Question: all accounts are good only numbers are wrong help pls eto meducation.com Moon Ch16 for work Agent Count Ch16 Homework Assignment Seved Help Save 4

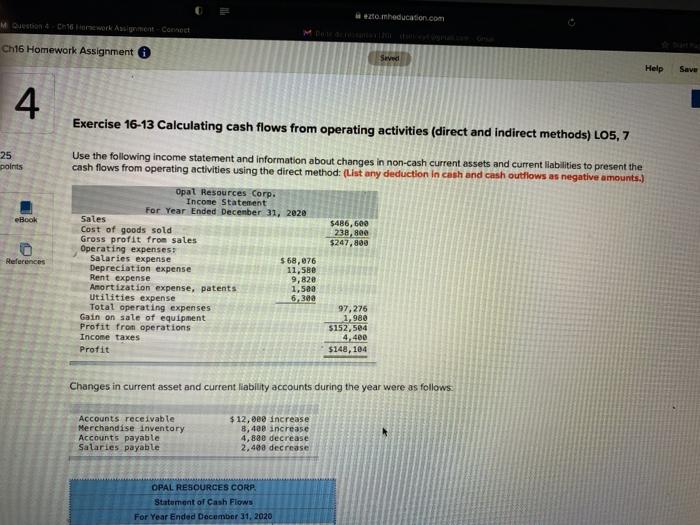

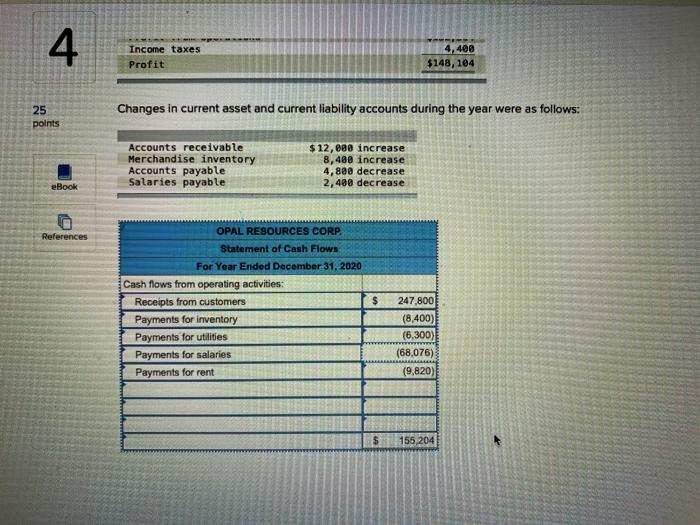

eto meducation.com Moon Ch16 for work Agent Count Ch16 Homework Assignment Seved Help Save 4 25 points eBook Exercise 16-13 Calculating cash flows from operating activities (direct and indirect methods) LO5, 7 Use the following income statement and information about changes in non-cash current assets and current liabilities to present the cash flows from operating activities using the direct method: (List any deduction in cash and cash outflows as negative amounts.) Opal Resources Corp. Income Statement For Year Ended December 31, 2020 Sales $486,600 Cost of goods sold 238,800 Gross profit from sales $247,800 Operating expenses Salaries expense $ 68,076 Depreciation expense 11,58 Rent expense 9,820 Amortization expense, patents 1,500 Utilities expense 6,388 Total operating expenses 97,276 Gain on sale of equipment 1.980 Profit from operations 5152,504 4.400 Income taxes Profit $148, 104 References Changes in current asset and current liability accounts during the year were as follows Accounts receivable Merchandise inventory Accounts payable Salaries payable $12, oee increase 8,400 increase 4,820 decrease 2.408 decrease OPAL RESOURCES CORP Statument of Cash Flows For Year Ended December 31, 2020 4. Income taxes Profit 4,400 $148, 104 25 points Changes in current asset and current liability accounts during the year were as follows: Accounts receivable Merchandise inventory Accounts payable Salaries payable $ 12,888 increase 8,488 increase 4,800 decrease 2,488 decrease eBook References OPAL RESOURCES CORP Statement of Cash Flows For Year Ended December 31, 2020 Cash flows from operating activities: Receipts from customers Payments for inventory Payments for utilities Payments for salaries Payments for rent $ 247,800 (8,400) (6,300) (68,076) (9,820) 155 204

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts