Question: All FINAL answers should be stated in 2 decimals ($/%) Question 1 (28 marks) Silicon Co. is a start-up company. It is now considering implementing

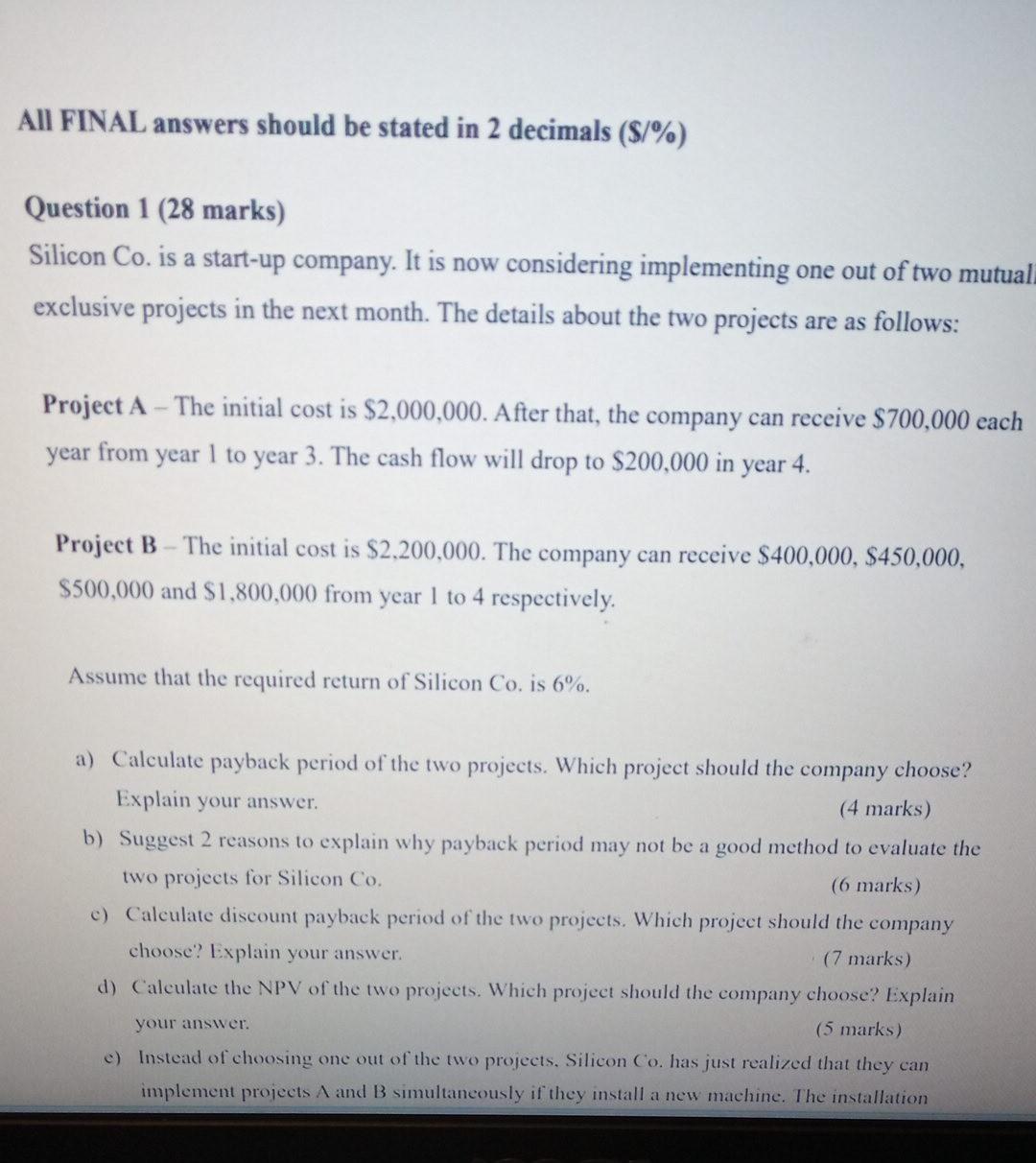

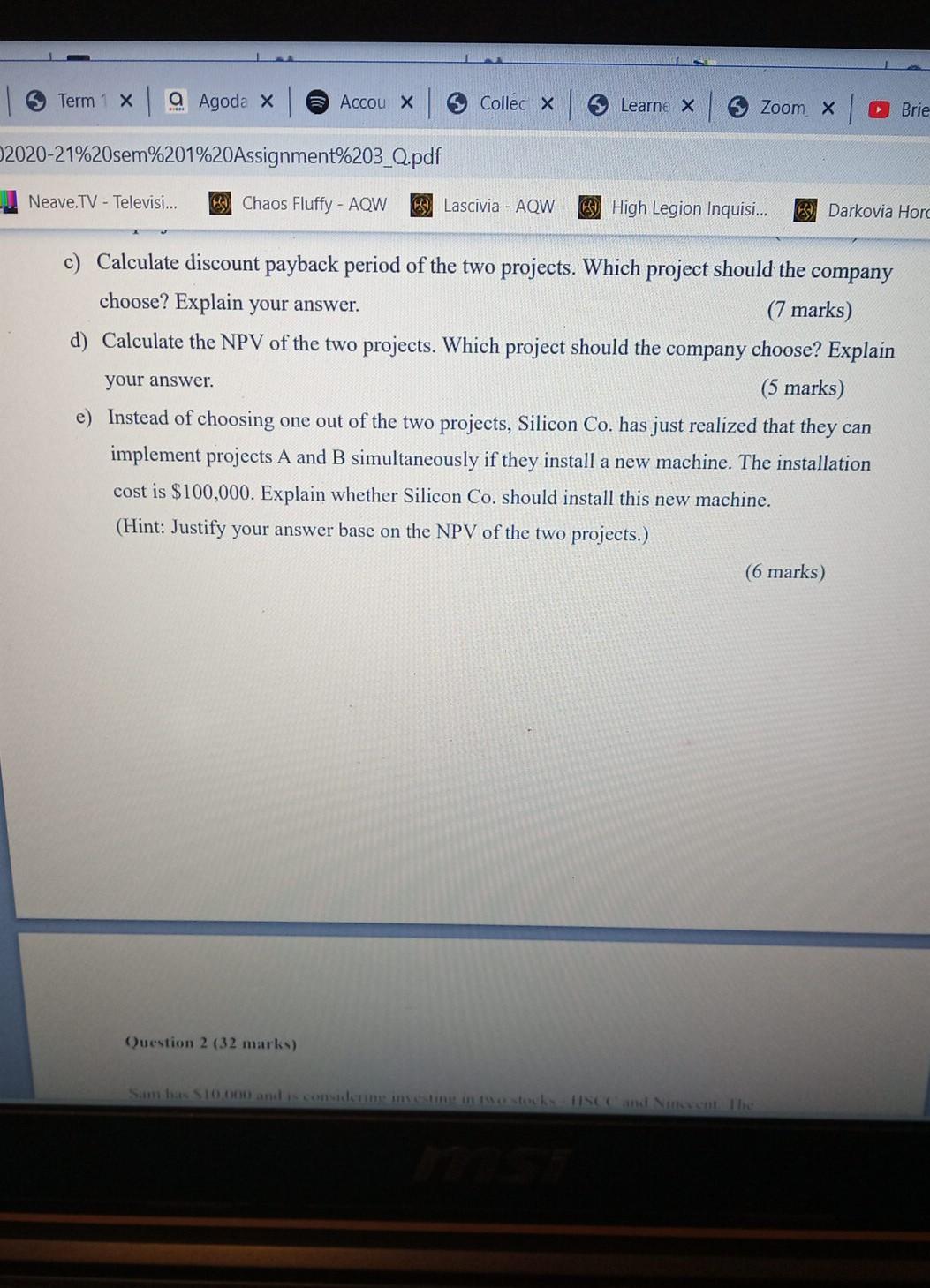

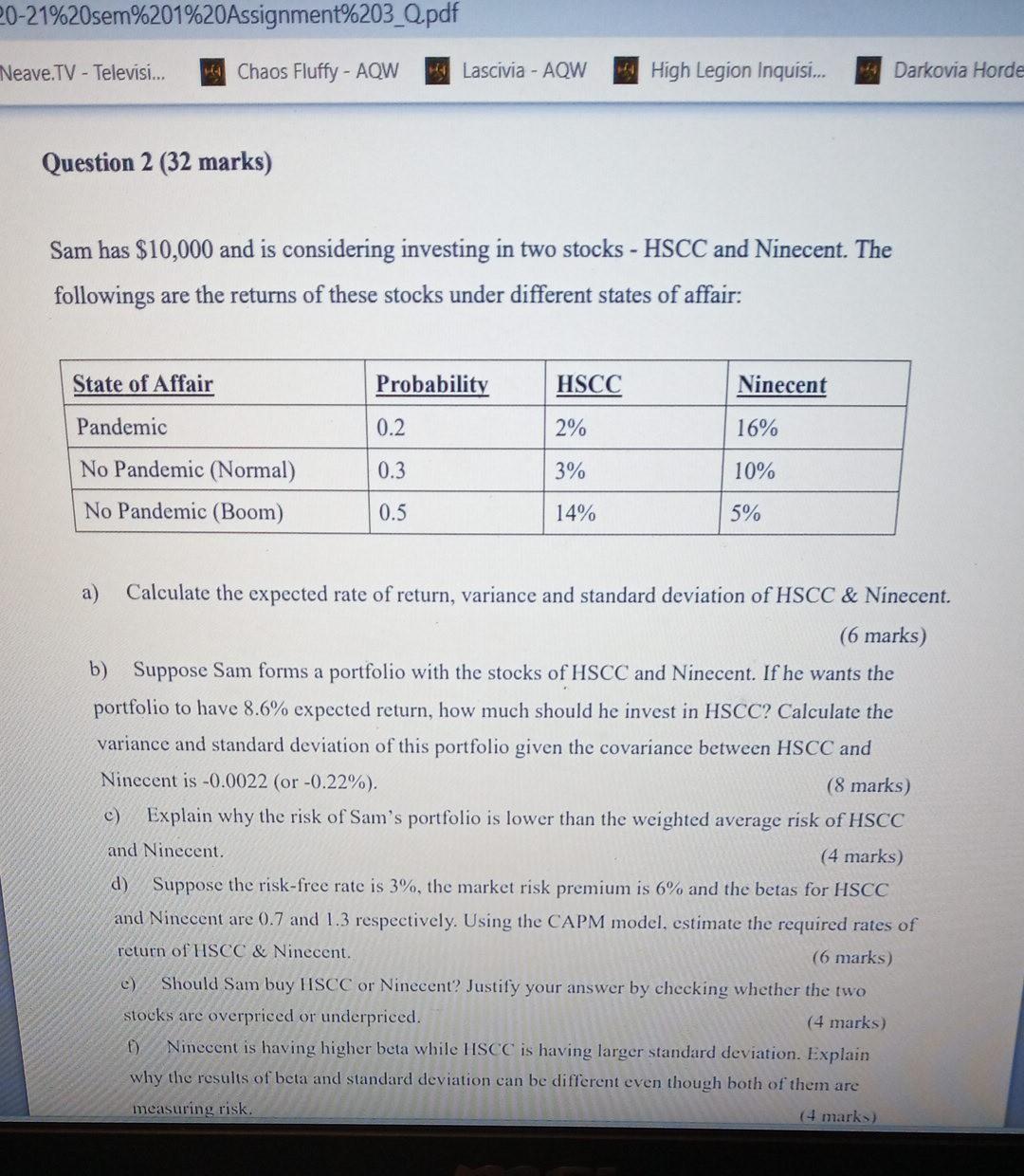

All FINAL answers should be stated in 2 decimals ($/%) Question 1 (28 marks) Silicon Co. is a start-up company. It is now considering implementing one out of two mutuali exclusive projects in the next month. The details about the two projects are as follows: Project A - The initial cost is $2,000,000. After that, the company can receive $700,000 each year from year I to year 3. The cash flow will drop to $200,000 in year 4. Project B - The initial cost is $2,200,000. The company can receive $400,000, $450,000, $500,000 and $1,800,000 from year 1 to 4 respectively. Assume that the required return of Silicon Co. is 6%. a) Calculate payback period of the two projects. Which project should the company choose? Explain your answer. (4 marks) b) Suggest 2 reasons to explain why payback period may not be a good method to evaluate the two projects for Silicon Co. (6 marks) c) Calculate discount payback period of the two projects. Which project should the company choose? Explain your answer. (7 marks) d) Calculate the NPV of the two projects. Which project should the company choose? Explain your answer. (5 marks) e) Instead of choosing one out of the two projects, Silicon Co. has just realized that they can implement projects A and B simultaneously if they install a new machine. The installation Term X a Agoda X Accou X 5 Collec X 5 Learne X Zoom Brie 2020-21%20sem%201%20Assignment%203_0.pdf Neave.TV - Televisi... Chaos Fluffy - AQW Lascivia - AQW 69 High Legion Inquisi... E Darkovia Hora c) Calculate discount payback period of the two projects. Which project should the company choose? Explain your answer. (7 marks) d) Calculate the NPV of the two projects. Which project should the company choose? Explain your answer. (5 marks) e) Instead of choosing one out of the two projects, Silicon Co. has just realized that they can implement projects A and B simultaneously if they install a new machine. The installation cost is $100,000. Explain whether Silicon Co. should install this new machine. (Hint: Justify your answer base on the NPV of the two projects.) (6 marks) Question 2 (32 marks) Sam S10 000 and is considering insting in a stacks ISC and Nincent The 20-21%20sem%201%20Assignment%203_0.pdf Neave.TV - Televisi... Chaos Fluffy - AQW 4 Lascivia - AQW High Legion Inquisi... Darkovia Horde Question 2 (32 marks) Sam has $10,000 and is considering investing in two stocks - HSCC and Ninecent. The followings are the returns of these stocks under different states of affair: State of Affair Probability HSCC Ninecent Pandemic 0.2 2% 16% 0.3 3% 10% No Pandemic (Normal) No Pandemic (Boom) 0.5 14% 5% a) Calculate the expected rate of return, variance and standard deviation of HSCC & Ninecent. (6 marks) b) Suppose Sam forms a portfolio with the stocks of HSCC and Ninecent. If he wants the portfolio to have 8.6% expected return, how much should he invest in HSCC? Calculate the variance and standard deviation of this portfolio given the covariance between HSCC and Ninecent is -0.0022 (or -0.22%). (8 marks) c) Explain why the risk of Sam's portfolio is lower than the weighted average risk of HSCC and Ninecent. (4 marks) d) Suppose the risk-free rate is 3%, the market risk premium is 6% and the betas for HSCC and Ninecent are 0.7 and 1.3 respectively. Using the CAPM model, estimate the required rates of return of HSCC & Ninecent. (6 marks) Should Sam buy HSCC or Ninecent? Justify your answer by checking whether the two stocks are overpriced or underpriced. (4 marks) f) Ninecent is having higher beta while HSCC is having larger standard deviation. Explain why the results of beta and standard deviation can be different even though both of them are measuring risk. (4 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts