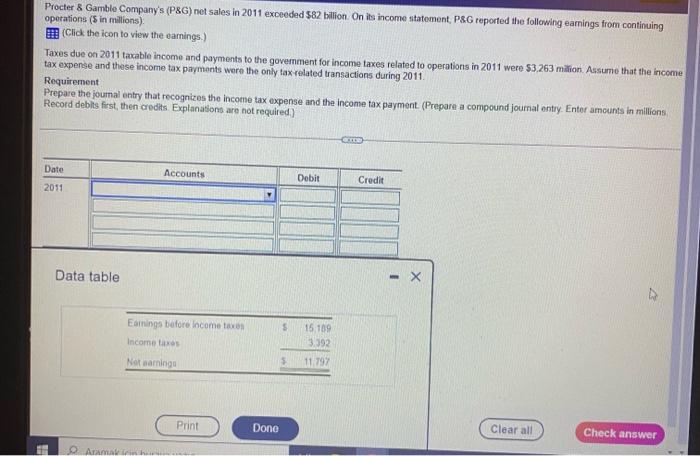

Question: all data on the table Procter & Gamble Company's (P&G) net sales in 2011 exceeded $82 billion. On its income statement, P&G reported the following

Procter & Gamble Company's (P&G) net sales in 2011 exceeded $82 billion. On its income statement, P&G reported the following earnings from continuing operations (Sin millions) 1. Click the icon to view the earnings) Taxes due on 2011 tatable income and payments to the government for income taxes related to operations in 2011 were 53,263 milion Assume that the income tax expense and these income tax payments were the only tax related transactions during 2011 Requirement Prepare the journal entry that recognizes the income tax expense and the income tax payment. (Prepare a compound journal entry Entor amounts in millions Record debits first, then credits. Explanations are not required) CH Date Accounts Dobit Credit 2011 Data table - X Earnings before Income taxes Income taxes S 15.109 3.392 11 797 Net warning 5 Print Done Clear all Check answer Arama

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts