Question: All are under question 1 but set up separately. A new restaurant is ready to open for business. It is estimated that the food cost

All are under question 1 but set up separately.

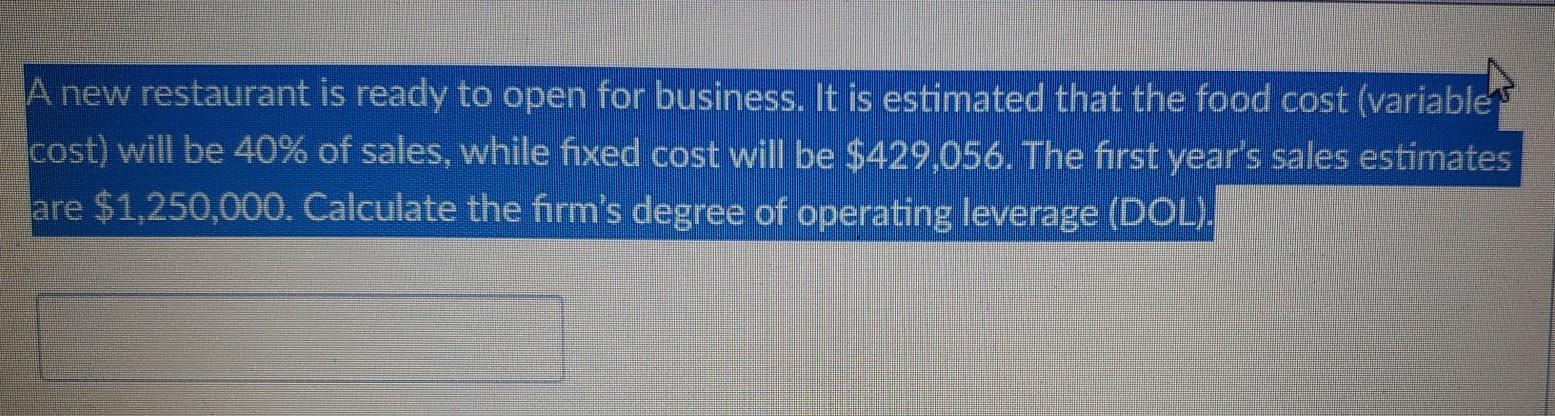

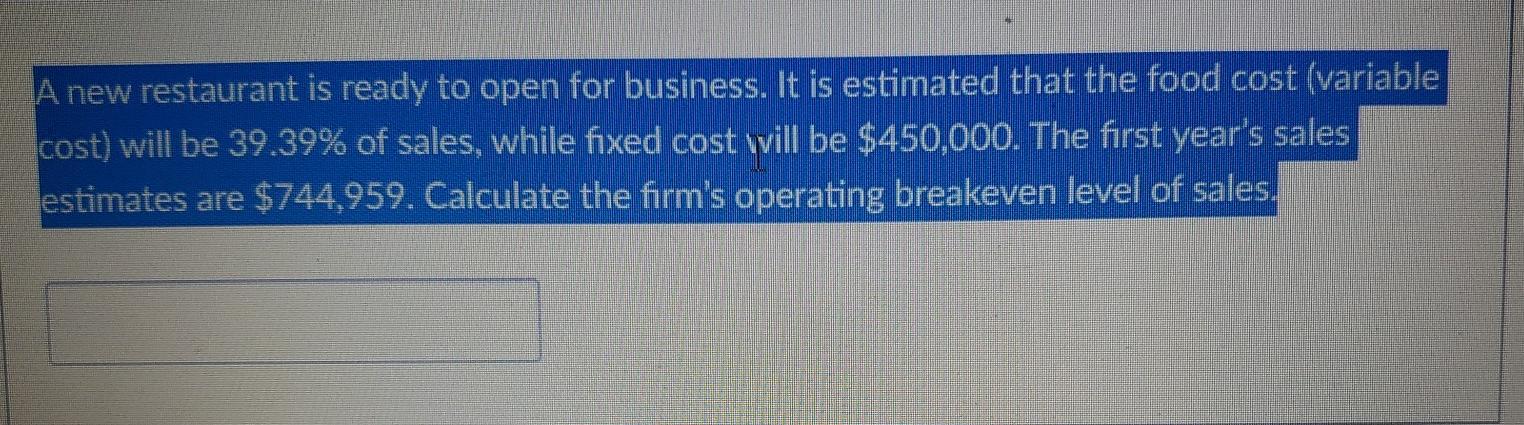

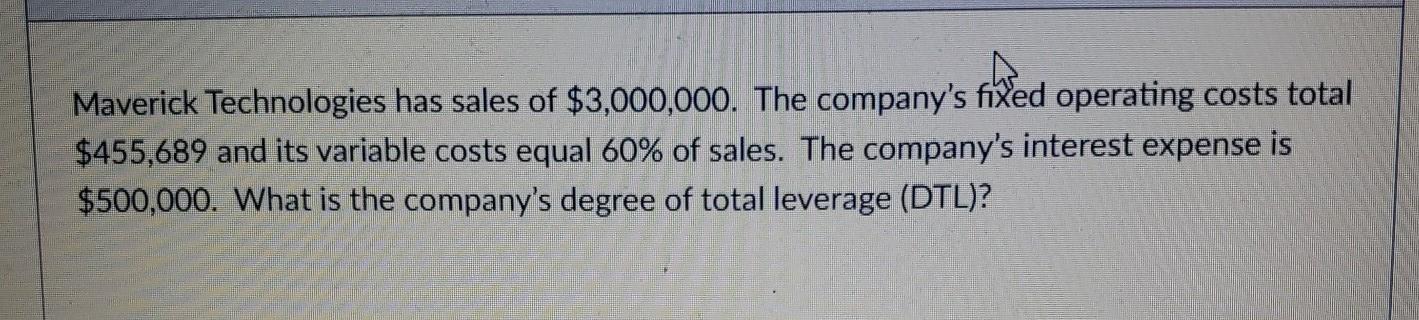

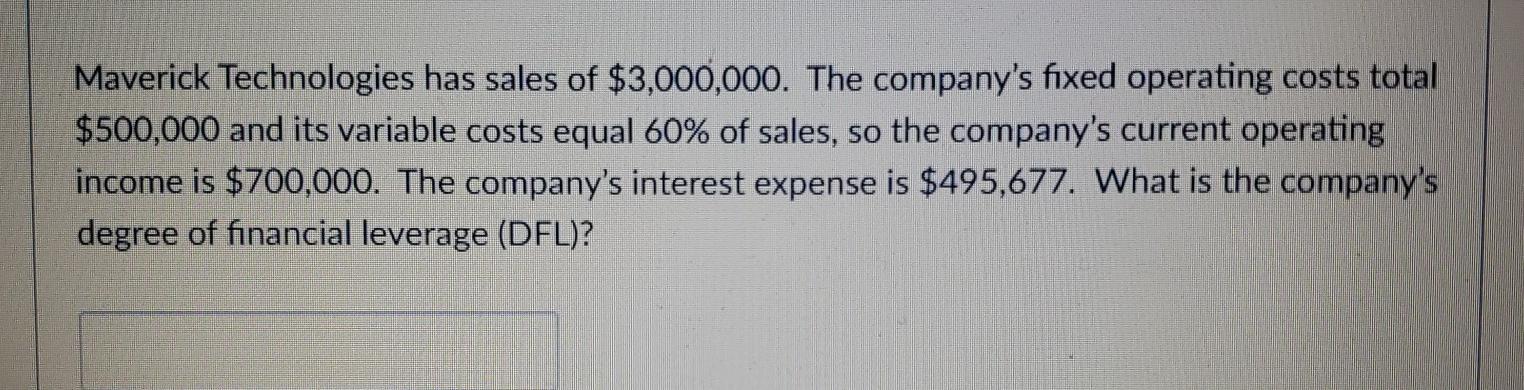

A new restaurant is ready to open for business. It is estimated that the food cost (variable cost) will be 40% of sales, while fixed cost will be $429,056. The first year's sales estimates are $1,250,000. Calculate the firm's degree of operating leverage (DOL). A new restaurant is ready to open for business. It is estimated that the food cost (variable cost) will be 39.39% of sales, while fixed cost will be $450,000. The first year's sales estimates are $744,959. Calculate the firm's operating breakeven level of sales. Maverick Technologies has sales of $3,000,000. The company's fixed operating costs total $455,689 and its variable costs equal 60% of sales. The company's interest expense is $500,000. What is the company's degree of total leverage (DTL)? Maverick Technologies has sales of $3,000,000. The company's fixed operating costs total $500,000 and its variable costs equal 60% of sales, so the company's current operating income is $700,000. The company's interest expense is $495,677. What is the company's degree of financial leverage (DFL)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts