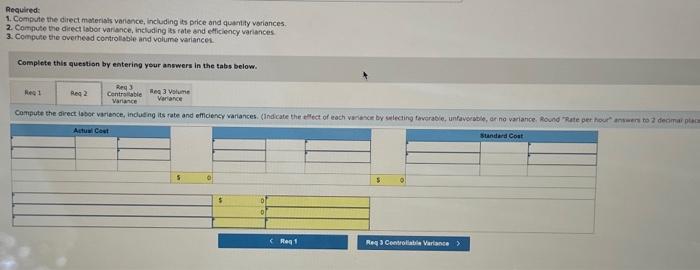

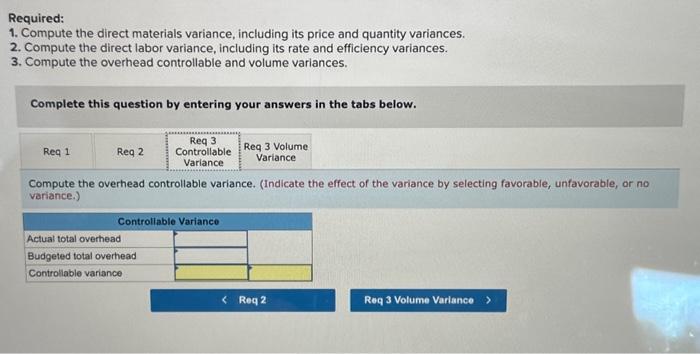

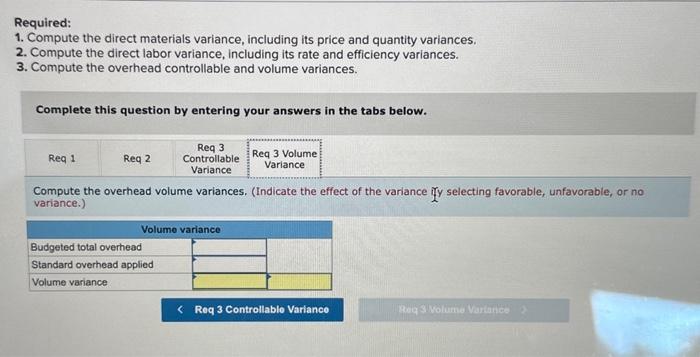

Required: 1. Compute the erect moterials varlance, including its price and quantity variances 2. Compute the cirect labor vatiance, including its rate and efikiency variances. 3. Compute the overhead contellable and volume variances: Complete thit question by entering your anwwers in the tabs beiew. Required: 1. Compute the direct materials variance, including its price and quantity variances. 2. Compute the direct labor variance, including its rate and efficiency variances. 3. Compute the overhead controllable and volume variances. Complete this question by entering your answers in the tabs below. Compute the overhead controllable variance. (Indicate the effect of the variance by selecting favorable, unfavorable, or no variance.) Required: 1. Compute the direct materials variance, including its price and quantity variances. 2. Compute the direct labor variance, including its rate and efficiency variances. 3. Compute the overhead controllable and volume variances. Complete this question by entering your answers in the tabs below. Compute the overhead volume variances. (Indicate the effect of the variance fyy selecting favorable, unfavorable, or no variance.) Regulied: 1. Compute the direct materisis variance, including its price and quantify variances. 2. Compute the diect tabor variance, including is fate and efficiency variances. 3. Compulie the overhesd controllable and volume variances. Complete this question by entering your answers in the tabs below. 4. Prepare a detailed overhead variance report that shows the variances for individual items of overhead. (Indicate the effect of each variance by selecting favorable, unfavorable, or no variance.) Antuan Company set the following standard costs per unit for its product. The standard overhead rate ( $18.50 per direct labor hour) is based on a predicted activity level of 75% of the factory's capacity of 20,000 units per month. Following are the company's budgeted overhead costs per month at the 75% capacity level. The company incurred the following actual costs when it operated at 75% of capacity in October

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts