Question: all cells highlighted in yellow must contain a cell reference, mathematical equation, or function Scenario: The Fad Corporation is considering production of a new food

all cells highlighted in yellow must contain a cell reference, mathematical equation, or function

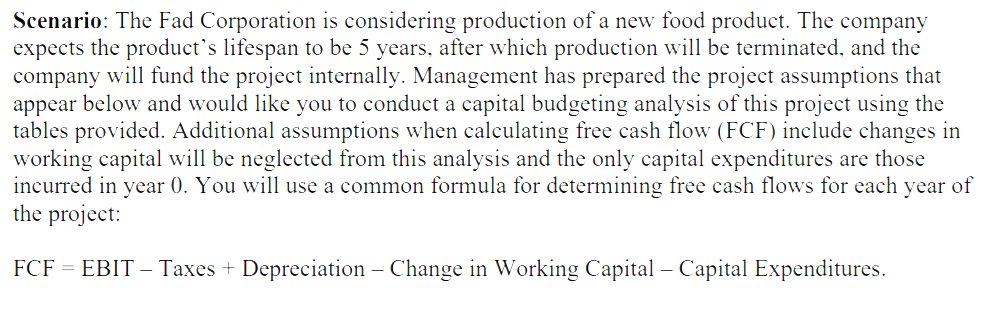

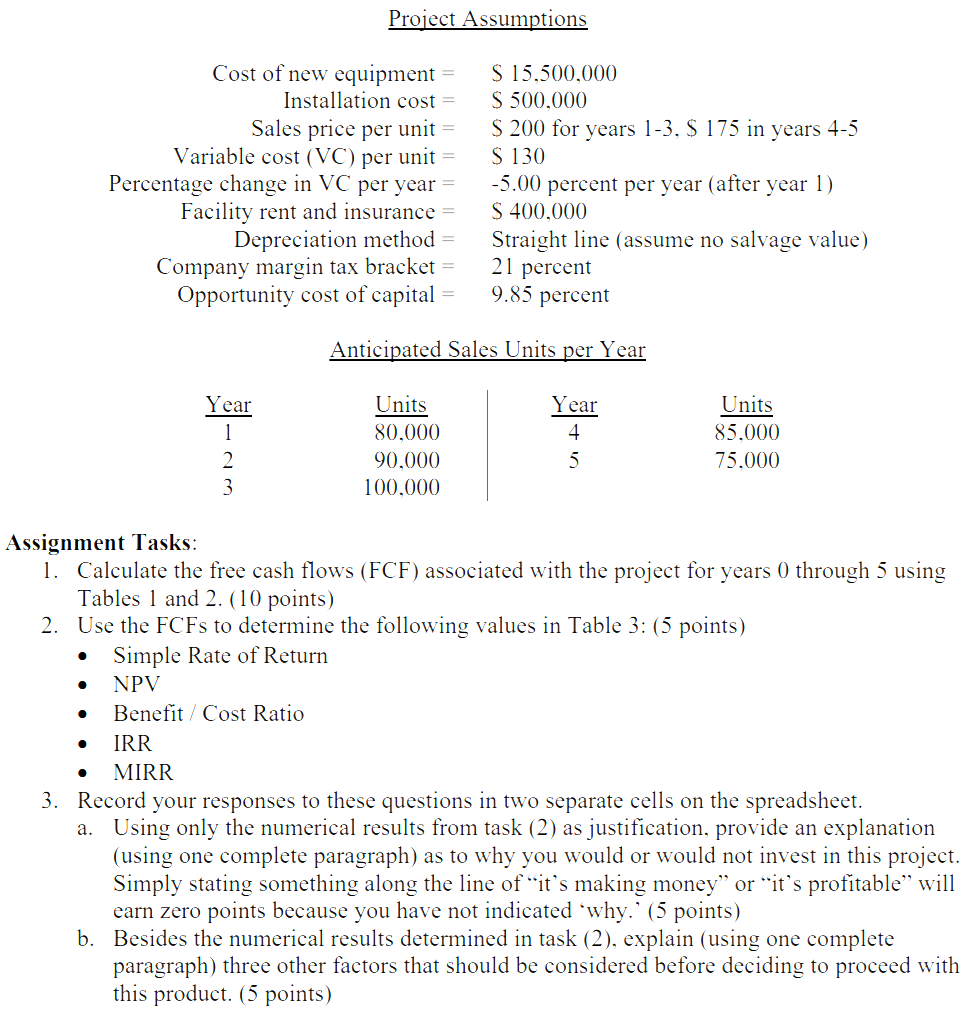

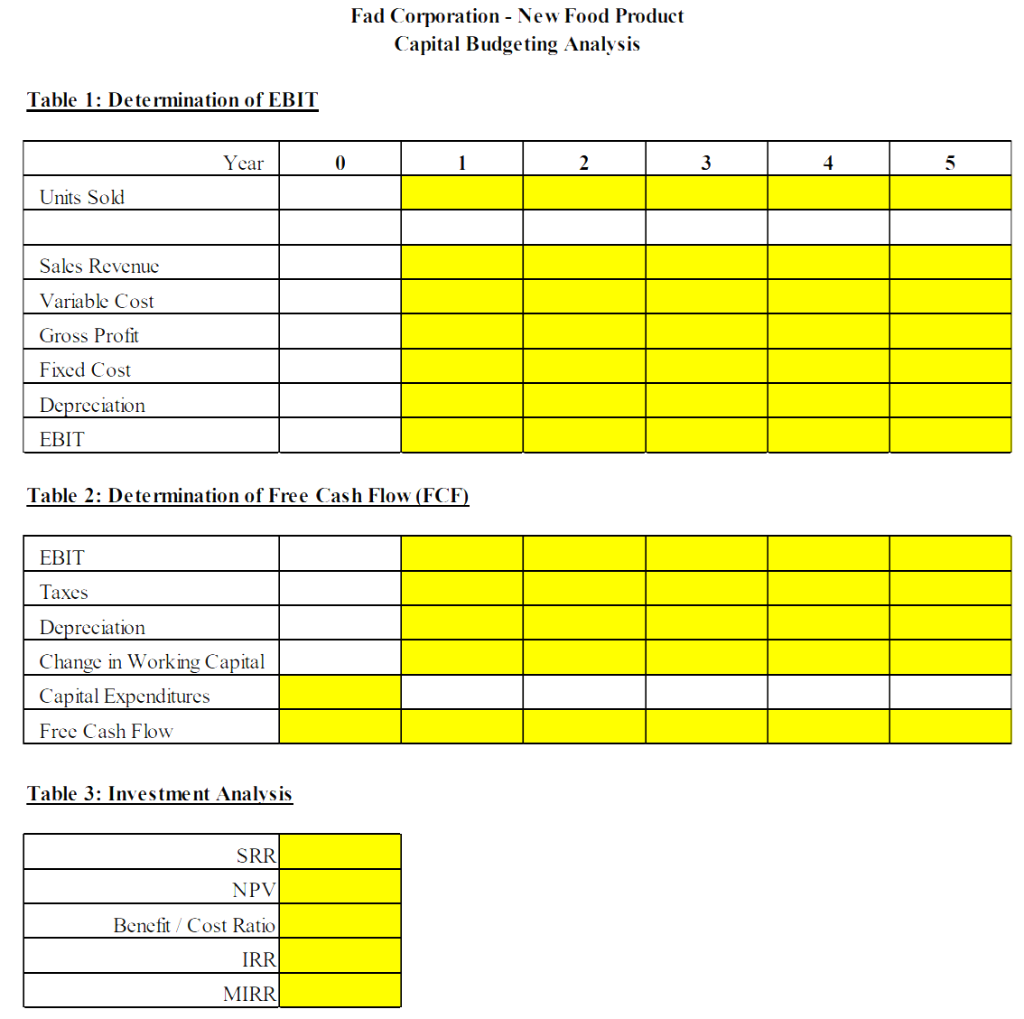

Scenario: The Fad Corporation is considering production of a new food product. The company expects the product's lifespan to be 5 years, after which production will be terminated, and the company will fund the project internally. Management has prepared the project assumptions that appear below and would like you to conduct a capital budgeting analysis of this project using the tables provided. Additional assumptions when calculating free cash flow (FCF) include changes in working capital will be neglected from this analysis and the only capital expenditures are those incurred in year 0. You will use a common formula for determining free cash flows for each year of the project: FCF EBIT Taxes + Depreciation - Change in Working Capital Capital Expenditures. Project Assumptions Cost of new equipment Installation cost = Sales price per unit Variable cost (VC) per unit = Percentage change in VC per year = Facility rent and insurance = Depreciation method Company margin tax bracket = Opportunity cost of capital $ 15,500,000 S 500,000 $ 200 for years 1-3, $ 175 in years 4-5 S 130 -5.00 percent per year (after year 1) S 400,000 Straight line (assume no salvage value) 21 percent 9.85 percent Anticipated Sales Units per Year -am Year 1 2 3 Units 80,000 90.000 100,000 Year 4 5 Units 85.000 75.000 . . Assignment Tasks: 1. Calculate the free cash flows (FCF) associated with the project for years () through 5 using Tables 1 and 2. (10 points) 2. Use the FCFs to determine the following values in Table 3: (5 points) Simple Rate of Return NPV Benefit Cost Ratio IRR MIRR 3. Record your responses to these questions in two separate cells on the spreadsheet. a. Using only the numerical results from task (2) as justification, provide an explanation (using one complete paragraph) as to why you would or would not invest in this project. Simply stating something along the line of it's making money or it's profitable" will earn zero points because you have not indicated 'why.' (5 points) b. Besides the numerical results determined in task (2), explain (using one complete paragraph) three other factors that should be considered before deciding to proceed with this product. (5 points) Fad Corporation - New Food Product Capital Budgeting Analysis Table 1: Determination of EBIT Year 0 1 2 3 4 5 Units Sold Sales Revenue Variable Cost Gross Profit Fixed Cost Depreciation EBIT Table 2: Determination of Free Cash Flow (FCF) EBIT Taxes Depreciation Change in Working Capital Capital Expenditures Free Cash Flow Table 3: Investment Analysis SRR NPV Benefit Cost Ratio IRR MIRR

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts