Question: All answers must be entererd as formulas CHAPTER 8 0 Saved Help Save & Exit Sub - - - Formatting Pom Styles Table Styles Clipboard

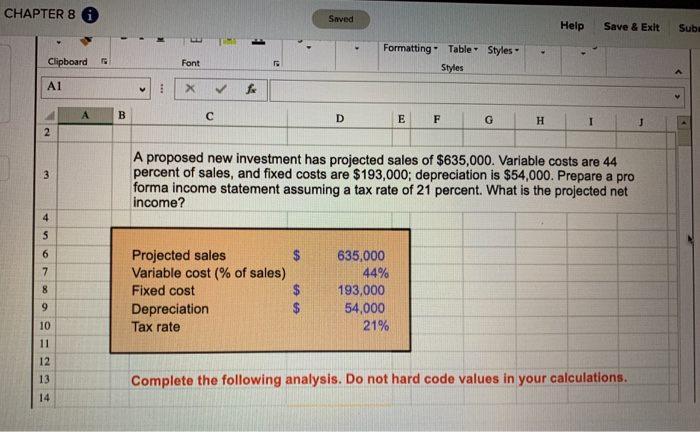

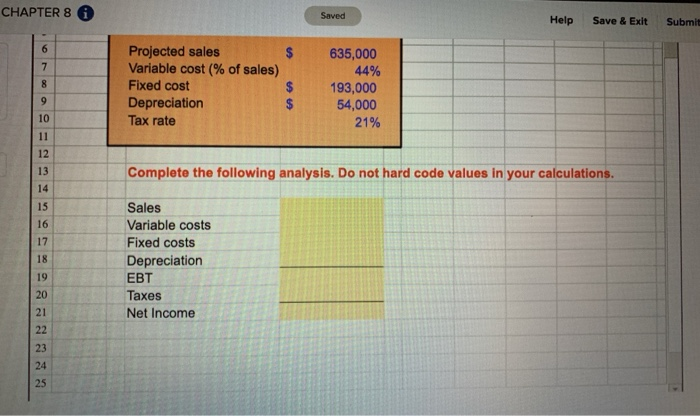

CHAPTER 8 0 Saved Help Save & Exit Sub - - - Formatting Pom Styles Table Styles Clipboard Font A E F G H I A proposed new investment has projected sales of $635,000. Variable costs are 44 percent of sales, and fixed costs are $193,000; depreciation is $54,000. Prepare a pro forma income statement assuming a tax rate of 21 percent. What is the projected net income? Projected sales Variable cost (% of sales) Fixed cost Depreciation Tax rate 635,000 44% 193,000 54,000 21% Complete the following analysis. Do not hard code values in your calculations. CHAPTER 8 0 Saved Help Save & Exit Submit Projected sales Variable cost (% of sales) Fixed cost Depreciation Tax rate 635,000 44% 193,000 54,000 21% Complete the following analysis. Do not hard code values in your calculations. Sales Variable costs Fixed costs Depreciation EBT Taxes Net Income

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts