Question: (All answers were generated using 1,000 trials and native Excel functionality.) The management of Madeira Computing is considering the introduction of a wearable electronic device

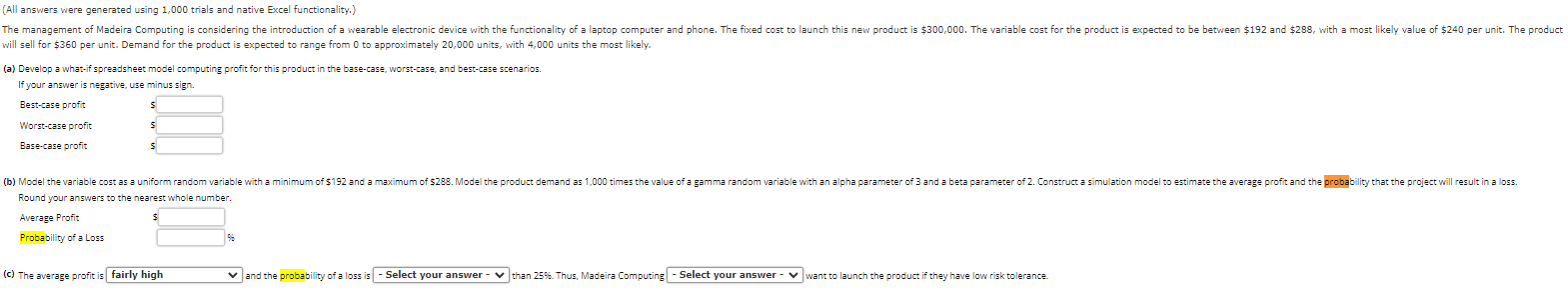

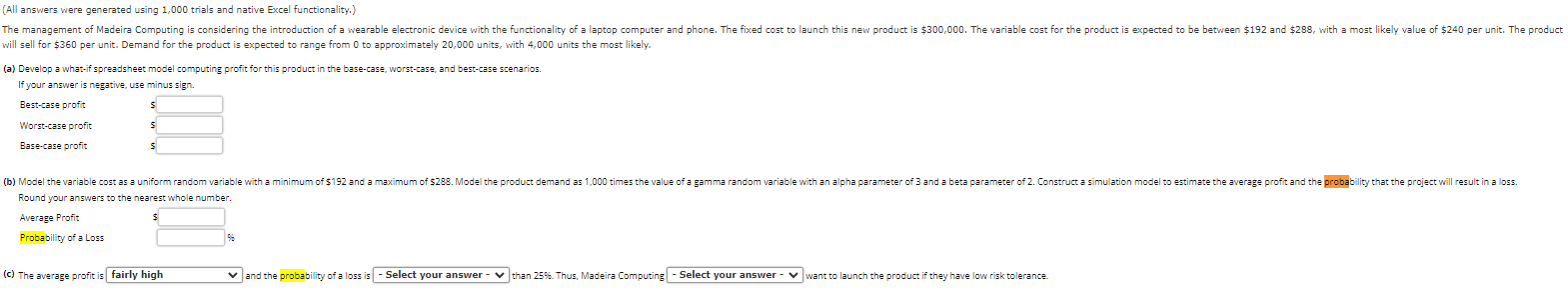

(All answers were generated using 1,000 trials and native Excel functionality.) The management of Madeira Computing is considering the introduction of a wearable electronic device with the functionality of a laptop computer and phone. The fixed cost to launch this new product is $300,000. The variable cost for the product is expected to be between $192 and $288, with a most likely value of $240 per unit. The product will sell for $360 per unit. Demand for the product is expected to range from 0 to approximately 20,000 units, with 4,000 units the most likely. (a) Develop a what-if spreadsheet model computing profit for this product in the base-case, worst-case, and best-case scenarios. If your answer is negative, use minus sign. Best-case profit s Worst-case profit S Base-case profit s (b) Model the variable cost as a uniform random variable with a minimum of $192 and a maximum of $288. Model the product demand as 1,000 times the value of a gamma random variable with an alpha parameter of 3 and a beta parameter of 2. Construct a simulation model to estimate the average profit and the probability that the project will result in a loss. Round your answers to the nearest whole number. Average Profit Probability of a Loss (C) The average profit is fairly high and the probability of a loss is - Select your answer than 25%. Thus, Madeira Computing - Select your answer - want to launch the product if they have low risk tolerance. (All answers were generated using 1,000 trials and native Excel functionality.) The management of Madeira Computing is considering the introduction of a wearable electronic device with the functionality of a laptop computer and phone. The fixed cost to launch this new product is $300,000. The variable cost for the product is expected to be between $192 and $288, with a most likely value of $240 per unit. The product will sell for $360 per unit. Demand for the product is expected to range from 0 to approximately 20,000 units, with 4,000 units the most likely. (a) Develop a what-if spreadsheet model computing profit for this product in the base-case, worst-case, and best-case scenarios. If your answer is negative, use minus sign. Best-case profit s Worst-case profit S Base-case profit s (b) Model the variable cost as a uniform random variable with a minimum of $192 and a maximum of $288. Model the product demand as 1,000 times the value of a gamma random variable with an alpha parameter of 3 and a beta parameter of 2. Construct a simulation model to estimate the average profit and the probability that the project will result in a loss. Round your answers to the nearest whole number. Average Profit Probability of a Loss (C) The average profit is fairly high and the probability of a loss is - Select your answer than 25%. Thus, Madeira Computing - Select your answer - want to launch the product if they have low risk tolerance