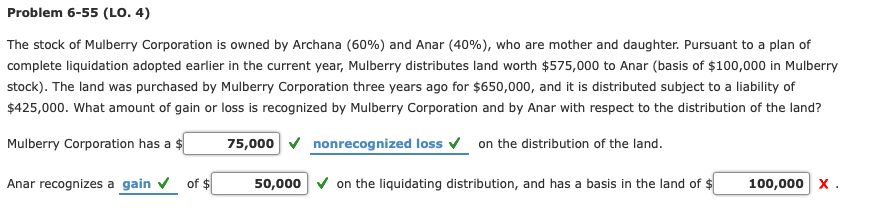

Question: *All answers are correct except for the basis in the land (the red X), please answer with the basis in the land.* Problem 6-55 (LO.

*All answers are correct except for the basis in the land (the red X), please answer with the basis in the land.*

Problem 6-55 (LO. 4) The stock of Mulberry Corporation is owned by Archana (60%) and Anar (40%), who are mother and daughter. Pursuant to a plan of complete liquidation adopted earlier in the current year, Mulberry distributes land worth $575,000 to Anar (basis of $100,000 in Mulberry stock). The land was purchased by Mulberry Corporation three years ago for $650,000, and it is distributed subject to a liability of 425,000. What amount of gain or loss is recognized by Mulberry Corporation and by Anar with respect to the distribution of the land? Mulberry Corporation hasa 75,000nonrecognized loss on the distribution of the land Anar recognizes a gainof$ 50,000V on the liquidating distribution, and has a basis in the land of $ 100,000 X

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts