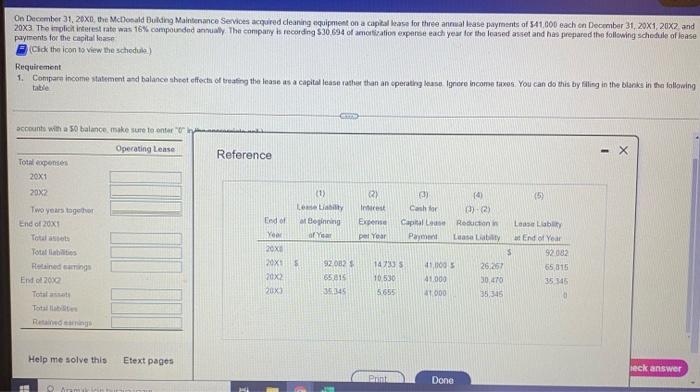

Question: All data on the table On December 31, 20XD the McDonald Duilding Maintenance Services acquired cleaning equipment on a capital kase for three annual lease

On December 31, 20XD the McDonald Duilding Maintenance Services acquired cleaning equipment on a capital kase for three annual lease payments of $41.000 each on December 31, 20X1,20x2 and 20x3 The implicit interest rate was 16% compounded annually. The company is recording 530 694 of amortization expense each year for the leased asset and has prepared the following schedule of base payments for the capitaloase Click the icon to view the schedule) Requirement 1. Compare Income statement and balance sheet effects of treating the lease as a capital lease rather than an operating kase Ignore income taxes. You can do this by filling in the blanks in the following accounts with a 50 balance, make sure to enter Operating Lease Reference Total expenses 20x1 (1) 20x2 Two years together End of 20X1 Toilet Totatis Reine einge End of 2000 Totalt Total Rese Lot End of Bening Year of Y 20x 2015 92002 20x2 65 815 203 35.145 21 3) 10 15 Interest Cash for 02) Expense Capital Rection Laas Lab pel Year Pay Luas Laby at End of Your $ 92.082 142335 41,1005 26.257 65 815 10.530 41.000 30470 3515 5655 41 000 35,345 Help me solve this Etext pages eck answer Pan Done

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts