Question: all details are provided. SECTION B THIS SECTION IS WORTH SIXTY PERCENT (60%) OF THE OVERALL MARK ANSWER ANY TWO (2) QUESTIONS FROM THIS SECTION.

all details are provided.

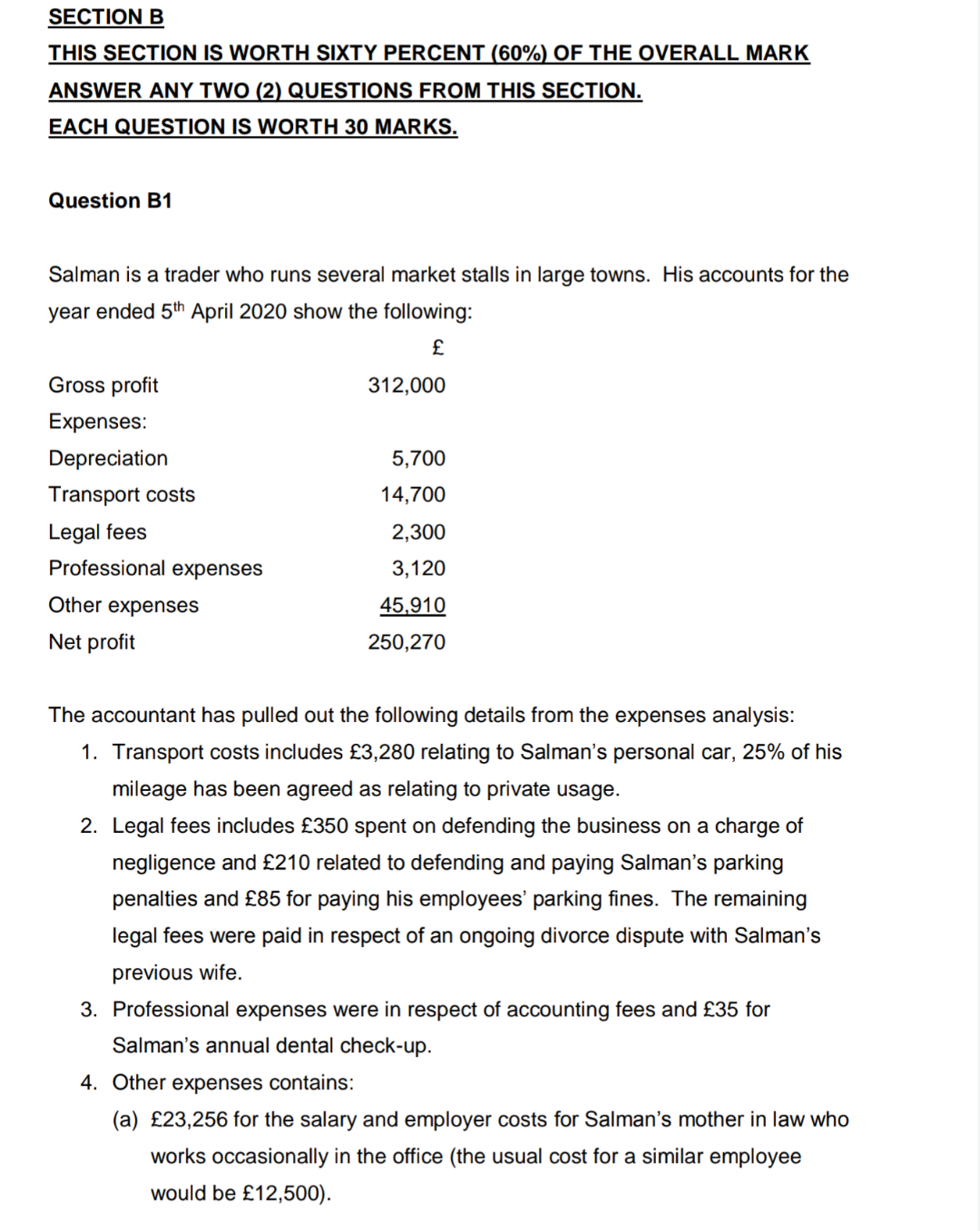

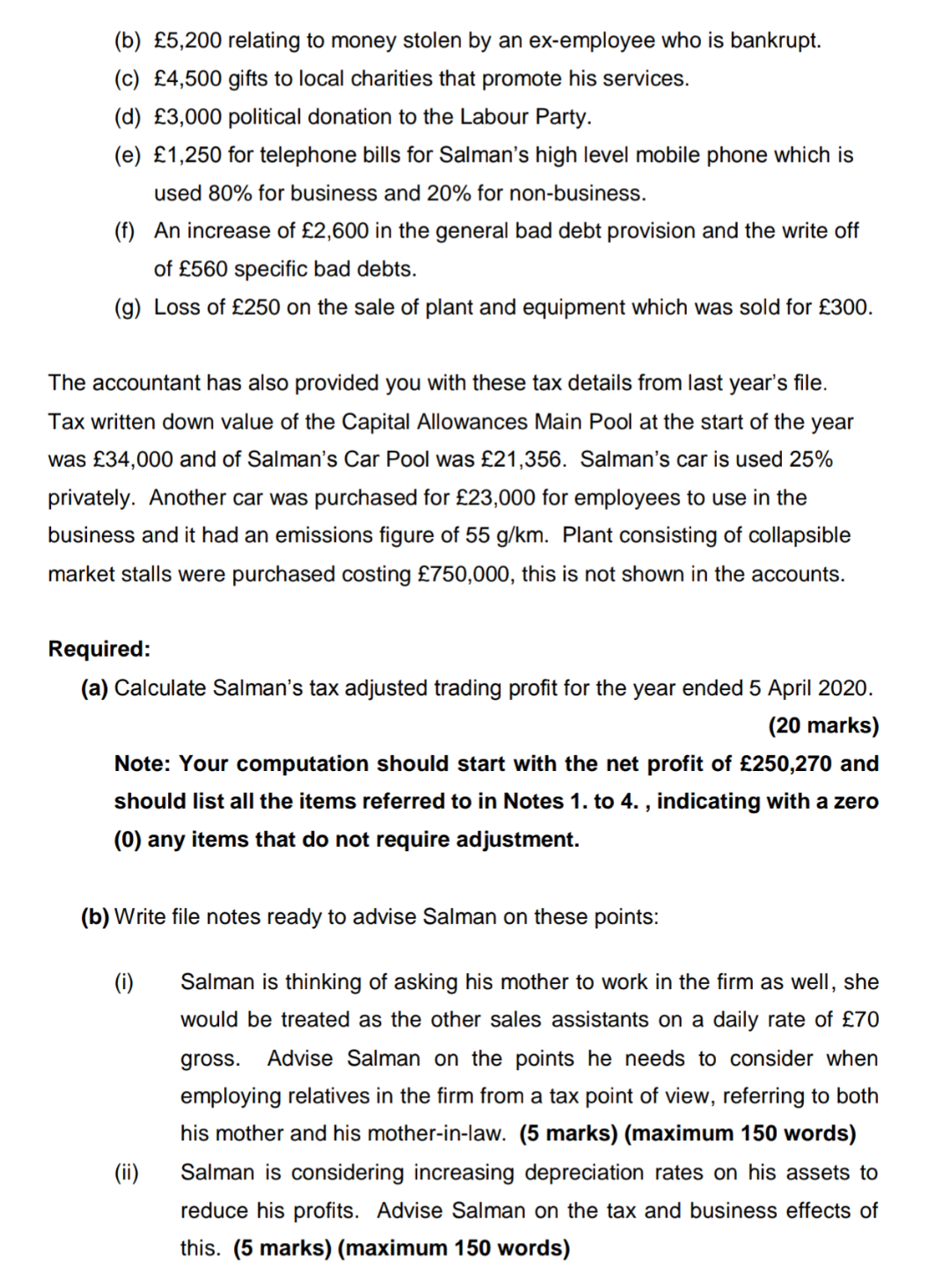

SECTION B THIS SECTION IS WORTH SIXTY PERCENT (60%) OF THE OVERALL MARK ANSWER ANY TWO (2) QUESTIONS FROM THIS SECTION. EACH QUESTION IS WORTH 30 MARKS. Question B1 Salman is a trader who runs several market stalls in large towns. His accounts for the year ended 5th April 2020 show the following: Gross profit 312,000 Expenses: Depreciation 5,700 Transport costs 14,700 Legal fees 2,300 Professional expenses 3,120 Other expenses 45,910 Net profit 250,270 The accountant has pulled out the following details from the expenses analysis: 1. Transport costs includes 3,280 relating to Salman's personal car, 25% of his mileage has been agreed as relating to private usage. 2. Legal fees includes 350 spent on defending the business on a charge of negligence and 210 related to defending and paying Salman's parking penalties and 85 for paying his employees' parking fines. The remaining legal fees were paid in respect of an ongoing divorce dispute with Salman's previous wife. 3. Professional expenses were in respect of accounting fees and 35 for Salman's annual dental check-up. 4. Other expenses contains: (a) 23,256 for the salary and employer costs for Salman's mother in law who works occasionally in the office (the usual cost for a similar employee would be 12,500). (b) 5,200 relating to money stolen by an ex-employee who is bankrupt. (c) 4,500 gifts to local charities that promote his services. (d) 3,000 political donation to the Labour Party. (e) 1,250 for telephone bills for Salman's high level mobile phone which is used 80% for business and 20% for non-business. (f) An increase of 2,600 in the general bad debt provision and the write off of 560 specific bad debts. (g) Loss of 250 on the sale of plant and equipment which was sold for 300. The accountant has also provided you with these tax details from last year's file. Tax written down value of the Capital Allowances Main Pool at the start of the year was 34,000 and of Salman's Car Pool was 21,356. Salman's car is used 25% privately. Another car was purchased for 23,000 for employees to use in the business and it had an emissions figure of 55 g/km. Plant consisting of collapsible market stalls were purchased costing 750,000, this is not shown in the accounts. Required: (a) Calculate Salman's tax adjusted trading profit for the year ended 5 April 2020. (20 marks) Note: Your computation should start with the net profit of 250,270 and should list all the items referred to in Notes 1. to 4., indicating with a zero (0) any items that do not require adjustment. (b) Write file notes ready to advise Salman on these points: (i) Salman is thinking of asking his mother to work in the firm as well, she would be treated as the other sales assistants on a daily rate of 70 gross. Advise Salman on the points he needs to consider when employing relatives in the firm from a tax point of view, referring to both his mother and his mother-in-law. (5 marks) (maximum 150 words) Salman is considering increasing depreciation rates on his assets to reduce his profits. Advise Salman on the tax and business effects of this. (5 marks) (maximum 150 words) (ii) SECTION B THIS SECTION IS WORTH SIXTY PERCENT (60%) OF THE OVERALL MARK ANSWER ANY TWO (2) QUESTIONS FROM THIS SECTION. EACH QUESTION IS WORTH 30 MARKS. Question B1 Salman is a trader who runs several market stalls in large towns. His accounts for the year ended 5th April 2020 show the following: Gross profit 312,000 Expenses: Depreciation 5,700 Transport costs 14,700 Legal fees 2,300 Professional expenses 3,120 Other expenses 45,910 Net profit 250,270 The accountant has pulled out the following details from the expenses analysis: 1. Transport costs includes 3,280 relating to Salman's personal car, 25% of his mileage has been agreed as relating to private usage. 2. Legal fees includes 350 spent on defending the business on a charge of negligence and 210 related to defending and paying Salman's parking penalties and 85 for paying his employees' parking fines. The remaining legal fees were paid in respect of an ongoing divorce dispute with Salman's previous wife. 3. Professional expenses were in respect of accounting fees and 35 for Salman's annual dental check-up. 4. Other expenses contains: (a) 23,256 for the salary and employer costs for Salman's mother in law who works occasionally in the office (the usual cost for a similar employee would be 12,500). (b) 5,200 relating to money stolen by an ex-employee who is bankrupt. (c) 4,500 gifts to local charities that promote his services. (d) 3,000 political donation to the Labour Party. (e) 1,250 for telephone bills for Salman's high level mobile phone which is used 80% for business and 20% for non-business. (f) An increase of 2,600 in the general bad debt provision and the write off of 560 specific bad debts. (g) Loss of 250 on the sale of plant and equipment which was sold for 300. The accountant has also provided you with these tax details from last year's file. Tax written down value of the Capital Allowances Main Pool at the start of the year was 34,000 and of Salman's Car Pool was 21,356. Salman's car is used 25% privately. Another car was purchased for 23,000 for employees to use in the business and it had an emissions figure of 55 g/km. Plant consisting of collapsible market stalls were purchased costing 750,000, this is not shown in the accounts. Required: (a) Calculate Salman's tax adjusted trading profit for the year ended 5 April 2020. (20 marks) Note: Your computation should start with the net profit of 250,270 and should list all the items referred to in Notes 1. to 4., indicating with a zero (0) any items that do not require adjustment. (b) Write file notes ready to advise Salman on these points: (i) Salman is thinking of asking his mother to work in the firm as well, she would be treated as the other sales assistants on a daily rate of 70 gross. Advise Salman on the points he needs to consider when employing relatives in the firm from a tax point of view, referring to both his mother and his mother-in-law. (5 marks) (maximum 150 words) Salman is considering increasing depreciation rates on his assets to reduce his profits. Advise Salman on the tax and business effects of this. (5 marks) (maximum 150 words) (ii)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts