Question: All associated information and instructions for the Chapter 11 project are presented between pages 534 and 598 in the text. The steps for setting up

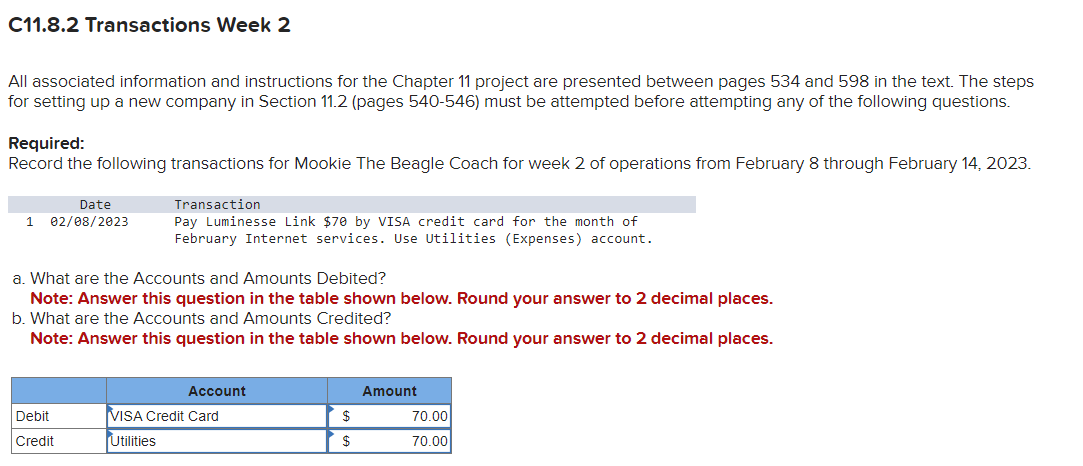

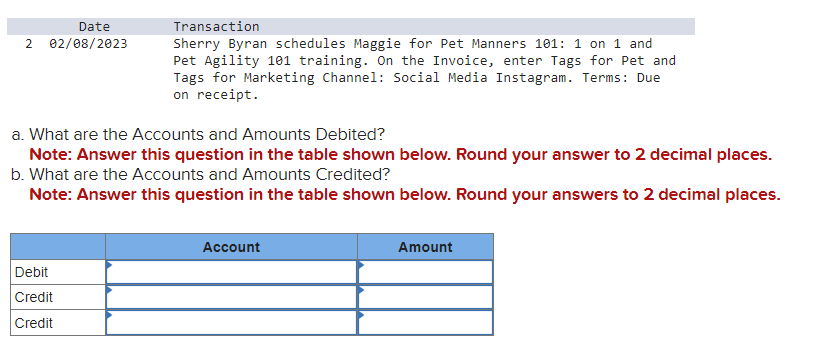

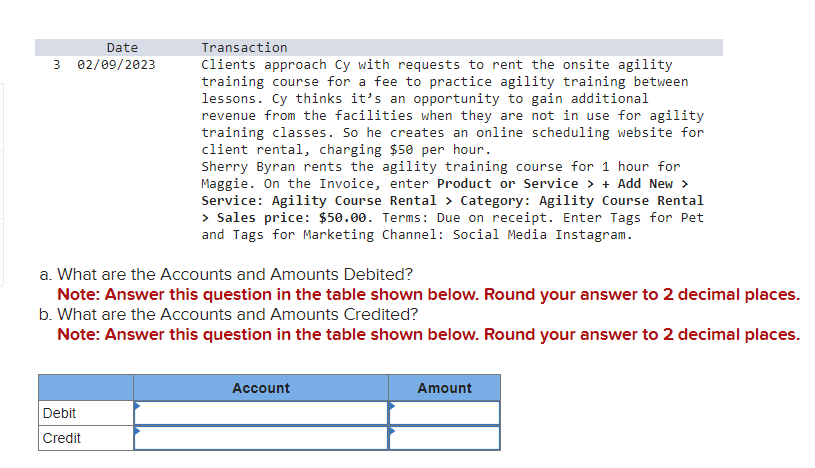

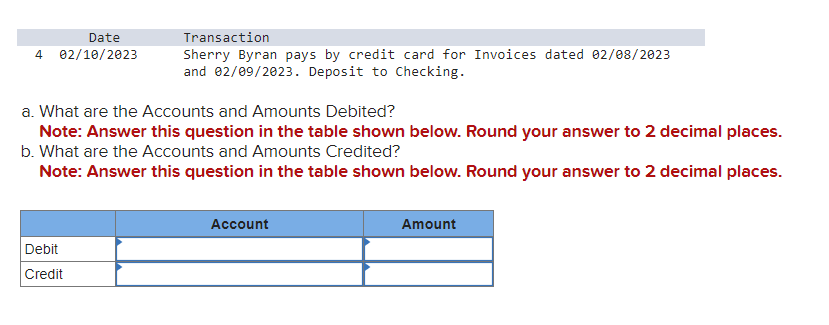

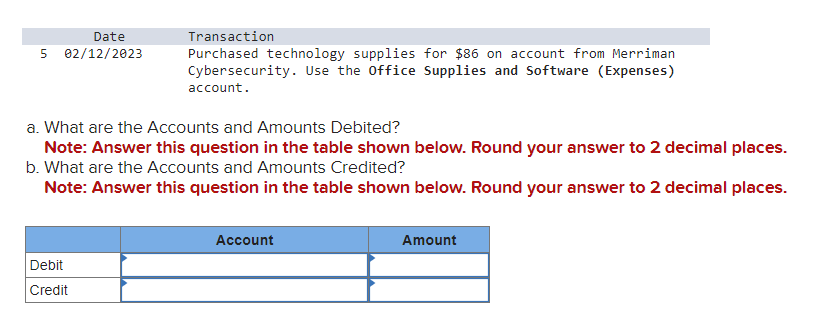

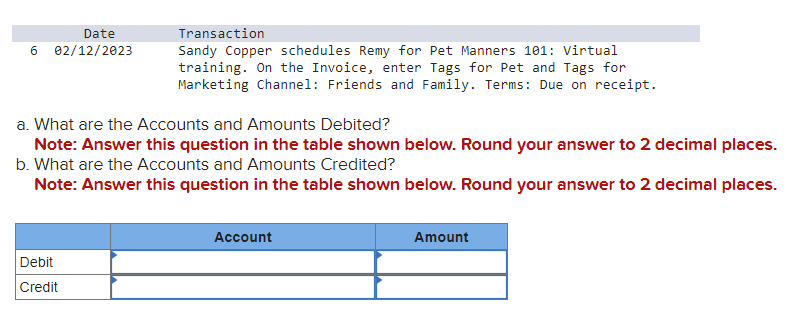

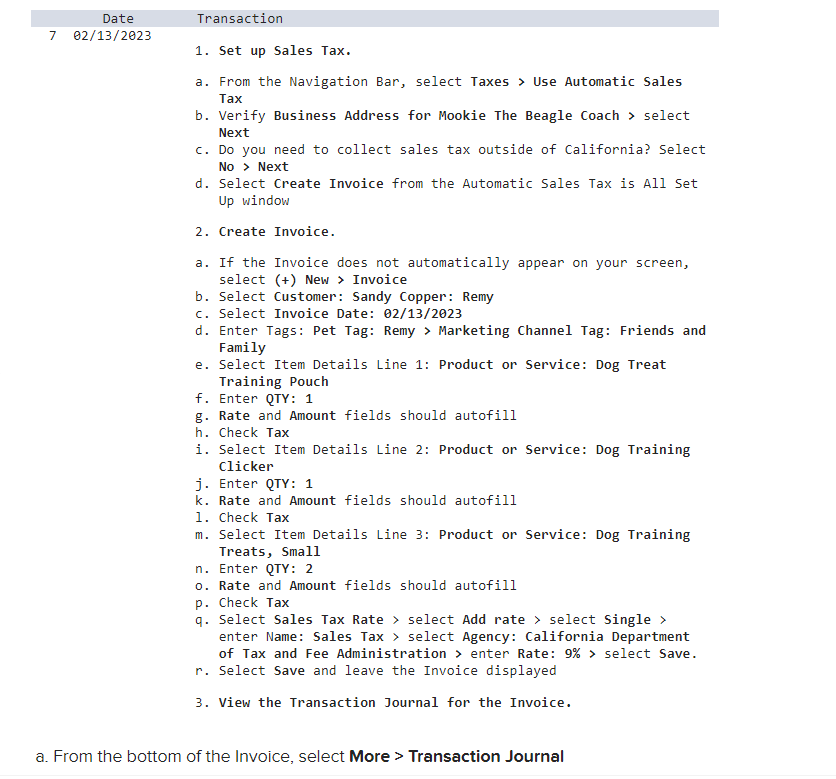

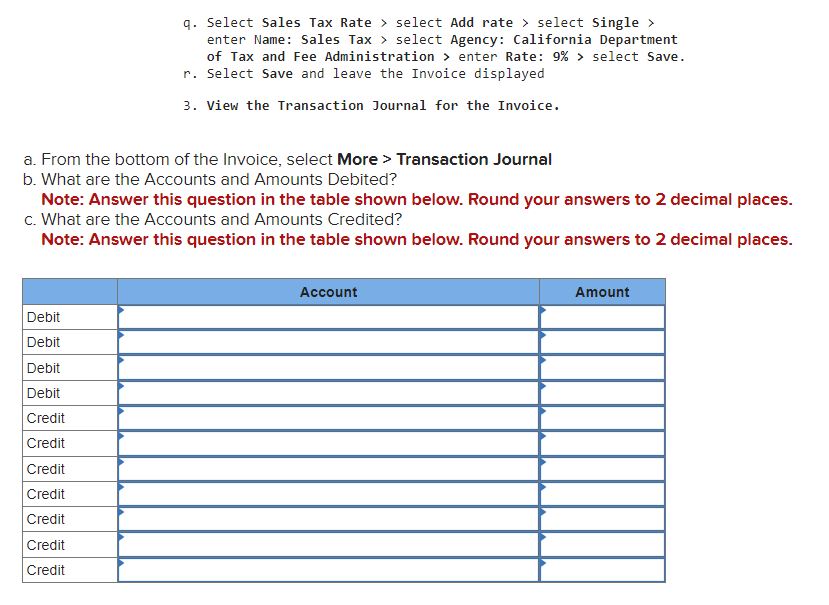

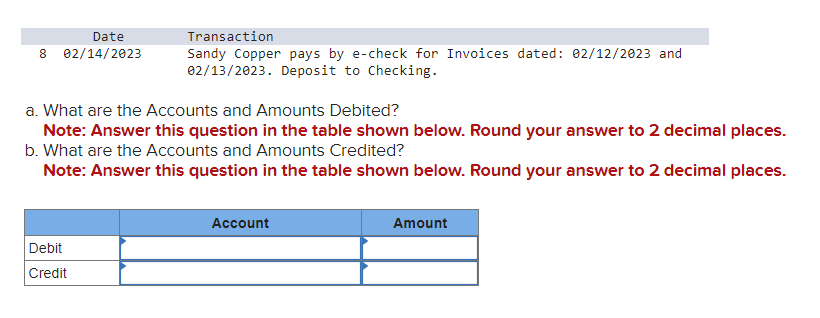

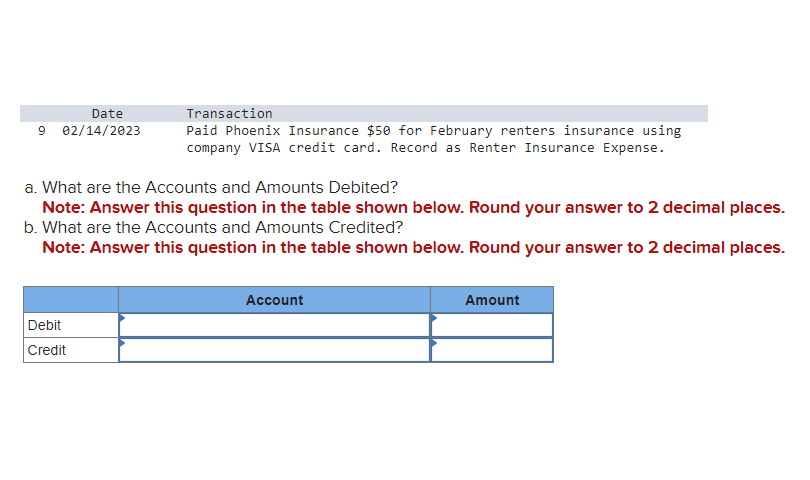

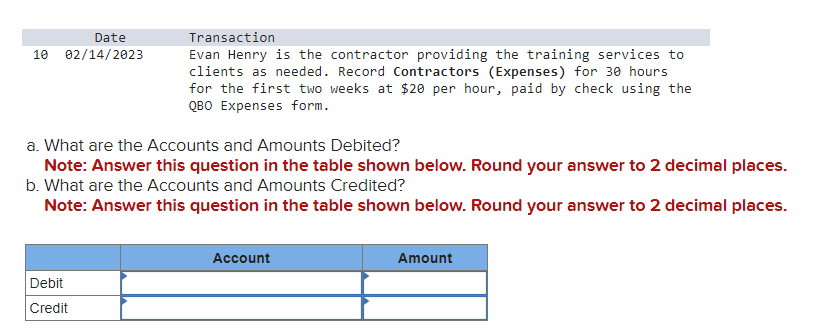

All associated information and instructions for the Chapter 11 project are presented between pages 534 and 598 in the text. The steps for setting up a new company in Section 11.2 (pages 540-546) must be attempted before attempting any of the following questions. Required: Record the following transactions for Mookie The Beagle Coach for week 2 of operations from February 8 through February 14 , 2023. a. What are the Accounts and Amounts Debited? Note: Answer this question in the table shown below. Round your answer to 2 decimal places. b. What are the Accounts and Amounts Credited? Note: Answer this question in the table shown below. Round your answer to 2 decimal places. a. What are the Accounts and Amounts Debited? Note: Answer this question in the table shown below. Round your answer to 2 decimal places. b. What are the Accounts and Amounts Credited? Note: Answer this question in the table shown below. Round your answers to 2 decimal places. DateTransactionClientsapproachCywithrequeststorenttheonsiteagilitytrainingcourseforafeetopracticeagilitytrainingbetweenlessons.Cythinksitsanopportunitytogainadditionalrevenuefromthefacilitieswhentheyarenotinuseforagilitytrainingclasses.Sohecreatesanonlineschedulingwebsiteforclientrental,charging$50perhour.SherryByranrentstheagilitytrainingcoursefor1hourforMaggie.OntheInvoice,enterProductorService>+AddNew>Service:AgilityCourseRental>Category:AgilityCourseRentalSalesprice:$50.00.Terms:Dueonreceipt.EnterTagsforPetandTagsforMarketingChannel:SocialMediaInstagram. a. What are the Accounts and Amounts Debited? Note: Answer this question in the table shown below. Round your answer to 2 decimal places. b. What are the Accounts and Amounts Credited? Note: Answer this question in the table shown below. Round your answer to 2 decimal places. a. What are the Accounts and Amounts Debited? Note: Answer this question in the table shown below. Round your answer to 2 decimal places. b. What are the Accounts and Amounts Credited? Note: Answer this question in the table shown below. Round your answer to 2 decimal places. a. What are the Accounts and Amounts Debited? Note: Answer this question in the table shown below. Round your answer to 2 decimal places. b. What are the Accounts and Amounts Credited? Note: Answer this question in the table shown below. Round your answer to 2 decimal places. 6 02/12/2023 Sandy Copper schedules Remy for Pet Manners 101: Virtual training. On the Invoice, enter Tags for Pet and Tags for Marketing Channel: Friends and Family. Terms: Due on receipt. a. What are the Accounts and Amounts Debited? Note: Answer this question in the table shown below. Round your answer to 2 decimal places. b. What are the Accounts and Amounts Credited? Note: Answer this question in the table shown below. Round your answer to 2 decimal places. 1. Set up Sales Tax. a. From the Navigation Bar, select Taxes > Use Automatic Sales Tax b. Verify Business Address for Mookie The Beagle Coach > select Next c. Do you need to collect sales tax outside of California? Select No > Next d. Select Create Invoice from the Automatic Sales Tax is All set Up window 2. Create Invoice. a. If the Invoice does not automatically appear on your screen, select (+) New > Invoice b. Select Customer: Sandy Copper: Remy c. Select Invoice Date: 02/13/2023 d. Enter Tags: Pet Tag: Remy > Marketing Channel Tag: Friends and Family e. Select Item Details Line 1: Product or Service: Dog Treat Training Pouch f. Enter QTY: 1 g. Rate and Amount fields should autofill h. Check Tax i. Select Item Details Line 2: Product or Service: Dog Training Clicker j. Enter QTY: 1 k. Rate and Amount fields should autofill 1. Check Tax m. Select Item Details Line 3: Product or Service: Dog Training Treats, Small n. Enter QTY: 2 o. Rate and Amount fields should autofill p. Check Tax q. Select Sales Tax Rate > select Add rate > select Single > enter Name: Sales Tax > select Agency: California Department of Tax and Fee Administration > enter Rate: 9\% > select Save. r. Select Save and leave the Invoice displayed 3. View the Transaction Journal for the Invoice. q. Select Sales Tax Rate > select Add rate > select Single > enter Name: Sales Tax > select Agency: California Department of Tax and Fee Administration > enter Rate: 9\% > select Save. r. Select Save and leave the Invoice displayed 3. View the Transaction Journal for the Invoice. a. From the bottom of the Invoice, select More > Transaction Journal b. What are the Accounts and Amounts Debited? Note: Answer this question in the table shown below. Round your answers to 2 decimal places. c. What are the Accounts and Amounts Credited? Note: Answer this question in the table shown below. Round your answers to 2 decimal places. a. What are the Accounts and Amounts Debited? Note: Answer this question in the table shown below. Round your answer to 2 decimal places. b. What are the Accounts and Amounts Credited? Note: Answer this question in the table shown below. Round your answer to 2 decimal places. a. What are the Accounts and Amounts Debited? Note: Answer this question in the table shown below. Round your answer to 2 decimal places. b. What are the Accounts and Amounts Credited? Note: Answer this question in the table shown below. Round your answer to 2 decimal places. a. What are the Accounts and Amounts Debited? Note: Answer this question in the table shown below. Round your answer to 2 decimal places. b. What are the Accounts and Amounts Credited? Note: Answer this question in the table shown below. Round your answer to 2 decimal places. All associated information and instructions for the Chapter 11 project are presented between pages 534 and 598 in the text. The steps for setting up a new company in Section 11.2 (pages 540-546) must be attempted before attempting any of the following questions. Required: Record the following transactions for Mookie The Beagle Coach for week 2 of operations from February 8 through February 14 , 2023. a. What are the Accounts and Amounts Debited? Note: Answer this question in the table shown below. Round your answer to 2 decimal places. b. What are the Accounts and Amounts Credited? Note: Answer this question in the table shown below. Round your answer to 2 decimal places. a. What are the Accounts and Amounts Debited? Note: Answer this question in the table shown below. Round your answer to 2 decimal places. b. What are the Accounts and Amounts Credited? Note: Answer this question in the table shown below. Round your answers to 2 decimal places. DateTransactionClientsapproachCywithrequeststorenttheonsiteagilitytrainingcourseforafeetopracticeagilitytrainingbetweenlessons.Cythinksitsanopportunitytogainadditionalrevenuefromthefacilitieswhentheyarenotinuseforagilitytrainingclasses.Sohecreatesanonlineschedulingwebsiteforclientrental,charging$50perhour.SherryByranrentstheagilitytrainingcoursefor1hourforMaggie.OntheInvoice,enterProductorService>+AddNew>Service:AgilityCourseRental>Category:AgilityCourseRentalSalesprice:$50.00.Terms:Dueonreceipt.EnterTagsforPetandTagsforMarketingChannel:SocialMediaInstagram. a. What are the Accounts and Amounts Debited? Note: Answer this question in the table shown below. Round your answer to 2 decimal places. b. What are the Accounts and Amounts Credited? Note: Answer this question in the table shown below. Round your answer to 2 decimal places. a. What are the Accounts and Amounts Debited? Note: Answer this question in the table shown below. Round your answer to 2 decimal places. b. What are the Accounts and Amounts Credited? Note: Answer this question in the table shown below. Round your answer to 2 decimal places. a. What are the Accounts and Amounts Debited? Note: Answer this question in the table shown below. Round your answer to 2 decimal places. b. What are the Accounts and Amounts Credited? Note: Answer this question in the table shown below. Round your answer to 2 decimal places. 6 02/12/2023 Sandy Copper schedules Remy for Pet Manners 101: Virtual training. On the Invoice, enter Tags for Pet and Tags for Marketing Channel: Friends and Family. Terms: Due on receipt. a. What are the Accounts and Amounts Debited? Note: Answer this question in the table shown below. Round your answer to 2 decimal places. b. What are the Accounts and Amounts Credited? Note: Answer this question in the table shown below. Round your answer to 2 decimal places. 1. Set up Sales Tax. a. From the Navigation Bar, select Taxes > Use Automatic Sales Tax b. Verify Business Address for Mookie The Beagle Coach > select Next c. Do you need to collect sales tax outside of California? Select No > Next d. Select Create Invoice from the Automatic Sales Tax is All set Up window 2. Create Invoice. a. If the Invoice does not automatically appear on your screen, select (+) New > Invoice b. Select Customer: Sandy Copper: Remy c. Select Invoice Date: 02/13/2023 d. Enter Tags: Pet Tag: Remy > Marketing Channel Tag: Friends and Family e. Select Item Details Line 1: Product or Service: Dog Treat Training Pouch f. Enter QTY: 1 g. Rate and Amount fields should autofill h. Check Tax i. Select Item Details Line 2: Product or Service: Dog Training Clicker j. Enter QTY: 1 k. Rate and Amount fields should autofill 1. Check Tax m. Select Item Details Line 3: Product or Service: Dog Training Treats, Small n. Enter QTY: 2 o. Rate and Amount fields should autofill p. Check Tax q. Select Sales Tax Rate > select Add rate > select Single > enter Name: Sales Tax > select Agency: California Department of Tax and Fee Administration > enter Rate: 9\% > select Save. r. Select Save and leave the Invoice displayed 3. View the Transaction Journal for the Invoice. q. Select Sales Tax Rate > select Add rate > select Single > enter Name: Sales Tax > select Agency: California Department of Tax and Fee Administration > enter Rate: 9\% > select Save. r. Select Save and leave the Invoice displayed 3. View the Transaction Journal for the Invoice. a. From the bottom of the Invoice, select More > Transaction Journal b. What are the Accounts and Amounts Debited? Note: Answer this question in the table shown below. Round your answers to 2 decimal places. c. What are the Accounts and Amounts Credited? Note: Answer this question in the table shown below. Round your answers to 2 decimal places. a. What are the Accounts and Amounts Debited? Note: Answer this question in the table shown below. Round your answer to 2 decimal places. b. What are the Accounts and Amounts Credited? Note: Answer this question in the table shown below. Round your answer to 2 decimal places. a. What are the Accounts and Amounts Debited? Note: Answer this question in the table shown below. Round your answer to 2 decimal places. b. What are the Accounts and Amounts Credited? Note: Answer this question in the table shown below. Round your answer to 2 decimal places. a. What are the Accounts and Amounts Debited? Note: Answer this question in the table shown below. Round your answer to 2 decimal places. b. What are the Accounts and Amounts Credited? Note: Answer this question in the table shown below. Round your answer to 2 decimal places

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts